Trade With Data ... Not Your Emotions

My Deep Dive into the Institutional-Grade Data Tool That Costs Less Than Lunch.

Hello Team,

We talk a lot about “Edge” here. It’s in the name of the newsletter. But what is an edge, really?

In the retail trading world, people think an “edge” is a magic indicator or a secret pattern. But if you talk to professional traders at Goldman Sachs or major hedge funds, they don’t trade off “vibes” or “hope.”

They trade off probability.

They don’t guess if a gap is going to fill. They know that historically, under these specific conditions, it fills 63% of the time. They are playing the house, not the gambler.

For years, retail traders like us have been bringing a knife to a gunfight. The institutions have the data; we have the emotions.

That changes today.

I have recently partnered with a platform called Edgeful, and after doing a complete deep dive into their software, I can honestly say: This is the tool that levels the playing field.

If you are tired of hesitating on entries, exiting winners too early, or revenge trading because you “feel” the market owes you, you need to read this breakdown.

The “Why”: Built by Wall Street, Priced for Main Street

Before I touch a piece of software, I want to know who built it. In this industry, there are too many “gurus” selling snake oil.

Edgeful was created by André Arslanian. He isn’t a marketer; he’s a former Goldman Sachs trader and Hedge Fund Manager.

He built Edgeful because he realized a massive gap existed. Institutional traders had expensive terminals telling them the statistical probability of every move, while retail traders were drawing lines on charts and guessing.

He built this platform to democratize that data. And instead of charging $2,000 a month like a Bloomberg terminal, he priced it starting at just $49/month.

The Solution: A Deep Dive into the Edgeful Platform

I spent the last week tearing this platform apart to see what it can actually do. It is massive, but here are the core features that are going to change your trading immediately.

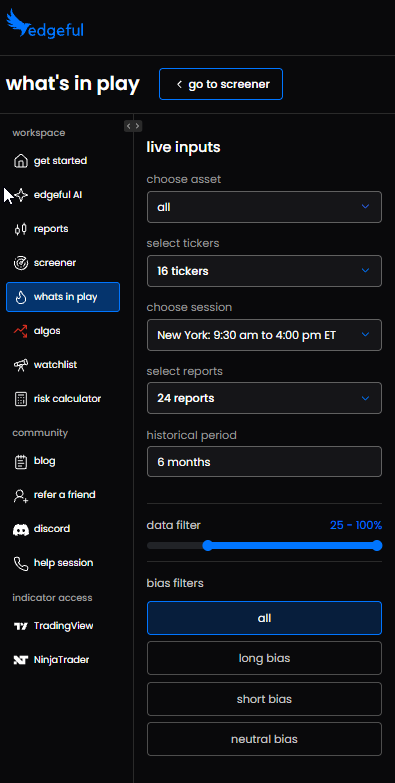

1. The “What’s In Play?” Dashboard (Your Daily Compass)

Imagine logging in at 9:00 AM. Instead of scanning 50 charts trying to find a pattern, you look at one dashboard.

It tells you, in real-time:

The Setup: “ES Gap Up forming.”

The Probability: “63% historical fill rate.”

The Target: “5,850.”

The Bias: Bullish/Bearish.

It does the heavy lifting for you. It tells you where the probabilities are stacked in your favor right now.

2. 100+ Customizable Reports (The Statistical Edge)

This is the engine room. Edgeful tracks over 100 different price action events across Stocks, Futures, Forex, and Crypto.

Gap Fills: Want to know how often the NQ fills a gap down on a Wednesday? It tells you.

Opening Range Breakout (ORB): Love trading the first 15 minutes? Edgeful breaks down the exact profit targets that get hit most often (e.g., 2x the range).

Initial Balance (IB): This is huge for my patience traders. The first hour of trading sets the tone. Edgeful shows that on NQ, once the IB breaks, there is a 76.8% probability it continues in that direction.

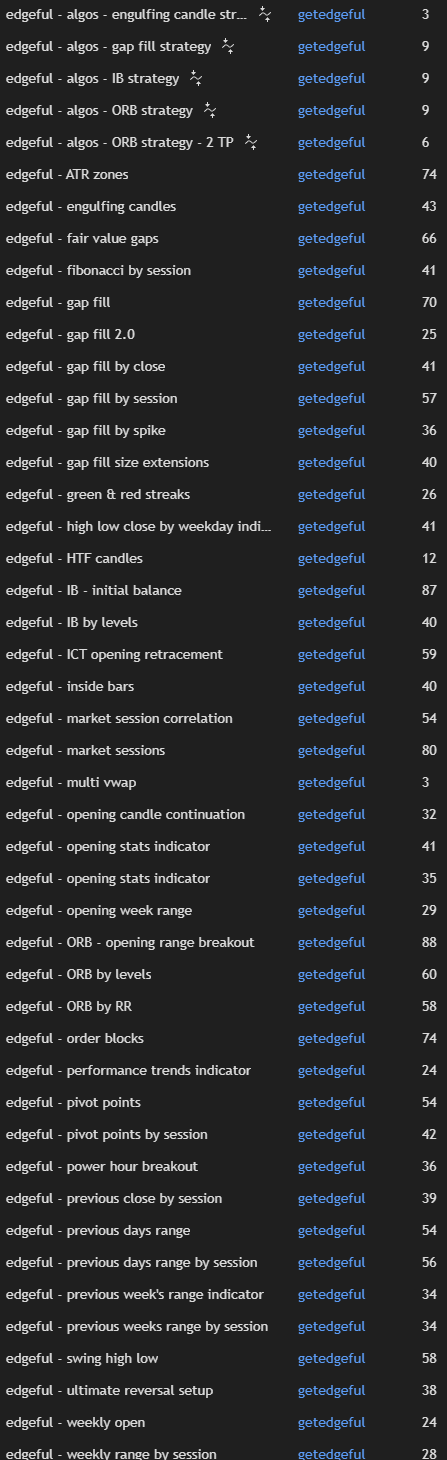

3. Custom Indicators for TradingView & NinjaTrader

This is a massive quality-of-life feature. If you use TradingView or NinjaTrader, Edgeful includes 35+ custom indicators that sync directly with your account.

Forget drawing lines manually every morning. These indicators automatically plot:

Session Boxes: Instantly visualize the London, NY, and Asia sessions.

ORB & IB Levels: The Opening Range and Initial Balance lines appear automatically on your chart.

Gap Targets: It marks the exact fill price for you.

Pivot Points: Daily, weekly, and monthly pivots with probability context.

Your chart essentially “wakes up” with the institutional levels already drawn for you.

For the Heavy Hitters: The Algo Tier ($299/mo)

If you are a serious trader looking to scale, Edgeful offers a premium Algo Tier for $299/month. This is where you move from “Data Analysis” to “Full Automation.”

This tier gives you access to the same algorithms that generate the data, allowing you to:

Automate the Strategies: You get fully automated versions of the Gap Fill, Opening Range Breakout (ORB), and Initial Balance (IB) strategies.

Backtest Everything: Before you risk a single dollar, you can run these algos against historical data. You can see exactly how a “20-point Gap Fill” strategy would have performed over the last 2 years (Win rate, Drawdown, Profit Factor).

The Future of Trading: By the end of 2025, they are rolling out full Broker Integration. This means you will be able to connect your broker, set your parameters (Risk, Position Size, Max Drawdown), and let the Algo execute the trades while you sleep or work.

For a Prop Firm trader or someone managing capital, this feature alone is worth the price of admission.

(ONE OF MANY ALGOS - I PICKED ONE TO SHOW)

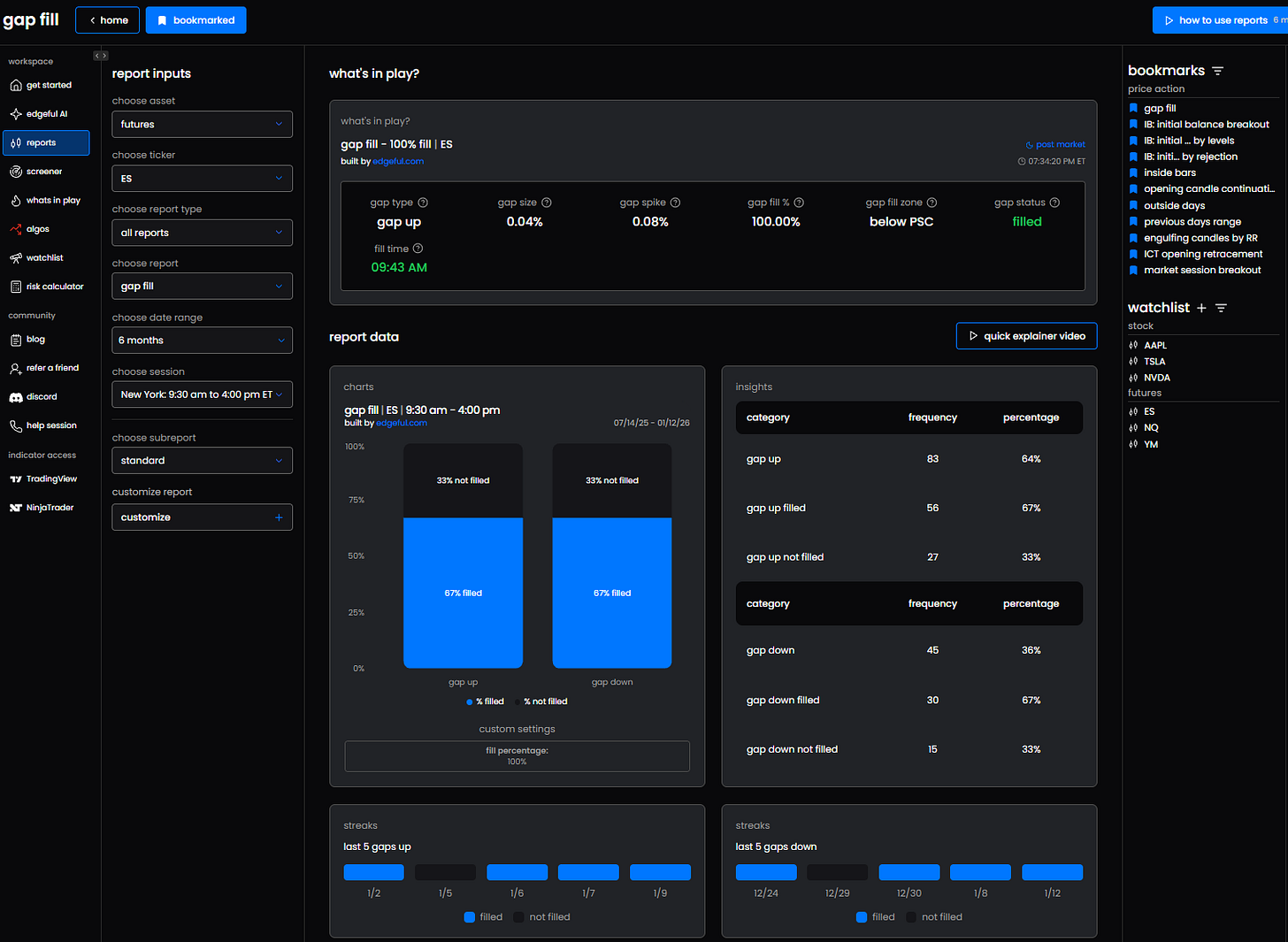

A Real-World Example: The “Gap Fill” Trade

Let’s walk through a trade to show you how this pays for itself.

The Scenario:

It’s Monday morning. The S&P 500 (ES) opens with a gap up of 20 points.

The Old You:

You stare at it. “Is it going to run? Is it going to fade? I feel like it’s too high.” You hesitate. You short it too early, get stopped out, then long it at the top.

The Edgeful You:

You check the dashboard.

It says: “ES Gap Up. Historical Fill Rate: 63%.”

It gives you the exact target price for the fill.

You enter the short with confidence because you have a statistical edge.

You set your profit target based on the data, not greed.

Result: You execute a disciplined, winning trade. No stress. No guessing.

The Value: It Costs Less Than a Cup of Coffee

Now, let’s talk price, because this is where I was shocked.

Institutional data feeds usually cost $500 to $2,000 a month. Competitors like Trade Ideas cost $200+ a month.

Edgeful’s base plan is $49 a month.

That breaks down to about $2.45 per trading day.

If this tool saves you from ONE bad emotional trade a month, it is free.

If it helps you find ONE winning trade you would have missed, it is free.

And if you are ready for automation, the $299 Algo plan is basically the cost of one good day in the markets.

My Verdict & An Exclusive Offer

I don’t recommend tools lightly. I recommend Edgeful because it forces you to be a better trader. It strips away the emotion and replaces it with cold, hard facts.

It helps you trade like the house, not the gambler.

If you are ready to stop guessing and start knowing, I have set up a special link for the VICI community.

You can try Edgeful completely FREE for 7 days.

I strongly suggest every person reading this try this out for the free trial at a minimum. The data in here is worth its weight in gold.

Test the data. Install the TradingView indicators. Run a backtest on the Algo. See if the probabilities align with your trading style. You have nothing to lose and an entire career of discipline to gain.

>> CLICK HERE to Start Your 7-Day FREE Trial of Edgeful <<

Note: The link above will ensure you get the best possible pricing if you decide to stay.

Let’s stop hoping the market moves our way, and start trading where the data says it’s going.

Until next time—trade smart, stay prepared, and together we will conquer these markets.

Ryan Bailey

Vici Trading Solutions