Trading the Unlikely: The Low-Probability Scenarios That Trap Most Traders

A data-driven look at the rarest S&P 500 market behaviors. Learn which low-probability ES futures setups to avoid for a smarter day trading strategy.

Hey everyone,

In our last post, we talked about the high-probability scenarios that can form the foundation of a solid trading plan. Knowing what the market is likely to do gives us an edge we can lean on day in and day out. But what about the flip side?

Understanding what the market rarely does is just as critical. It’s the defensive side of the playbook. It keeps us from getting caught in low-probability trades, from fighting institutional momentum, and from betting on scenarios that are statistical long shots.

Today, we’re diving into the data on the market's rarest habits. These are the setups and outcomes with less than a 30% chance of happening. Knowing them will help you spot a trader's trap before you step in it.

1. The Myth of the Perfectly Balanced Day

Many traders come into the day expecting the market to stay within a neat, predictable range. They look for mean reversion and play for failures at the edges. While that works on some days, the data shows that true balance is surprisingly uncommon.

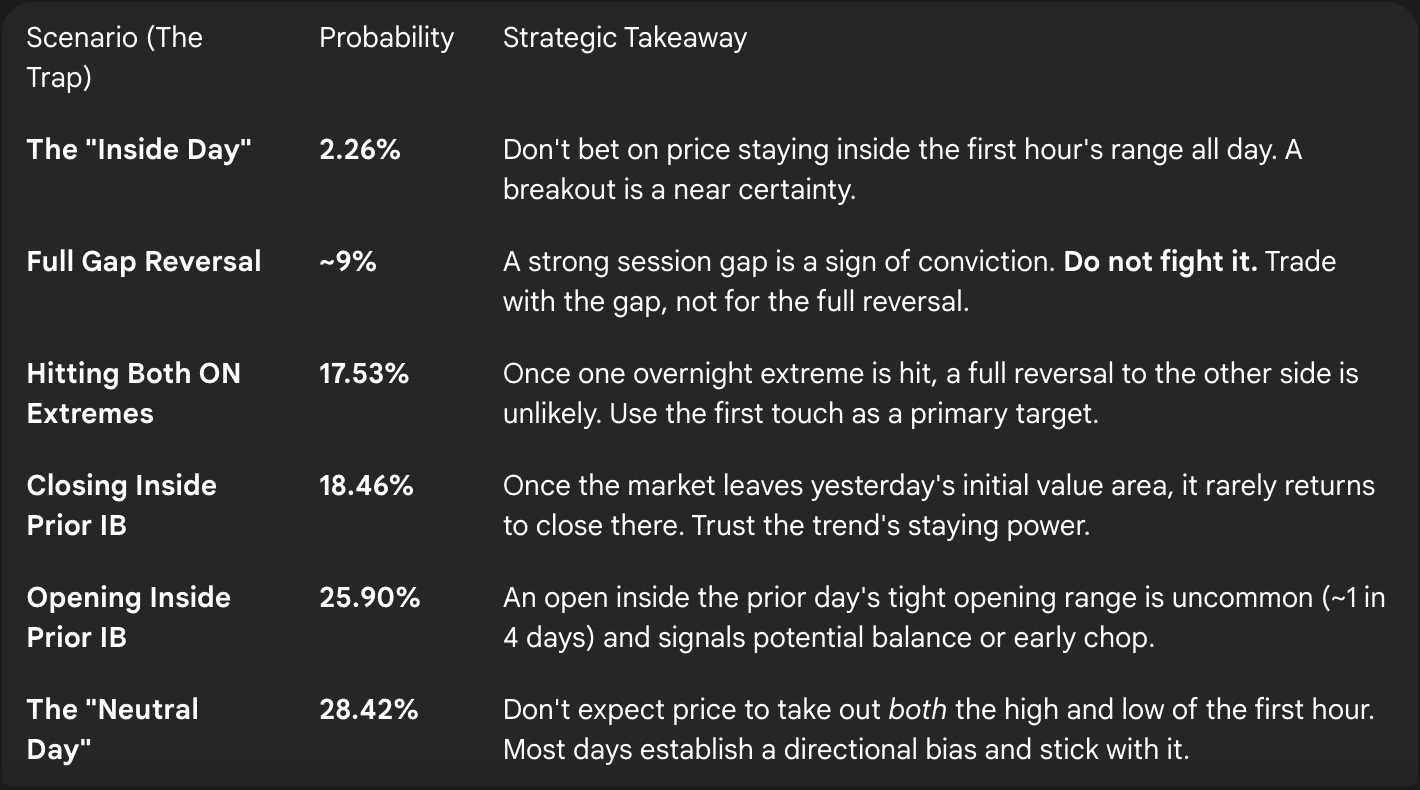

The "Inside Day" is a Unicorn (2.26%): The market has only a 2.26% chance of staying completely contained within the first hour's range (the Initial Balance). Let that sink in. Betting on price to not break the IB high or low is one of the lowest-probability plays you can make.

True "Neutral Days" are Infrequent (28.42%): A day where the market is volatile enough to break both the IB high and the IB low only happens 28.42% of the time. This means most days, once a direction is established out of the initial range, it tends to stick.

The Takeaway: Stop waiting for the market to be perfectly range-bound. The S&P 500 is a creature of momentum. The data tells us to expect a breakout of the opening range and to be prepared to trade in that direction.

2. Why You Should Never Fight a Strong Gap

We all know what a gap is, but a "session gap"—where the market opens completely outside of the previous day's entire high/low range—is a powerful sign of conviction. And the data on what happens next is some of the most important you will ever see.

First, these gaps are already uncommon, especially to the downside (a gap down below the prior low only happens 17.00% of the time).

But here’s the critical part: When a strong gap occurs, the odds of the market completely reversing to fill the gap and tag the opposite end of the prior day's range are almost zero.

When opening above the prior day's high, the chance of price ever returning to tag the prior day's low is just 9.00%.

When opening below the prior day's low, the chance of price ever returning to tag the prior day's high is even lower, at 8.59%.

The Takeaway: A session gap is a message from the market's largest players. Do not fight it. The odds of a full reversal are astronomically against you. The smart play is to look for opportunities in the direction of the gap. Fading it is a recipe for disaster.

3. Other Statistical Outliers to Be Aware Of

Finally, here are a few other rare events that are good to know, as they can keep you from chasing unlikely scenarios.

Hitting Both Overnight Extremes (17.53%): While we know there's a 92% chance of hitting the ONH or the ONL, the probability of the market hitting both in the same session is only 17.53%. Once one side is tagged, the odds of a full reversal to the other are low.

Opening Inside Yesterday's IB (25.90%): The market opening inside the tight range of the previous day's first hour only happens 25.90% of the time. This tells us that the market usually prefers to open with a gap away from the prior day's initial value.

Closing Inside Yesterday's Value (18.46%): The market only has an 18.46% chance of closing back inside the previous day's Initial Balance range. This reinforces the idea that once the market moves, it tends to accept prices outside of the prior day's initial value area.

The Takeaway: These are rare for a reason. Don't build a primary strategy around events that happen less than once every five trading days.

The Traders Trap: Low Probability Cheat Sheet

By understanding and applying these four data-backed tendencies, you can move from hoping to preparing. You can build a daily plan around what the market does most of the time, not what you wish it would do.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey,

VICI Trading Solutions