Hello everyone and welcome back. It is time for the Weekend Review.

This week is looking pretty interesting as we set up for the Santa Claus Rally. We held our very important significant spot that we were eyeing hardcore down at the 6770.00 area and we have launched. The middle of last week was basically us setting up for more up as we get primed for this week.

We shouldn’t be too complacent as there are always geopolitical concerns, but right now it looks like we are going to get the typical up move. It really wouldn’t surprise me if we hit new All-Time Highs by New Year’s.

🧠 Current Market Context

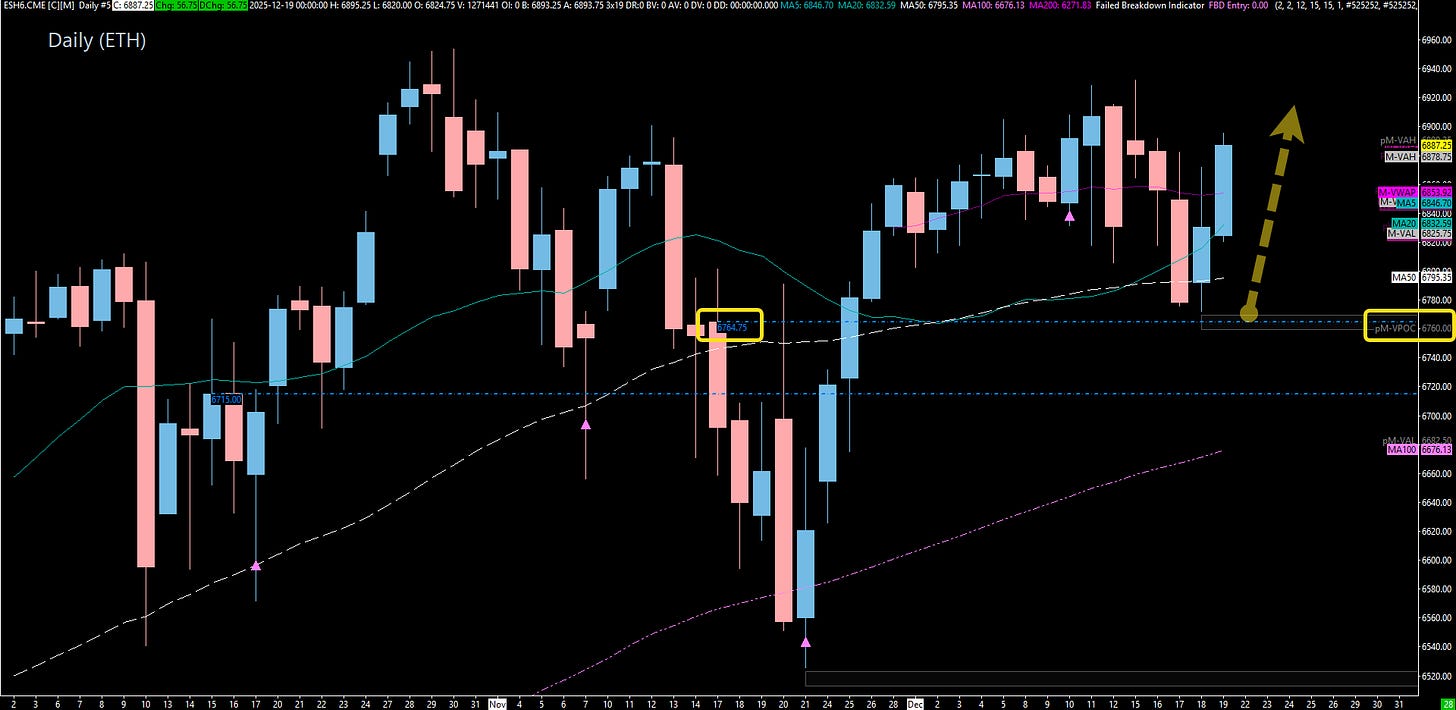

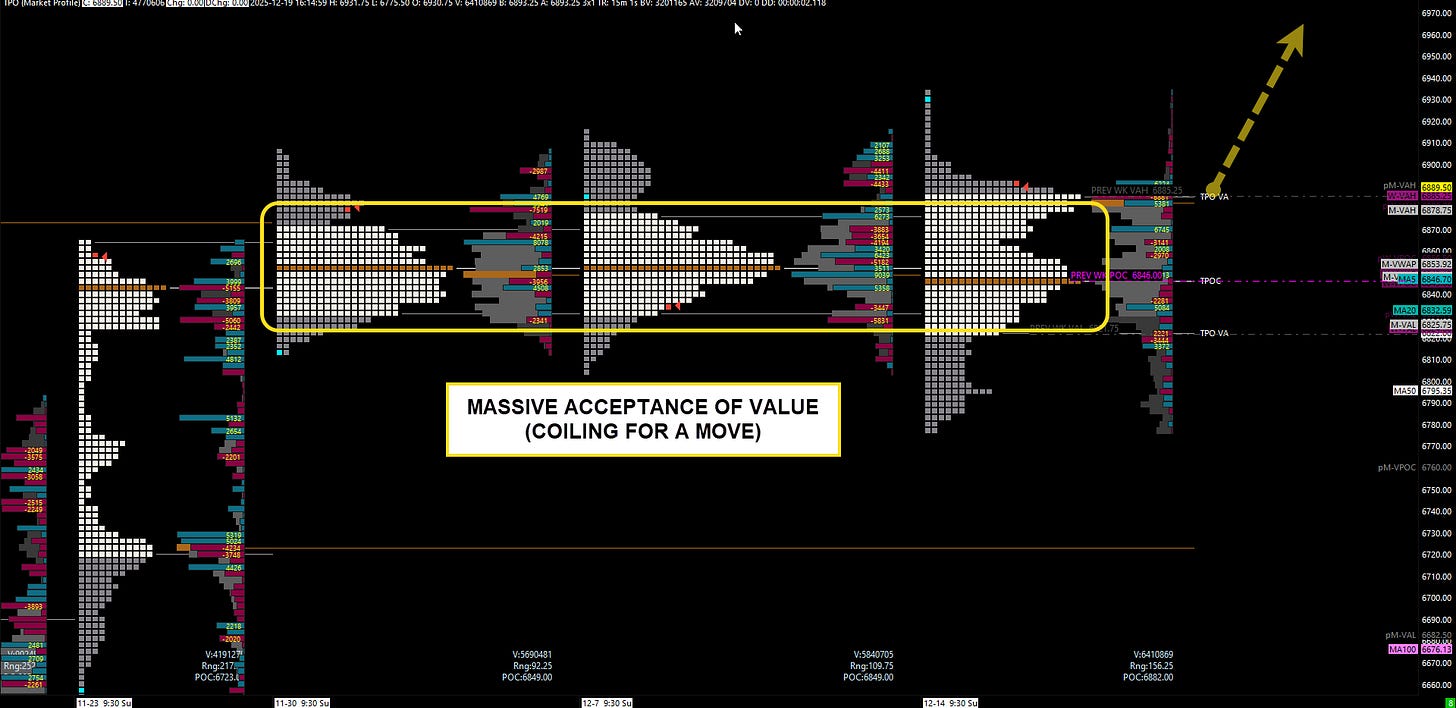

We had a massive push up (350 points) and have sat sideways for a little over three weeks, distributing and building value.

Overlapping Value: We are building value straight across. We have multiple weeks of overlapping value areas.

The Catalyst: We swept the previous two weeks’ high and low this week. The push down was essentially our catalyst for more potential up.

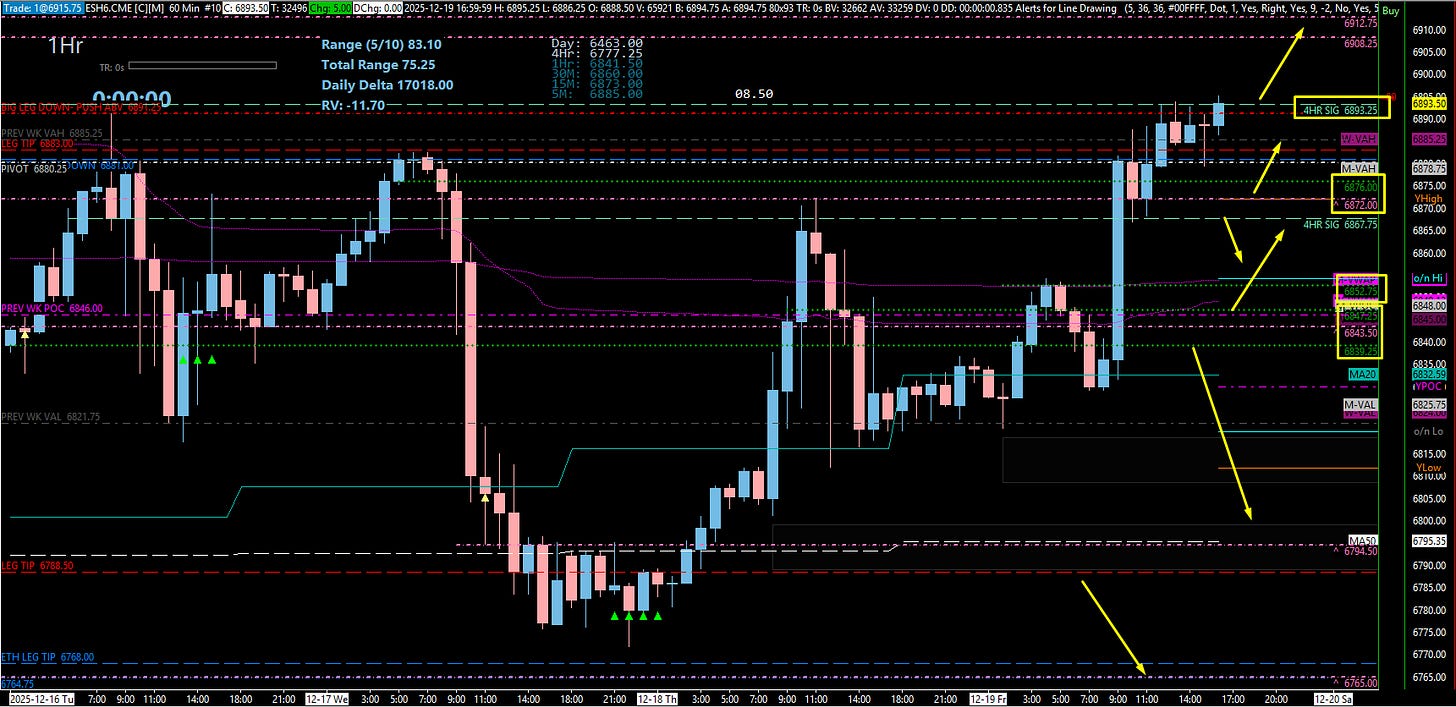

The Structure: We gained on the 4-Hour timeframe. We have not truly gained on the Daily timeframe yet (need a close above 6891.25), but we have not lost on the Weekly.

Daily TPO: We have a large market inefficiency that takes us all the way up to 6929.00 (edge of rollover). Friday left a very poor high and a huge buying tail.

🎯 Detailed Actionable Trade Plan (ES Futures)

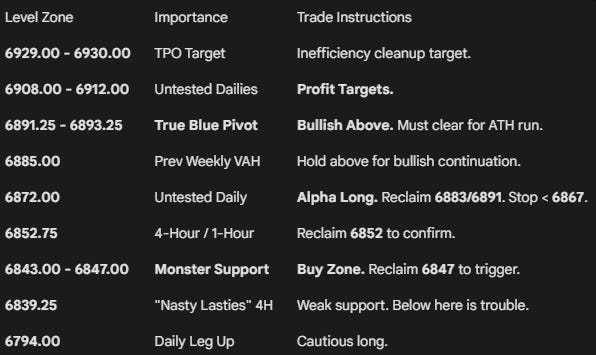

We are looking to clear the 6891.25 pivot to access the targets in the 6900s.

🔴 Key Resistance Zones & Setups

The “True Blue” Pivot: 6891.25

6891.25 (Daily Leg to Low) and 6893.25 (4-Hour).

Actionable Setup: Nothing is truly more important than 6891.25 right now. A push above this pivot should send us into the 6908.00 and 6912.00 area.

Rollover Targets: 6908.00 - 6912.00

Untested Dailies.

Actionable Setup: I am using these as targets. I am a little “sketched out” by the rollover data in this area until we get new price action, but there is no reason we shouldn’t push here if we hold above 6891.25.

TPO Target: 6929.00 - 6930.00

Edge of rollover area / Market inefficiency cleanup.

🔵 Key Support Zones & Setups

Previous Weekly VAH: 6885.00

We need to pay attention to being above/below the Previous Weekly Value Area High at 6885.00.

“Phenomenal” Buy Setup: 6872.00

6872.00 (Untested Daily).

Actionable Setup: If they pull back and play 6872.00, this could be a phenomenal trade setup. We want to see it hold and start to get back above the 6883.00 Weekly and 6891.00 Daily.

Invalidation: Stop out under the 4-Hour at 6867.75. If it doesn’t hold, we look lower.

Midpoint Cluster: 6852.75

6852.75 (4-Hour/1-Hour).

Actionable Setup: If this plays, I think it will pop, but look out for it to come back down to play 6843/6847, and get back above 6852.00 for confirmation.

The “Monster” Area: 6843.00 - 6847.00

6846.00 area is an “absolute monster” (Overlapping POCs).

6847.00 (4-Hour) and 6843.00 (Daily / Weekly POC).

Actionable Setup: If 6852 fails, we look here. I want to see price immediately get back above 6847.00 for continuation higher.

Deep Support: 6794.00

6794.00 (Daily Leg Up) and 6788.00.

Actionable Setup: I am a little cautious here because the Daily timeframe hasn’t gained. If we push back under 6794 and 6788, look for a sweep of the Wednesday Low (6765 area)—that looks “sexy” for a reclaim of 6788/6794.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

We are in full Santa Claus Rally mode. We have swept liquidity, built massive value for three weeks, and are primed for more up.

The charts are pointing up, and VIX is looking down. Funds are doing end-of-year rebalancing and tax loss harvesting, so expect some grind, but we are looking for setups to traverse into new All-Time Highs.

I will see you guys in the Discord room Monday morning, post market breakdown at 5pm on the the socials for the stream, and then on Tuesday for the trade plan for the masses.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.