Happy Martin Luther King Day and Happy Weekend Review.

For those of you who usually expect it on a Sunday, you get it on a Monday. I did this intentionally because I was expecting a gap down coming into the market on Sunday and I wanted to wait for the dust to settle.

We had the Trump headlines regarding the tariff stuff in Greenland and the UK backing out, so we have some volatility. To be honest, the chart told us that at the close on Friday.

🧠 Current Market Context

The tariff stuff is right on time. We have been walking up from the lows on VIX, and every time we get down into this area ($13-$14 handle), we pop super duper hard.

Weekly TPO: Last week we missed the range by about 3-4 points. Right now, we are expecting 93 points for the week, leaving 64 points left.

The Target: The weekly range targets 6825. This becomes really important as it puts us down by our 3-Week Composite Value Area Low. This is a massive structure of overlapping composites and a huge area to play the outside of.

🚨 VIX Analysis: The 17.50 Deciding Factor

I have been talking about VIX being in the $13-$14 handle for some time and how dangerous it could be.

Intermediate Pivot: 16.75. My guess is we popped over this. If they can play off this and get VIX up, ES will come down.

The Breakout Spot: 17.50. This is our big deciding factor. It is a massive Monthly level and a super important structure.

Actionable Note: Above 17.50, momentum shifts hard. If it breaks, we come to 20.00 and potentially higher.

🎯 Detailed Actionable Trade Plan (ES Futures)

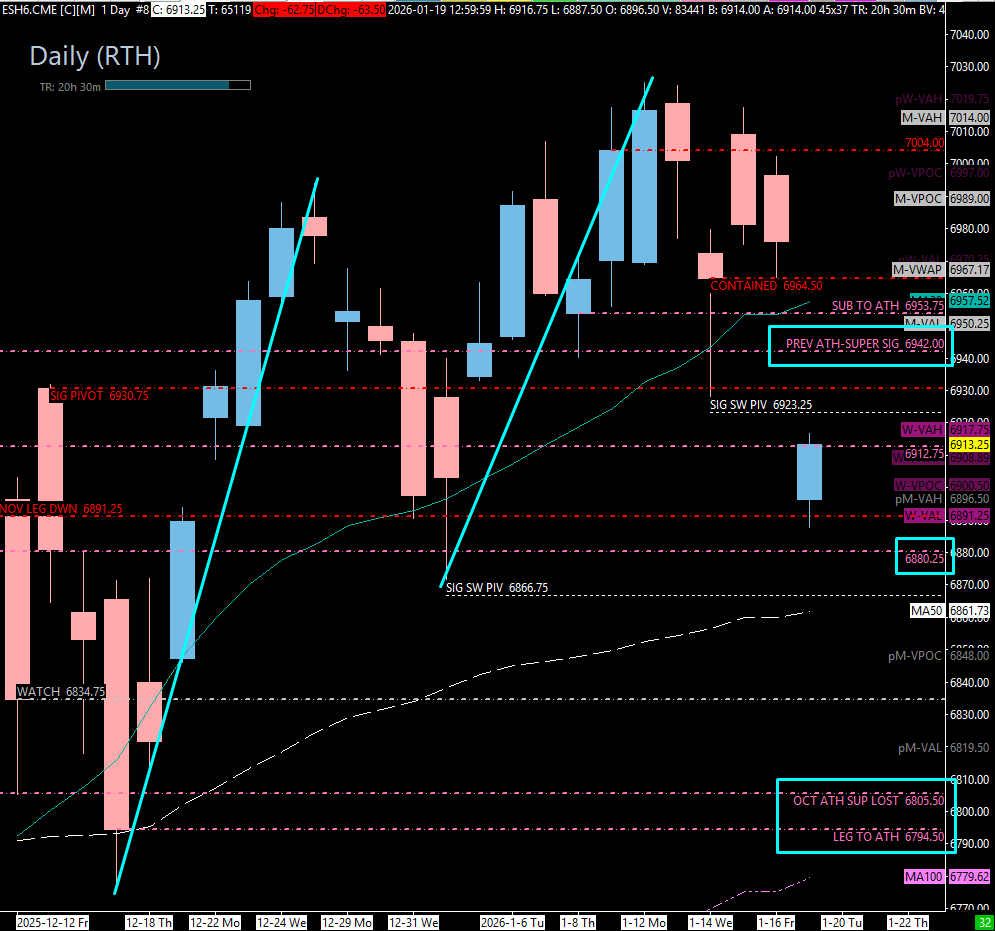

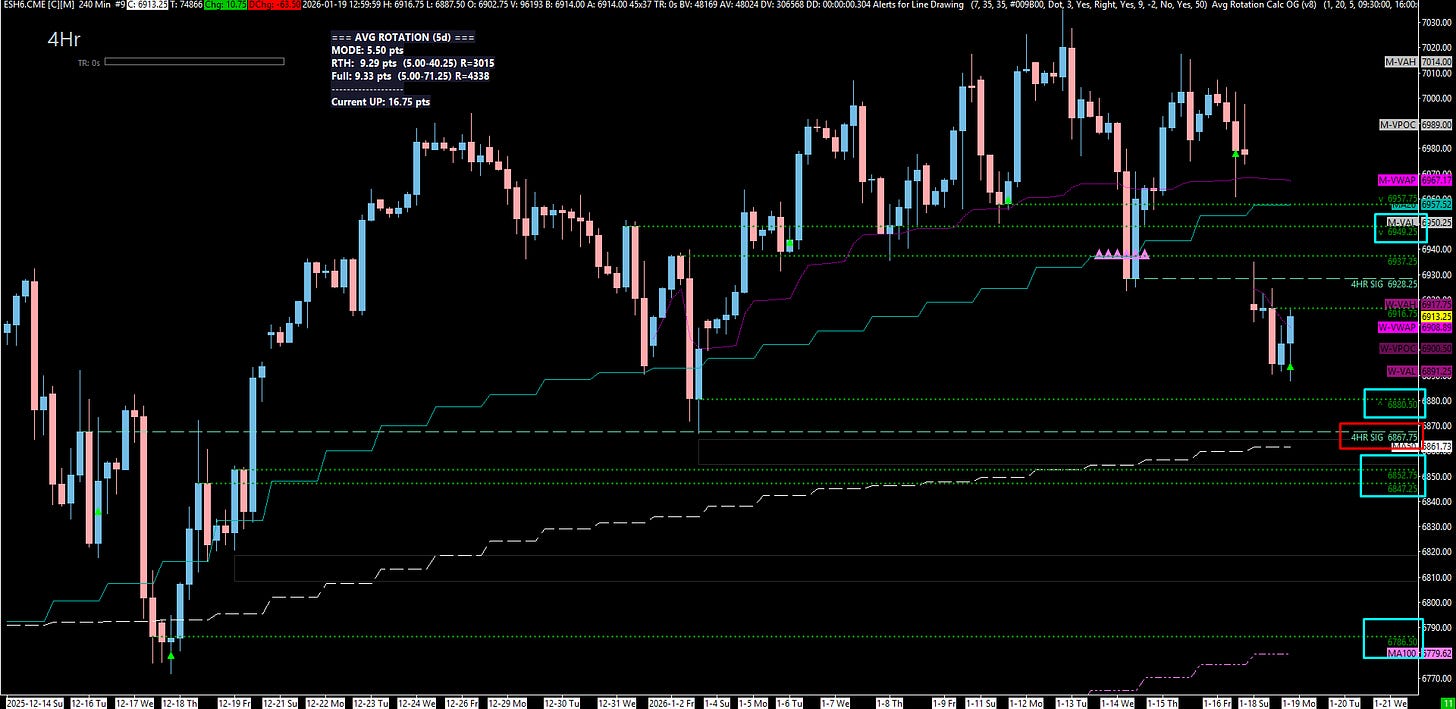

We are currently holding the 6891 support (November leg down), but if we sweep below, we shift momentum into the 6880 area.

🔴 Key Resistance Zones & Setups

The “Insane” Resistance: 6928.00 - 6964.00

The whole area from 6964 to 6928 is insane resistance. Layered Dailies at 6930.75 , 6942.00, 6953.75, 6964.50.

Major Pivot: 6942.00

This is our massive Daily pivot. We have played this above/below so many times.

Significant 4-Hour / Daily: 6928.00 - 6930.00

Great spot to determine if we are above or below.

Short Setup: If we come into the 4-Hour at 6937.50, wait to get below 6937, and then lose 6930 to come down.

Swing Pivot: 6923.00

Significant Swing Pivot. This is where the move truly begins to the upside (above 6923).

🔵 Key Support Zones & Setups

Immediate Support: 6891.00

November Leg Down. We are holding this right now.

“Leg In” Support: 6880.00

Untested Daily (6880).

Actionable Setup: If we sweep below 6891, look for 6880 to play and get back above the 6883 weekly. We want to see this hold and go at least back to 6942. This is the “Leg End”.

Weekly Top-Down: 6883.00

Big Weekly to watch for above/below momentum.

Composite Value Zone: 6850s Area

6851.75 (3-Week Composite POC), 6852.75 (4-Hour), 6847.25 (4-Hour).

Actionable Setup: I really like the 6850s area. Look to play this area and get back above the Monthly at 6857.

Composite VAL Cluster: 6830.00 - 6834.00

6831 (3-Week Composite VAL), 6834 (Daily), 6830 (Daily).

Context: Massive spot, but tested.

Leg End: 6794.00 - 6805.50

Daily Leg End / 4-Hour at 6786.50. This will probably hold and pay.

“Killer Spot” (Sweep): 6761.00 - 6765.00

6765 (SPX played, ES didn’t), 6761 (Weekly).

Actionable Setup: Worst case scenario, we sweep this low (near 100-day MA) and boogie as soon as we get back above.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

We are in a very critical spot. We go up a lot slower than we come down, so they could do this move in a week or two if they want to get down there. But it is all going to come down to 6880 right here. This is our structure and our big above/below.

I’m on a mission right now. Join me in the trade plans and until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.

RTH Daily

4Hr Chart Only