The Financialization of Bitcoin: When the Tail Starts Wagging the Dog

Nasdaq’s push to quadruple option limits on IBIT marks the final transition of Bitcoin from “digital gold” to a Wall Street volatility engine.

Bitcoin was created as an antidote to the traditional financial system—a bearer asset, peer-to-peer, disconnected from the leverage and gamesmanship of Wall Street.

But today, we are watching the final stages of its absorption into that very machine.

The Nasdaq International Securities Exchange (ISE) has officially filed a proposal with the SEC to aggressively expand the trading limits for options on BlackRock’s iShares Bitcoin Trust (IBIT). They aren’t asking for a small bump. They want to quadruple the position limits from 250,000 contracts to 1,000,000 contracts.

This might sound like boring regulatory plumbing, but let me translate what this actually means: Bitcoin is about to be subjected to the same “gamma squeeze” mechanics that send stocks like NVIDIA and GameStop to the moon.

The Proposal: Opening the Floodgates

Currently, the limit of 250,000 contracts is a bottleneck. Big institutional players—pensions, macro funds, and volatility desks—can’t size their positions large enough to make it worth their while without hitting these ceilings.

Nasdaq’s argument is simple math:

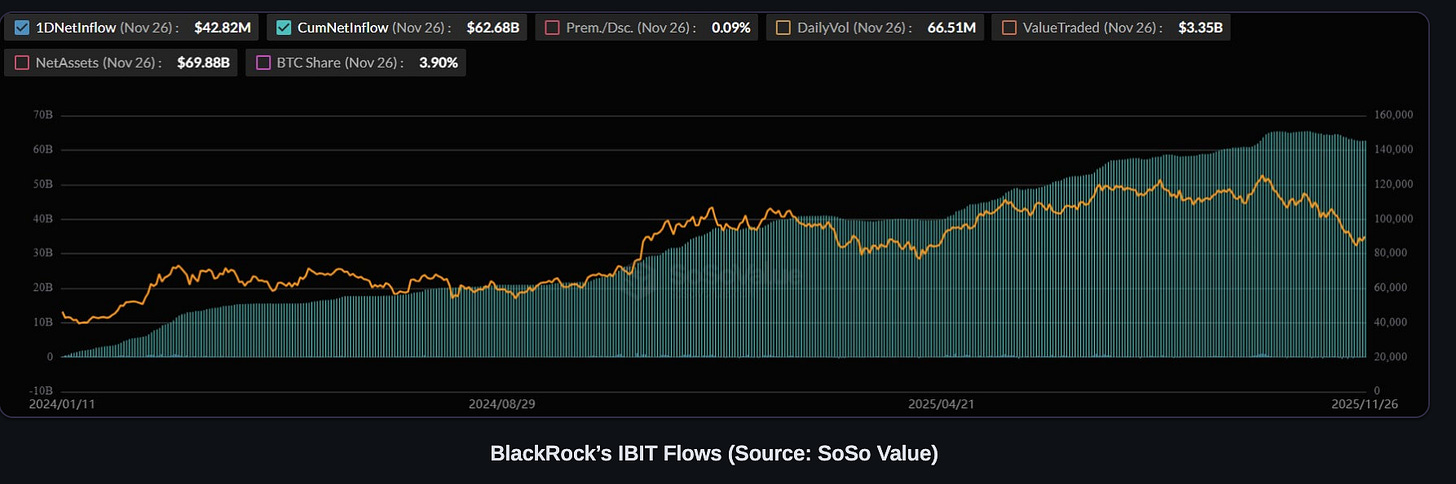

IBIT has grown into an $86.2 billion behemoth.

Its average daily volume exceeds 44 million shares.

A 1-million-contract limit would still only represent ~7.5% of IBIT’s float and less than 0.3% of the total Bitcoin supply.

In their eyes, Bitcoin has graduated. It deserves the same trading bandwidth as Apple or Tesla.

The “Gamma Whale” Risk

Here is where the crossover from “physical asset” to “financialized asset” gets interesting—and potentially volatile.

In the old days, Bitcoin price moved because people bought Bitcoin. Simple. Supply and demand.

In this new world, price can move because a dealer is hedging an option contract. When institutions buy massive amounts of Call Options (betting price goes up), the Market Makers on the other side are “short” those calls. To protect themselves, these Market Makers must buy the underlying asset (IBIT or Bitcoin) as the price rises.

This creates a feedback loop:

Price goes up.

Market Makers are forced to buy more to hedge.

Buying pressure drives price up further.

Repeat.

This is a Gamma Squeeze. By raising the limit to 1 million contracts, Nasdaq is effectively building a much larger “rocket engine” for these squeezes. We are moving from a market driven by spot accumulation to one driven by option convexity.

The VICI Take

This is a double-edged sword.

On one hand, this brings massive liquidity and allows Bitcoin to function as high-grade collateral in the global macro grid. It legitimizes the asset in a way nothing else can.

On the other hand, we have to accept that Bitcoin is no longer just a store of value; it is a volatility product. The “pure” price action of the past is gone. We are now trading a financial derivative of a derivative.

For traders like us, this is opportunity. Volatility is our lifeblood. But for the purists, it’s a wake-up call: Bitcoin hasn’t just entered the building; it’s now part of the foundation.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.