Hello Traders!

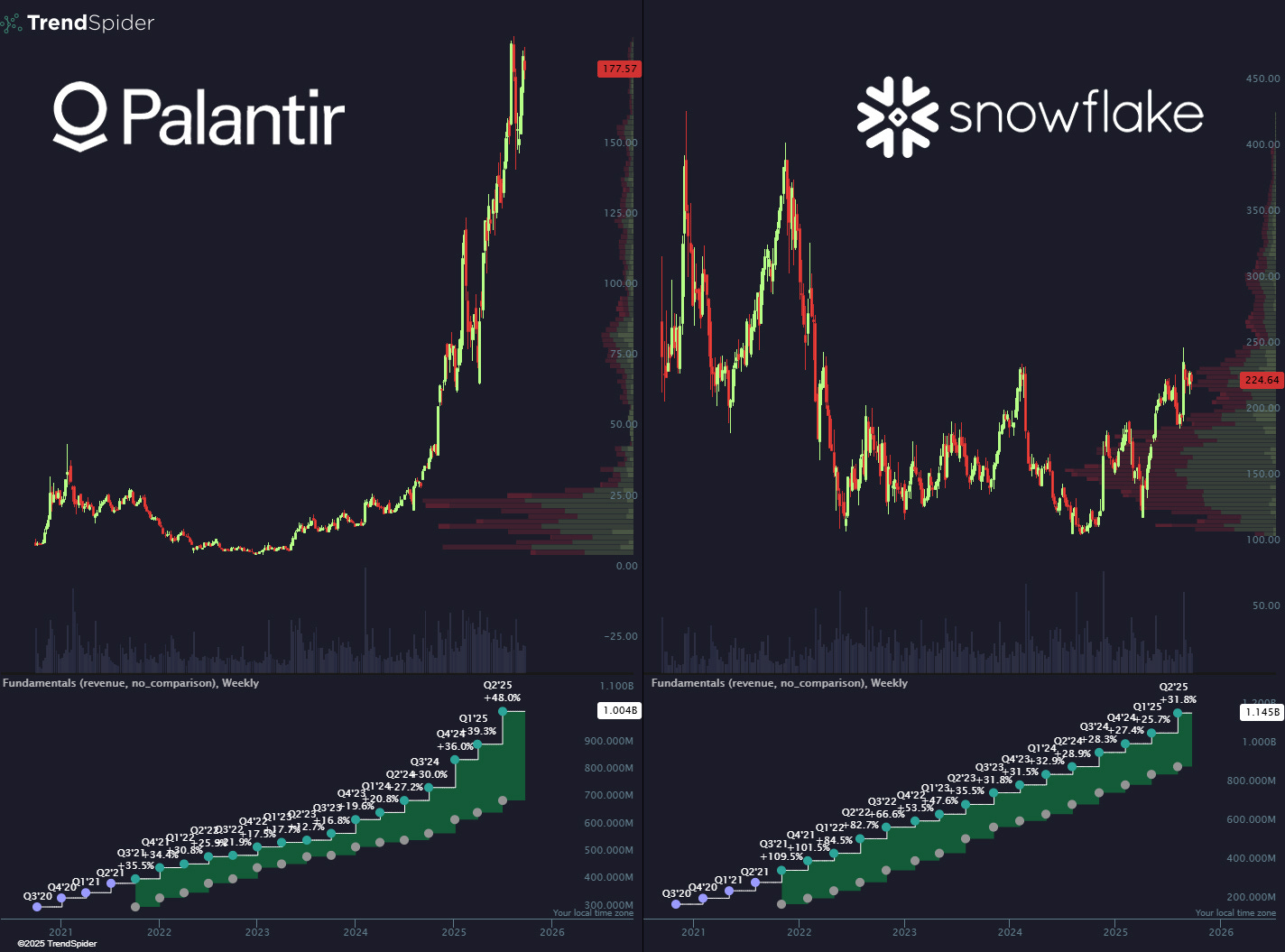

Today, we’re diving into Snowflake (SNOW). A post from Trendspider on Twitter caught my eye, comparing its chart and revenue growth to Palantir before its massive run-up. The comparison is striking: Snowflake’s revenue just steps up every single quarter, they never miss, and yet the stock has been stuck in a huge three-year consolidation range.

This led me down a rabbit hole to solve the central puzzle of Snowflake: how can a company that is absolutely dominant and used by nearly every Fortune 500 company not be making any money? I figured it out, and when you combine the answer with the technical picture, this starts to look like a phenomenal long-term opportunity.

The Profitability Puzzle, Solved

On the surface, the numbers are confusing. Revenue and earnings are beating expectations by huge margins (like a 31% earnings surprise last quarter), yet they have no P/E ratio because they consistently post a net loss. The answer isn’t a business failure; it’s a brilliant and aggressive long-term strategy.

The “No-Profit” Strategy: Snowflake isn’t profitable on paper for two main reasons. First, they use a significant amount of their stock to pay employees. This stock-based compensation attracts elite talent without burning through cash, but accounting rules force them to book it as a massive non-cash expense, wiping out profits. Second, they reinvest 30-40% of their revenue directly back into customer acquisition.

Underlying Financial Strength: Don’t let the accounting fool you; this company is stockpiling cash. They are sitting on $3.5 billion from their IPO and are hoarding it by using stock to incentivize employees. They are making real cash, even if it doesn’t show up as GAAP profit.

An Unbelievably “Sticky” Business Model: Snowflake’s business model is its superpower. It’s usage-based, meaning as a client’s data grows (and it always does), they automatically pay more. My wife uses them at her company and confirmed it: once you’re integrated into their platform, you don’t leave. The cost and complexity of a data migration for a major company is a multi-year nightmare. This is why they have a customer retention rate of 130%—the same customers are spending 30% more a year later.