The Casino vs. The House: Why You Need to Stop Guessing

Trading isn’t about being right. It’s about being profitable. And the only way to do that is to stop gambling and start measuring.

Hey Team,

Let’s have a serious conversation about “Edge.”

Most retail traders think having an edge means knowing a secret pattern or having a magic indicator. It doesn’t.

Trading is a game of probabilities. That is it.

It is about having a process that is mathematically measurable so you know exactly what your chances of winning or losing are every single time you click that mouse.

When you take a loss, it shouldn’t ruin your day. If you are trading a system with a verified high win rate, a loss is just a statistical operating cost. You brush it off because you know, with absolute certainty, that the math is in your favor over the long run.

This is how the business runs.

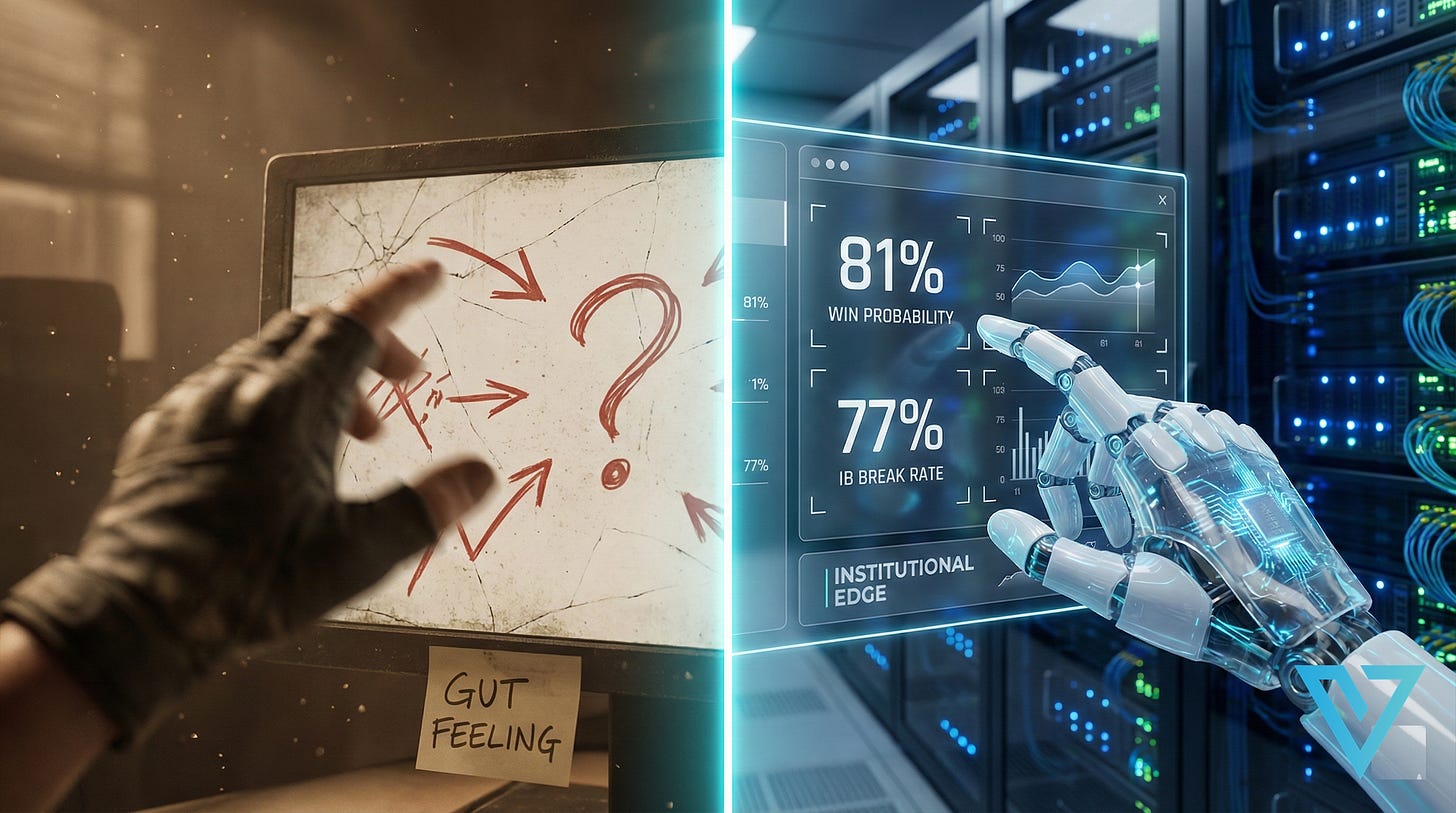

The Institutional Divide

Retail traders are the only ones who don’t measure this.

Institutions measure everything. They track Sharpe ratios, win-loss ratios, and drawdowns to the decimal point. They don’t take trades because they “feel” good. They take trades because their system says: “This setup has an 82% probability of success.”

If you are trading without knowing your probabilities, you aren’t trading. You’re gambling.

Enter Edgeful: Institutional Data for $50

I have been talking about this platform for a reason. Edgeful is the tool that bridges the gap between retail guessing and institutional precision.

This isn’t just a scanner. It is a probability engine.

They have data going back 5 years across Stocks, Forex, Crypto, and Futures. They track every statistic you can think of:

Overnight High/Low Breaks

Initial Balance Breaks

Gap Fills

Inside Day Breakouts

Outside Day Reversals

It calculates the data instantly and shows you the potential for these things to happen in real-time.

For an individual to calculate this manually? Impossible. You would need a team of quants. Edgeful gives it to you on a silver platter.

The “One Point” Rule

I am an ES Futures trader. Let me put the cost of this platform into perspective for you.

It costs me one point a month.

One single point on the ES. That is it.

For the cost of four ticks of movement, I get the confidence and statistical edge to know exactly which trades to take.

I have a simple rule: I focus on plays with an 80% probability or higher.

If I see a setup on the Edgeful “What’s In Play” dashboard that has an 80% historical win rate, I take it. It is too good to pass up. The platform gives me the data to make that decision without hesitation.

The Investment Mindset (The Popeyes Test)

Here is the reality check.

This platform costs $50 a month.

You spend more than that on coffee in a week. You spend more than that on sandwiches at Popeyes or junk food at McDonald’s.

Fast food makes you fat. Caffeine dissipates in a few hours.

This platform makes you money.

It is updated in real-time. It brings institutional-grade statistics to a beautiful, forward-facing dashboard. It is, frankly, the most insane value I have seen in this industry.

Stop spending your money on liabilities and start investing in your edge. Invest in probabilities. Invest in statistics.

Do yourself a favor. Click the link below, skip the drive-thru this week, and get the data that will actually change your P&L.

>> CLICK HERE to Stop Guessing & Start Edgeful <<

You will not be disappointed.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey

VICI Trading Solutions