Welcome back, I hope everyone had a fantastic Christmas, Hanukkah, or whatever holiday you celebrate. It is always nice to unplug for a moment and spend time with family. We had a fantastic 2025, and I am looking to absolutely conquer these markets with you in 2026.

These markets are going to be relatively slow until we come into the New Year. However, we are setting up for the tail end of the Santa Claus Rally, which typically lasts until around January 5th producing an average of 1.5%

🧠 Current Market Context

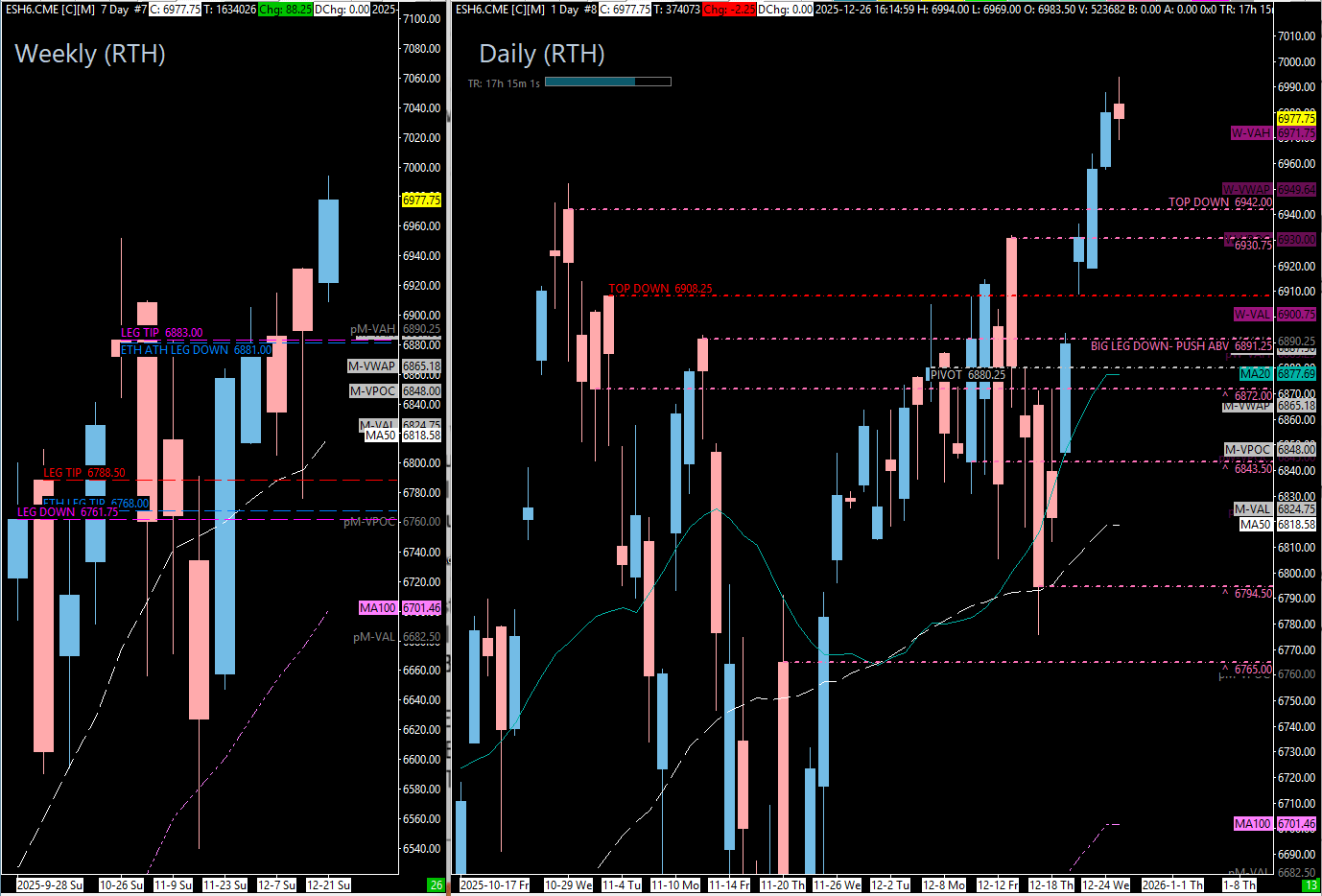

We have a massive three-week composite on the Weekly TPO where we sat sideways and accumulated value.

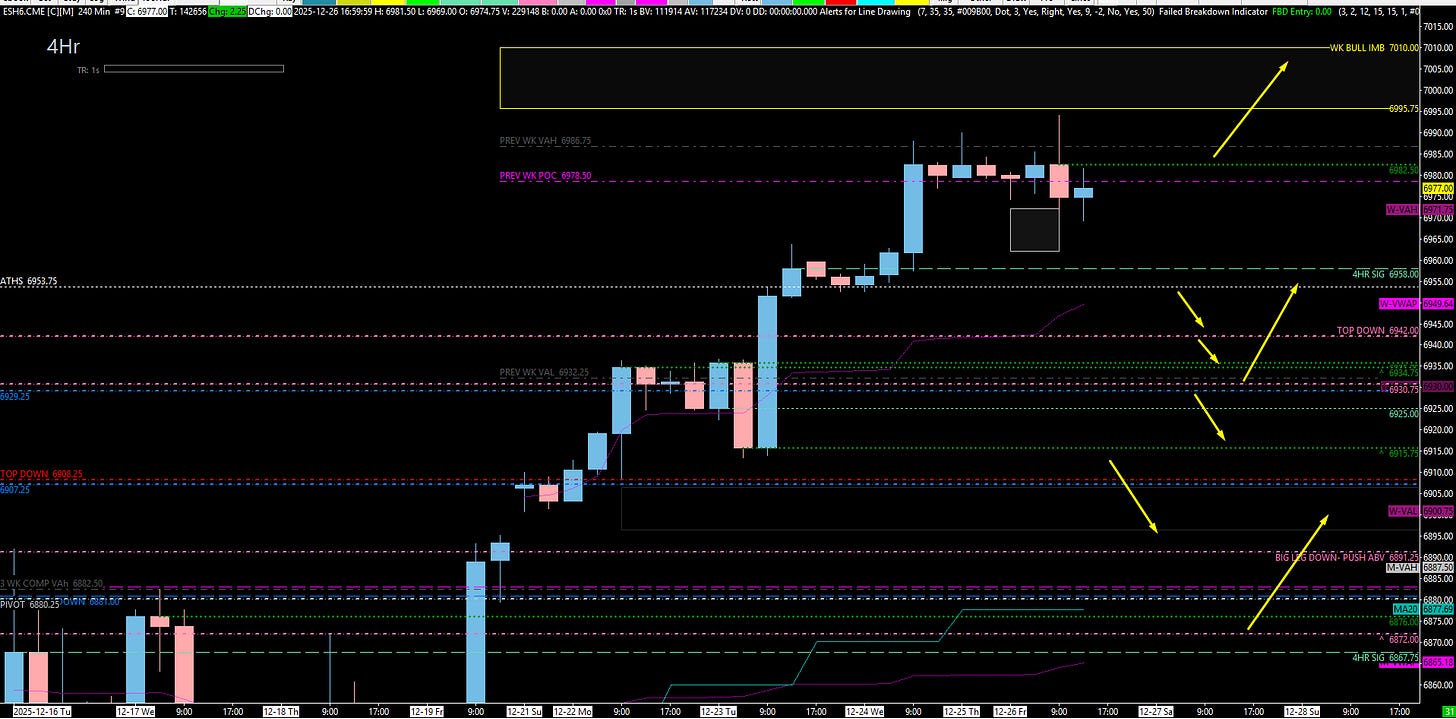

The Structure: Last week was a short week (only 85 points of range vs. 151 average). We closed with a large Weekly Bullish Imbalance taking us up to 7010.00.

The Target: 7010.00 is my upside target for now. After that, we could look for 7050-7060.

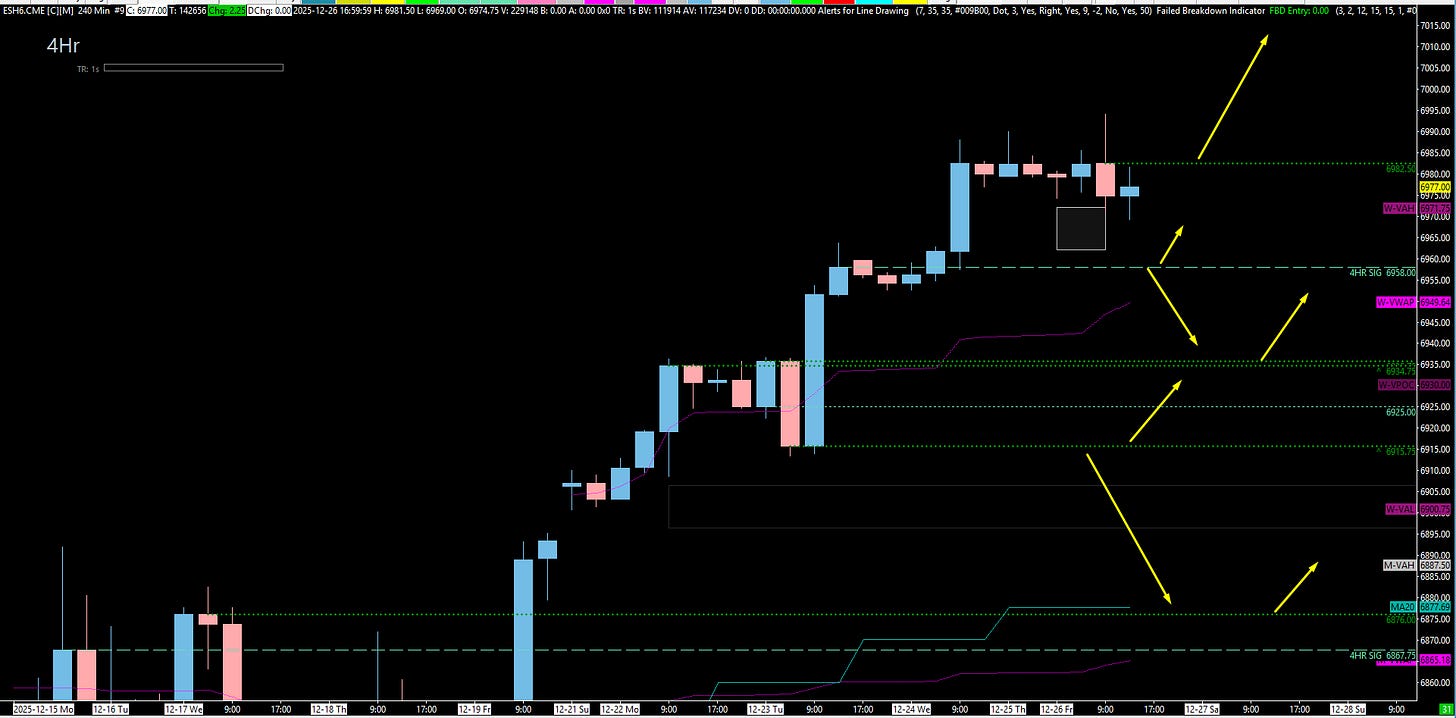

The Inefficiency: We have a “dividing line” at 6958.00 (where buyers and sellers battled). If we push back underneath 6958.00, we start to clean up the thin area down to 6932.00.

🚨 VIX Analysis: The “Dangerous” 12 Handle

VIX is “way the f*** down here.” We are getting ready to enter the $12 handle, which is super duper low.

The Warning: At any moment, “shit could break off.” Any little news could flush this market down 100-200 points while VIX spikes. Be super careful with stops and risk management.

The Target: My main target is the 12.92 - 12.77 Weekly/Monthly spot. This is a major tip from last year. I would not be surprised if they played 12.77, got back above 12.92, and “ripped everybody’s face off.”

The Breakout: Once VIX pops above the 14.42 Daily and 14.22 Weekly, “it’s on like Donkey Kong.”

📈 SPX Analysis: Fib Extension Targets

We knew weeks ago we were going to make new All-Time Highs, and we did.

Fib Targets: Based on the extensions, I am looking at 6957 (61.8%), 7020 (76.8%), and 7100 (110%). It wouldn’t surprise me to see 6950 to 7020 through the first part of January.

Support:

6910.10: Main leg top down.

6901: Sub-leg.

6882: Support level. Below here, we start to lose levels.

6867: Weekly support. The moment we get below 6867, we have a “world of problem on our hands.”

🎯 Detailed Actionable Trade Plan (ES Futures)

We are in price discovery mode. We are looking for the progression higher to 7010.00+ on ES, buying support until it fails.

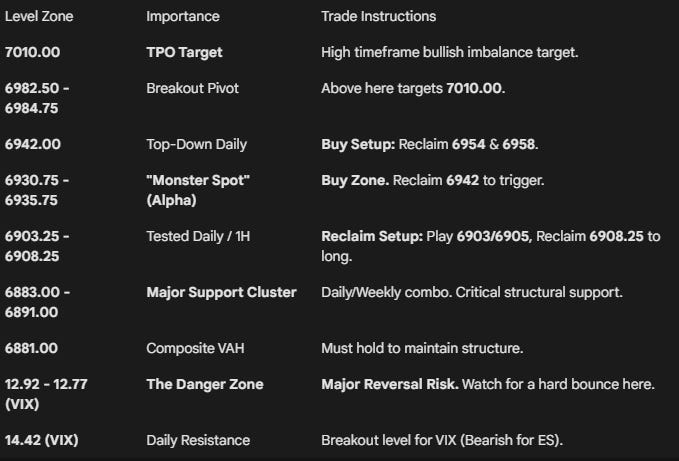

🔴 Key Resistance Zones & Setups

TPO Target: 7010.00

Top of the Weekly Bullish Imbalance.

Actionable Setup: This is the primary upside target.

Breakout Level: 6982.50 - 6984.75

4-Hour (6982.50) and 1-Hour (6984.75) / Previous Weekly VAH (6986).

Actionable Setup: A push above this area should get us up into the 7010.00 imbalance.

🔵 Key Support Zones & Setups

Immediate 1-Hour: 6960.00

Untested 1-Hour support.

Actionable Setup: This is thin, but it is the only untested level nearby.

The “Top-Down” Daily: 6942.00

Significance: This is a daily level at 6942.00 that I actually really like, which is crazy because it hasn’t gotten any love from the left previously. I found that strange on the way up, but I am not ignoring it now.

Actionable Setup: I am going to keep an eye on this level. If this level plays, we want to see it immediately get back above the Previous All-Time High at 6954.00 and ultimately 6958.00 for continuation higher.

“Monster Spot” (Alpha Long): 6930.75 - 6935.75

Confluence: Daily (6930.75), Previous Weekly VAL (6932.00), Stacked 4-Hours (6934.75/6935.75), ETH Daily (6929.25).

Actionable Setup: I like this area a lot. If this plays, we want to get back over the 6942.00 Daily and ultimately 6953.00 (Previous ATH) for continuation higher.

4 Hour Leg: 6915.75

Actionable Setup: Stop is very limited here because levels below are tested. If 6915 holds, look to reclaim 6925, 6930, 6935.

Tested Daily / 1-Hour Reclaim: 6903.25 - 6908.25

This area includes the Tested Daily at 6908.25 and two 1-Hour levels at 6905.75 and 6903.25.

Actionable Setup: I typically do not like these 1-Hour levels, but what I do like is for the 6905.75 or 6903.25 to play and immediately get us back above the 6908.25 Daily for a failed breakdown/liquidity sweep squeeze. That is a trade setup for me, absolutely 100%.

Major Support Cluster: 6883.00 - 6891.25

If we slip below the higher levels, we come down into the 6891.25 Daily (Big Leg Down). Directly below that is the 6883.00 Weekly.

Actionable Setup: This is a monster spot because 6883.00 is also the Three-Week Composite Value Area High (with the ETH Weekly at 6881.00). If we come down in here, you want to see this area play and get back above 6891.00 and ultimately 6908.25.

Composite Value High: 6881.00 - 6883.00

Weekly (6883.00) and ETH Weekly / Composite VAH (6881.00).

Actionable Setup: This is a monster spot. If we come down here, you want to see this play and get back above 6891.00.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

We are buying support until it fails. We are grinding higher, looking for 7010.00 and potentially 7020 on SPX.

However, be extremely careful. VIX is so low that “President Trump could fart in a plastic cup and the news will send this market down.” If VIX hits 12.77 and reclaims 12.92, I might even look for shorts, which I normally wouldn’t do at All-Time Highs. If we start to flush, stand back unless you are short—don’t try to knife catch with VIX this low.

Let’s make it a killer 2026.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.

ES:

Weekly Daily

4hr Only

4HR Overlay