Happy weekend, everybody. It is time for the Week in Review.

I hope everyone is staying warm. We are hitting so much snow here in Indiana—we probably have 16 inches. I haven’t left the house in two days, so I figured I would stay in my jammies and bust out this review.

On Friday, we had a monster sell-off after price broke our main Daily leg at 6891.00. They came all the way down and swept the lows into our 6805.50 Daily, which is a monster level holding up this whole structure. We immediately got long in the 6808.00 / 6813.00 area and played this for 50 points all the way up to 6857.25 for a perfect touch.

🧠 Current Market Context

Last week was interesting. We poked a new high and a new low, essentially breaking both sides of the weekly range.

The Divergence: SPX closed higher and is telling us we need a new high (even SPY came within a few dollars). However, ES did not close above the weekly leg on the weekly time frame.

The Weakness: ES has lost support on the Daily and 4-Hour timeframes (specifically the leg to the high). This is a little concerning.

The Bull Case: As long as we are above 6805.50, I am still looking to get long. This level is the “Make it or Break it” spot.

🚨 VIX Analysis: The 14.93 Floor

VIX is getting its head beat in, but be aware: every time we get into the $15.00 handle, we tend to get a pop.

The Floor: On Friday, we opened right at the 14.93 Daily. This provided an insane reaction that popped us past 17.21.

The Pivot: We are monitoring the Weekly at 15.73. Right now, we are sitting on it.

Resistance: 17.21 (Tested Daily). We need to watch this. If we push above the 15.73 Weekly, we look to the 17.21 Daily.

🎯 Detailed Actionable Trade Plan (ES Futures)

We are currently in a spot where we have lost the 4-Hour leg to the high, but the 6805.50 fortress is holding the structure.

🔴 Key Resistance Zones & Setups

Immediate Resistance: 6857.00

Previous Weekly POC: (6852.00)

Actionable Setup: If we can push and hold above 6857.00, we have a chance of moving higher. If we fail here, look for a fall back below.

Untested 4-Hour: 6861.00

Look for this area to potentially get a reaction. If it does, expect a fall back below 6857.00 for a potential short play.

The Resistance Cluster: 6872.00

Un-Tested Daily. We bumped our head a lot here and has proven to be a significant level. This spot is now untested and should be considered for a potential reaction.

The Major Pivot: 6891.00 - 6893.00

Daily Leg Down (6891.00) and 4-Hour (6893.00).

Actionable Setup: This is the “True Blue Pivot.” A push above this would likely continue our move higher, but a rejection from here could be catastrophic.

High Target: 6907.75

Untested 4-Hour / ETH Daily. Watch for a reaction here.

Actionable Setup: Look for continuation below 6891.00 for the short however a hold above 6891 will lead to more upside.

🔵 Key Support Zones & Setups

The Fortress: 6805.50

Line in the Sand. This level has held up the structure multiple times.

Actionable Setup: As long as we hold this (and 6813.50), we are bullish. If we lose 6805.50, “shit gets real.”

Reclaim Play: If we sweep below 6805.50, the moment we get back above 6805.50, this thing is juking back to the upside.

Weekly Singles Fill: 6784.50 - 6777.00

If 6805.50 fails, we clean up singles to 6784.50.

6788.50: Large Weekly (Previous Leg Tip). This could be a nice pullback area.

“Love It” Buy: 6765.00 - 6761.00

Daily Top Down Leg (6765.00) - ETH WK Leg Tip (6768.00) and RTH Weekly Leg Down (6761.00)

Actionable Setup: I love 6765.00 area. If we get down here, get back above 6768.00 and buy this thing.

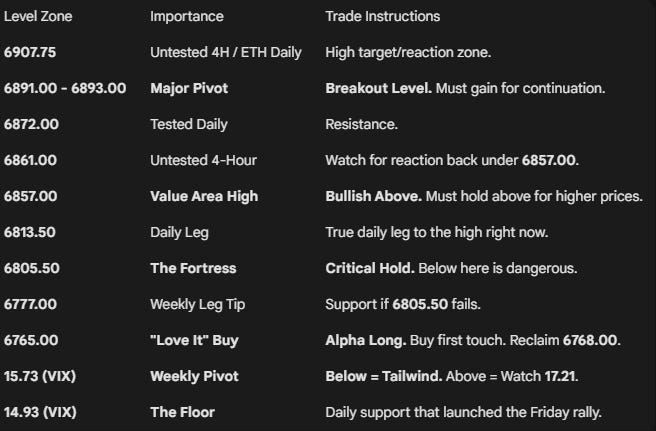

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

We have weakness on the Daily and 4-Hour, but we are holding the 6805.50 fortress. If we hold the lows in the Sunday overnight session Don’t be surprised if we start to get a big push on Monday and come all the way back up into the 6872 - 6891.25 spot.

If we pull back, I am looking to buy the 6805.50 reclaim or the 6765.00 level.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.