Why the S&P 500 Takes the Elevator Down, But the Stairs Back Up

The data and psychology behind the market’s two modes: Why fear causes 2% drops, and why greed creates a slow, grinding recovery.

If you’ve been a trader for any length of time, you’ve felt this in your gut.

The market spends three weeks painstakingly grinding 100 points higher, with every dip bought and every small pullback defended. It’s a slow, methodical climb.

Then, in a single session—often in just a few hours—the market gives back that entire move in a violent, 1-2% freefall.

This isn’t a bug; it’s a core feature of market structure. It’s famously called “taking the stairs up and the elevator down.” This isn’t just a market “saying”; it’s a precise description of a statistically measurable phenomenon.

It happens for two specific reasons: one is based on human psychology, and the other is based on pure market mechanics and hard data.

Mode 1: The Elevator Down (The Psychology of FEAR)

The elevator drop is fast, violent, and emotional. It’s driven by the most powerful, primitive human emotion: fear.

In the market, fear is infinitely more powerful than greed. Greed is a slow-burning desire to make more money. Fear is the immediate, visceral panic that you are about to lose everything.

When a 2% drop begins, a series of cascading events happen all at once:

Panic Selling: A surprise headline hits. A key level breaks. Traders who were comfortably long moments ago are suddenly underwater. They don’t just want to sell; they need to sell, and they all rush for the exit at the same time.

A “Void” of Buyers: When the market is in freefall, where are the buyers? They’re gone. Smart money doesn’t try to catch a falling knife. They pull their bids and wait on the sidelines, which creates a vacuum. With no bids to absorb the flood of sell orders, the price plummets.

Forced Liquidation (Margin Calls): This is the mechanical accelerator. Leveraged traders who were on the wrong side of the move get a tap on the shoulder from their broker: “You’re out of margin.” Their positions are forcefully liquidated at any price, adding even more selling pressure to an already collapsing market.

Fear, a void of buyers, and forced liquidations create a toxic feedback loop that can wipe out weeks of gains in a single afternoon. That is the elevator down.

The Data Behind the Elevator

This isn’t just a feeling; it’s statistically proven.

1. Asymmetry in Speed: Drawdowns vs. Recoveries

The most direct evidence is the time it takes for the market to fall versus the time it takes to recover. The data here is clear: on average, it takes the S&P 500 about 25 calendar days to experience a 10% correction. However, to get a full 100% recovery from that drop, the median time required is 95 days.

It falls 10% in less than a month and takes more than three months to get it all back. This perfectly quantifies the fast drop versus the slow grind higher.

2. Asymmetry in Returns: Negative Skewness

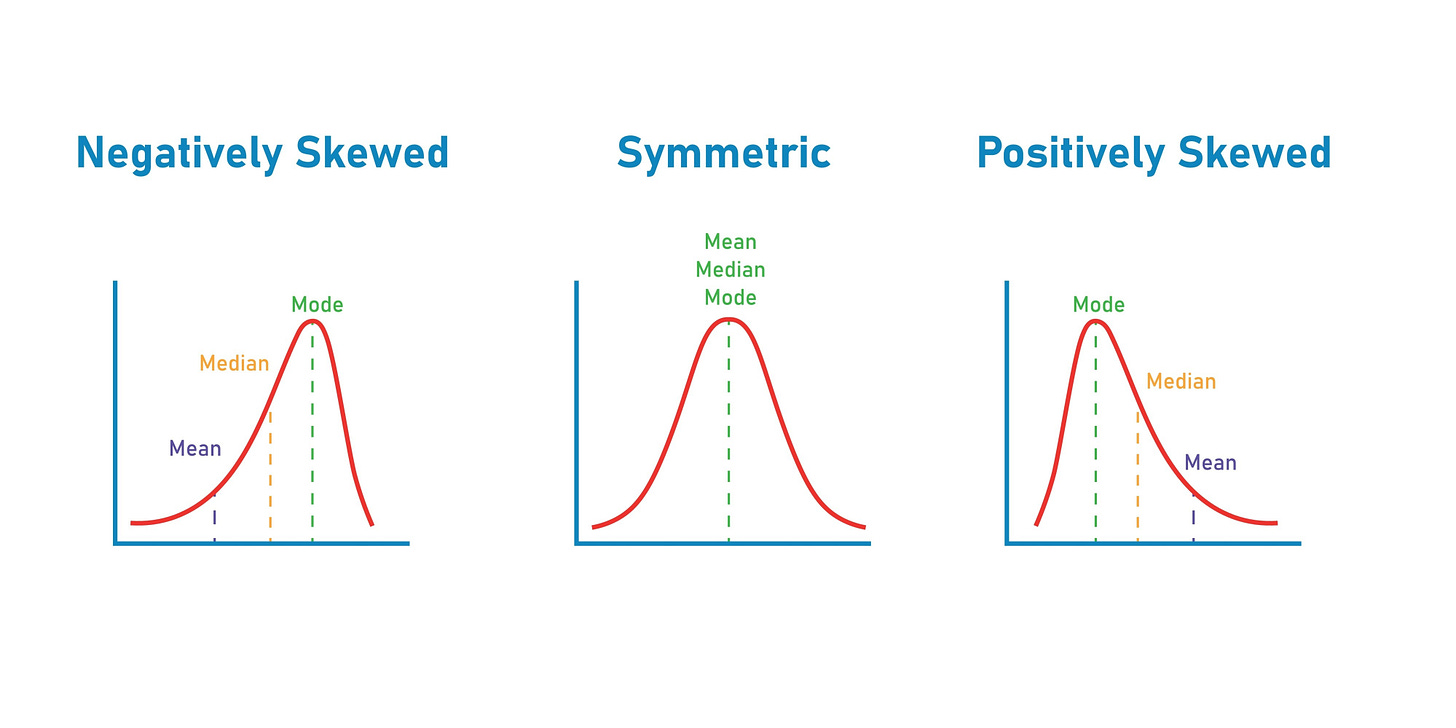

This is the statistical term for the “elevator down” phenomenon. In a normal “bell curve” distribution, you’d expect a 2% gain to happen as often as a 2% loss. The S&P 500 is not normal.

The S&P 500 has a “negative skew.” This means that while small up-days are very common (the “stairs”), large, sudden moves are far more likely to be to the downside. Analyses confirm that 2% and 3% moves are more likely to be to the downside, which “fits with the adage.”

3. Asymmetry in Price: The “Volatility Skew”

This is my favorite piece of evidence because it shows how the market prices this fear. The “volatility skew” (or “smirk”) shows the cost of S&P 500 options.

In a normal market, an option for a 10% rally (a call) would cost the same as an option for a 10% drop (a put). This is not what happens.

Investors are so afraid of a sudden “elevator down” drop that they are always willing to pay a much higher premium for put options (downside protection) than they are for call options (upside bets). This chart is the market’s own data-driven admission that it believes in the elevator down.

Mode 2: The Stairs Up (The Psychology of GREED & ACCUMULATION)

The recovery is the exact opposite. The grind back up is slow, skeptical, and methodical. It’s driven by a mix of cautious optimism, institutional accumulation, and a lack of panic.

Confidence Builds Slowly: After a big drop, trust is broken. Traders and institutions don’t just jump back in all at once. They dip a toe in. They buy a small position, see if it holds, and then add a little more on the next small dip. This is the “grind” you feel.

Institutional Accumulation: Big funds can’t just market-buy 10,000 contracts without spiking the price on themselves. Their goal is to accumulate a large position without moving the market. How do they do this? They patiently buy the small dips, day after day. This process of absorption creates a steady, upward-sloping floor that we see as the “stairs up.”

A Lack of Urgency: During a rally, there is no “margin call to buy.” There is no forced liquidation that makes you buy higher. The only emotion is greed or the “fear of missing out” (FOMO), which builds much more slowly than the acute fear of loss.

The Data Behind the Stairs (and the Rallies in Between)

The “stairs up” refers to the slow, steady, low-volatility climb that defines a true bull market, where improving earnings and economic growth slowly build investor confidence.

Ironically, this brings us to a critical distinction: the largest single-day gains in history almost never happen during the “stairs up” phase. They happen inside the “elevator down.”

These are violent, short-covering “bear market rallies”—a desperate gasp for air inside the elevator shaft. Look at the dates of the biggest S&P 500 percentage gains in history. They are a “who’s who” of market panic:

October 13, 2008: +11.58%

October 28, 2008: +10.79%

March 24, 2020: +9.38%

These are not calm, orderly rallies. They are panic-fueled bounces that occur because the market has fallen so far, so fast. The true “stairs up” is the long, patient, multi-year climb, which is what makes the “elevator down” drops feel so sudden and violent in comparison.

Why This Matters for Your Trading

Understanding these two modes is critical.

Respect the Elevator: Never underestimate how quickly the market can move against you. This is why risk management is not optional. A professional thinks first about how much they can lose, because they know the elevator drop can happen at any time.

Trust the Stairs: Don’t fight the grind up. A market that is slowly climbing is a sign of health and institutional support. Trying to call the top in a “stairs up” market is a good way to get run over.

The market isn’t random. It’s driven by the collective emotions and mechanics of its participants. The next time you see that 2% drop, you’ll know exactly what’s happening: the crowd is taking the elevator. And when you feel that slow, relentless grind, you’ll know the pros are patiently taking the stairs.

Until next time—trade smart, stay prepared, and together we will conquer these markets.

Ryan Bailey

Vici Trading Solutions

The asymetry you describe between the 25 days to drop and 95 days to recover is striking. That point about negative skewness realy quantifies what traders feel intutively. The volatility skew showing investors willing to pay more for puts than calls is facinating proof of how fear dominates. Your distinction between true bull market stairs and desperate bear market rallies inside the elevator shaft clarifys a lot.