What’s up, everybody? It’s time for the Week in Review.

Before we dive into the charts, some exciting news! Starting this Monday, October 27th, I’m launching daily post-market breakdown streams every day at 5 PM EST. We’ll go over the ES action, see how the plan played out, look at stocks on the radar, and line up for the next session. I’ll be streaming live on X, YouTube, Twitch, and Substack.

This is part of the transition to the Ryan Bailey’s S&P Edge brand, which officially launched on Substack this Previous Monday. Moving forward You’ll get a more in-depth look at my trading, profitability, and process. To stay connected and get updates instantly, please follow my new channels:

Follow the New YouTube Channel: @RyanBaileyEdge

Follow Me on Twitter: @RyanBaileyEdge

Follow Me on Twitch: @RyanBaileyEdge

I’m extremely active on Twitter now, posting insights directly from the Discord. It’s the fastest way to get info outside the room itself. This will be the last week this review is posted on the VICI YouTube channel.

Now, let’s get into the plan.

🧠 Current Market Context

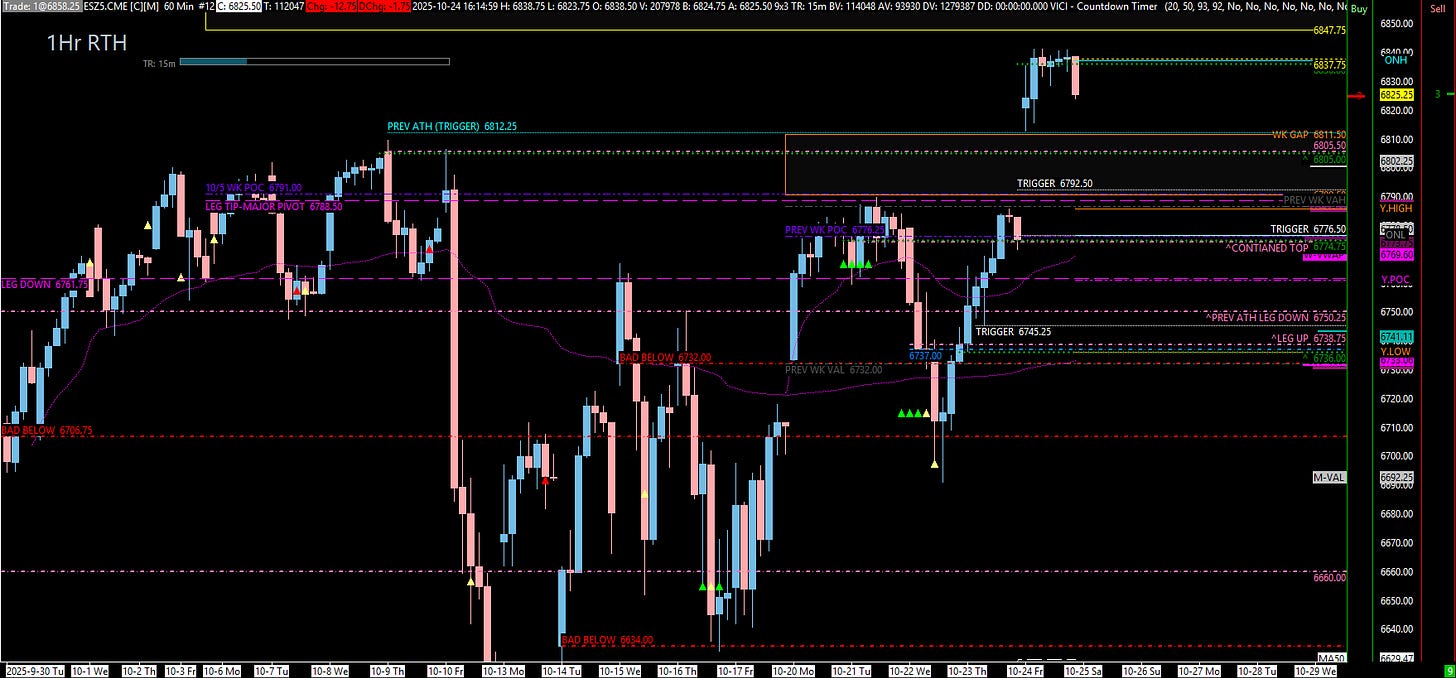

Looking at the weekly TPO chart, it’s no surprise that we’ve been balancing. After the big drop, we spent all of last week cleaning up the inefficient auction from the week prior, accepting value within that range. We’re essentially in a multi-week balance area. While this makes directional trading difficult, the structure remains bullish.

Despite Friday’s CPI gap-up appearing like a potential “blow-off top” to some, I sincerely doubt it. Yes, some tech P/E ratios are stretched, but many stocks still have room to run, potentially dragging the indices higher. Remember the Golden Cross (100-day over 200-day MA) we discussed back in August?

Historically, this signal points to significant upside over the next 1-2 years. Blow-off top? Probably not. Can we pull back 100 points? Absolutely, and I have buy spots ready. But the bigger picture remains bullish. Next week is huge with big tech earnings, FOMC, and Trump’s meeting with President Xi – expect volatility.

🚨 VIX Analysis

The VIX is getting absolutely pounded, now trading below the critical 17.35 monthly pivot.

17.35 remains the major “make-it-or-break” level. Above puts pressure on ES; below gives ES a tailwind.

The immediate pivot is the 16.17 weekly. A push below this adds another tailwind for ES.

The next key support zones are the untested dailies at 15.29 and 14.93. I expect a reaction in one of these areas, potentially causing a small pullback in the ES.

The major weekly support below is 14.22 (tested).

📊 Weekly TPO Insights

Massive Bullish Imbalance: Still exists up to 6950.00. This aligns with the JP Morgan collar top and remains the ultimate magnet.

CPI Gap / Inefficiency: Runs from 6790.00 up to 6811.00. This needs to get filled.

Key TPO Levels: The weekly POC at 6791.00 (from 10/5) is an area of contention. The previous weekly value area high at 6788.00 is a key support reference. Below 6660.00, the structure weakens significantly according to the profile.

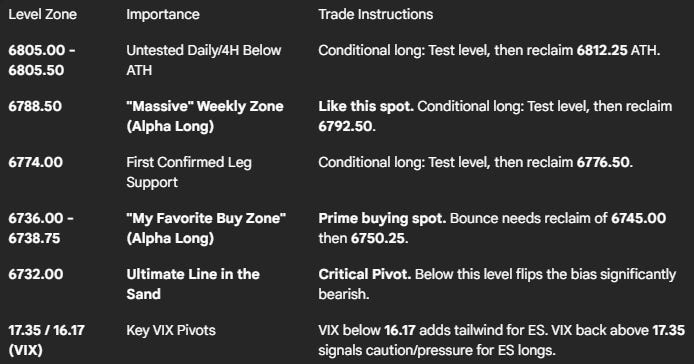

🎯 Detailed Actionable Trade Plan (ES Futures)

We’re approaching this using the cash session (RTH) chart structure, as that’s the basis for my high-timeframe outlook. The plan is built around the 6732.00 daily level – our make-or-break spot.

🔴 Key Resistance & Profit-Taking Targets

The Untested Daily/4H Zone: 6805.00 - 6805.50

This zone contains an untested daily at 6805.50 and a 4-hour at 6805.00. It sits just below the previous all-time high.

Actionable Setup: This is a conditional long. Let price pull back into this zone. The trigger is acceptance back above the previous all-time high (6812.25 based on prior context, though not explicitly stated for ES in this transcript - using 6812.25 for clarity). A reclaim confirms the long, with a tight stop possible.

🔵 Key Support Zones & Setups

The “Massive” Weekly Zone: 6788.50

I really like this spot right here. This is the massive weekly leg tip resistance that smacked us down hard. It also aligns with the previous weekly value area high and the 10/5 weekly POC just above.

Actionable Setup: This is a conditional long. Look for price to test down into this area. The trigger is acceptance back above 6792.50. Take profits around 6805.00, and if we get above 6812.25, look to add/hold runners.

The First Confirmed Leg Support: 6774.00

This zone contains a contained daily and a 4-hour level. It represents support from the recent leg up.

Actionable Setup: This is another conditional long. Wait for acceptance above 6776.50 before entering. Take profits around 6788.00, and look to add/hold runners if we squeeze above that.

The Untested Daily Zone: 6750.25

This daily actually took us down significantly before and also played as amazing support. I don’t want to ignore this level, even though others nearby might seem stronger. It is untested.

“My Favorite Buy Zone”: 6736.00 - 6738.75

This is the key prime area – the inception of the move up. It contains the new daily leg up at 6738.75, a 4-hour at 6736.00, the ETH daily at 6737.00, and the monthly VWAP. The 20-day MA adds confluence around 6740.00.

Actionable Setup: I absolutely love this level. A bounce here needs confirmation back above 6745.00 and ultimately the daily at 6750.25 to confirm the move higher is sustained.

The Ultimate Line in the Sand: 6732.00

This is our major high-timeframe pivot. Below this level, the bullish structure is seriously compromised, aligning with the weekly TPO value area low. Everything below here points significantly lower toward the 6660.00 area and below.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

Do I think we’re going to get decimated? Probably not. But we have to stay prepared. The market structure is still pointing up, supported by VIX action and longer-term stats like the Golden Cross. However, we are in a balance area and approaching key resistance near the highs. Next week will be massive with earnings, FOMC, and geopolitical headlines – expect volatility. The plan is clear: focus on buying dips at our key defined levels, using the specific triggers for confirmation, and respect the ultimate line in the sand at 6732.00.

Play the levels as you see fit, and I look forward to seeing you guys on Monday for the first post-market breakdown!

Have an excellent weekend.

Ryan Bailey, VICI Trading Solutions.