The Anonymity Of A Daily Trade Plan - A Professional Approach

See exactly what a professional trade plan looks like: the full blueprint I deliver before every session, complete with market bias, key levels, and the framework traders use to trade with confidence.

*BELOW IS THE EXACT LAYOUT DELIVERED TO YOUR IN BOX PRE MARKET*

Good morning, everyone. Today is Thursday, September 11th, and once again, we are on a mission to seek new all-time highs.

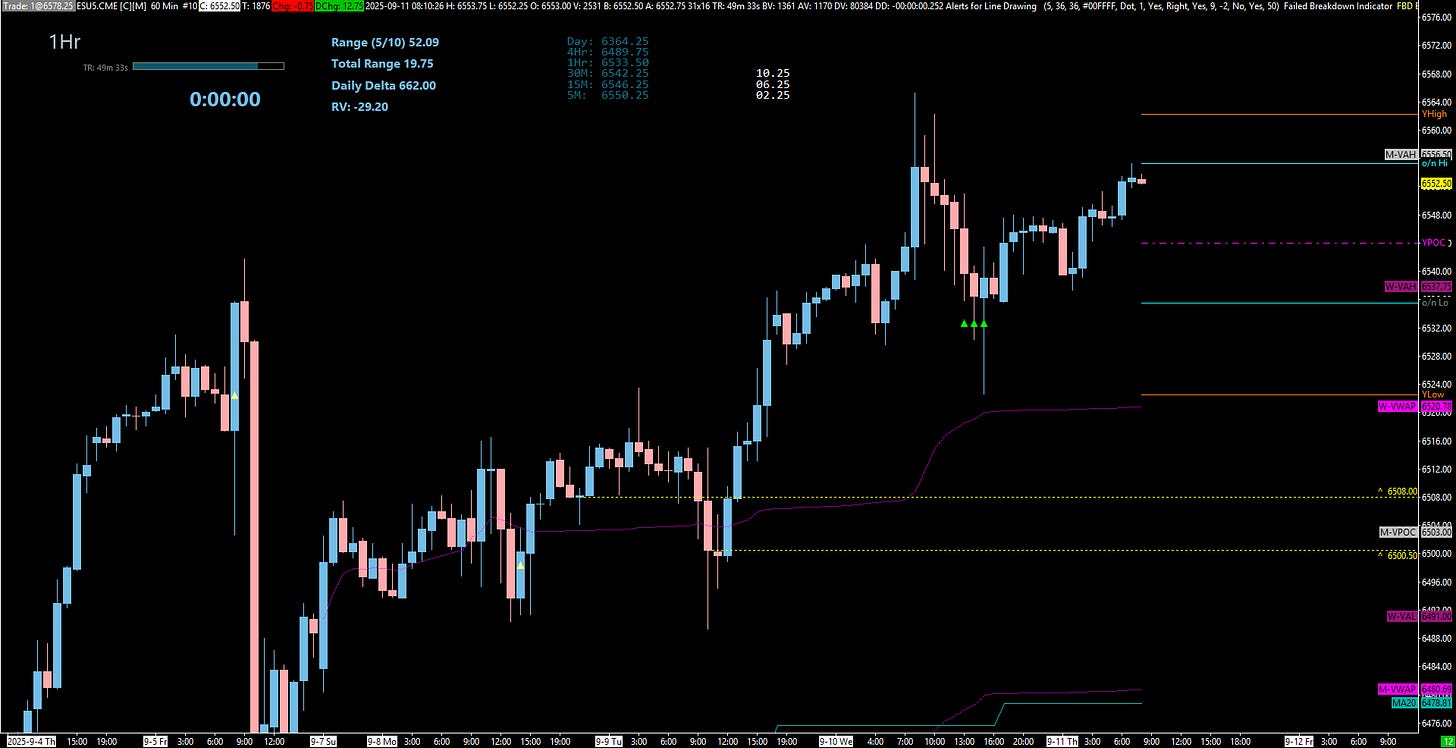

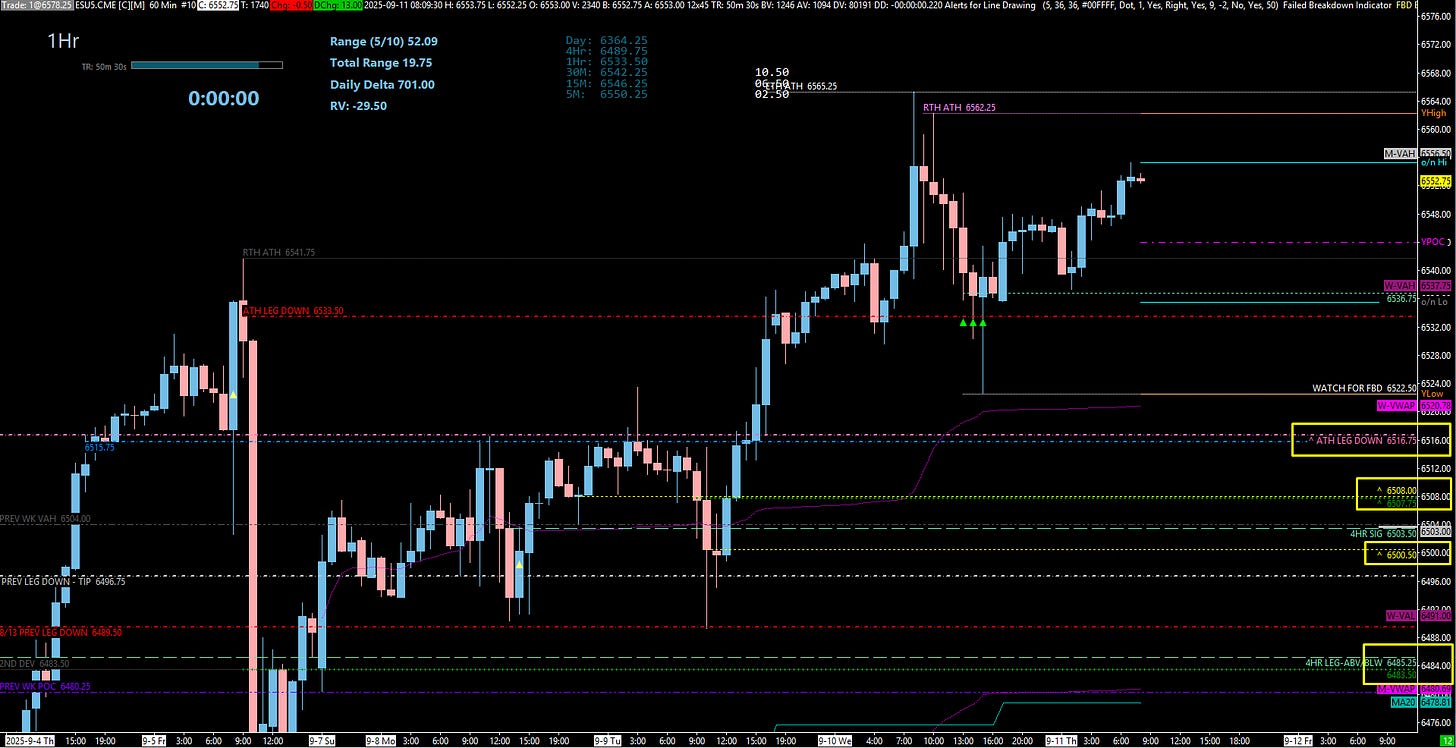

We had an excellent trade towards the end of the day yesterday when price reclaimed the significant daily at 6533.50. That setup has led to a 20+ point grind higher all night. The real question is what happens today. We have serious red-tag news pre-market at 8:30 AM ET with Core CPI and Unemployment Claims, so we must be prepared for either direction. Let's get right into the levels.

🧠 Current Market Context

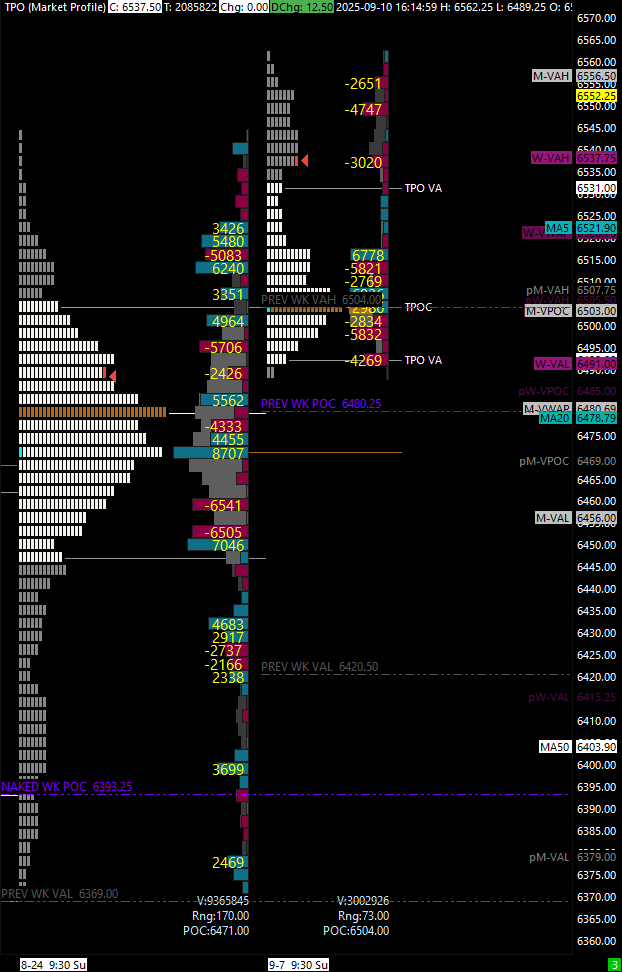

The market is poised to continue its move higher. The successful reclaim of 6533.50 yesterday showed that buyers are still in control. The primary mission for the cash session is to take out the all-time high that was made in Globex yesterday, as these levels are rarely left unchecked. However, with high-impact news on deck, anything is possible, which is why having a clear map of the support structure below us is critical. While there is no significant untested support immediately below us, we have a series of key tested levels and leg structures to lean on.

🚨 VIX Analysis

It is important to note that the VIX is currently trading above our 14.85 weekly pivot. This is the high-timeframe Line in the Sand for volatility.

Upside Resistance: The significant monthly at 15.65. A move above this would likely push the indices lower.

Key Pivot: The weekly at 14.85. If the VIX falls below this level, it would likely push the indices much higher. Please keep track of both of these levels.

🎯 Detailed Actionable Trade Plan

🔴 Key Resistance & Upside Targets

With the market in price discovery, we have no technical resistance above us, only targets.

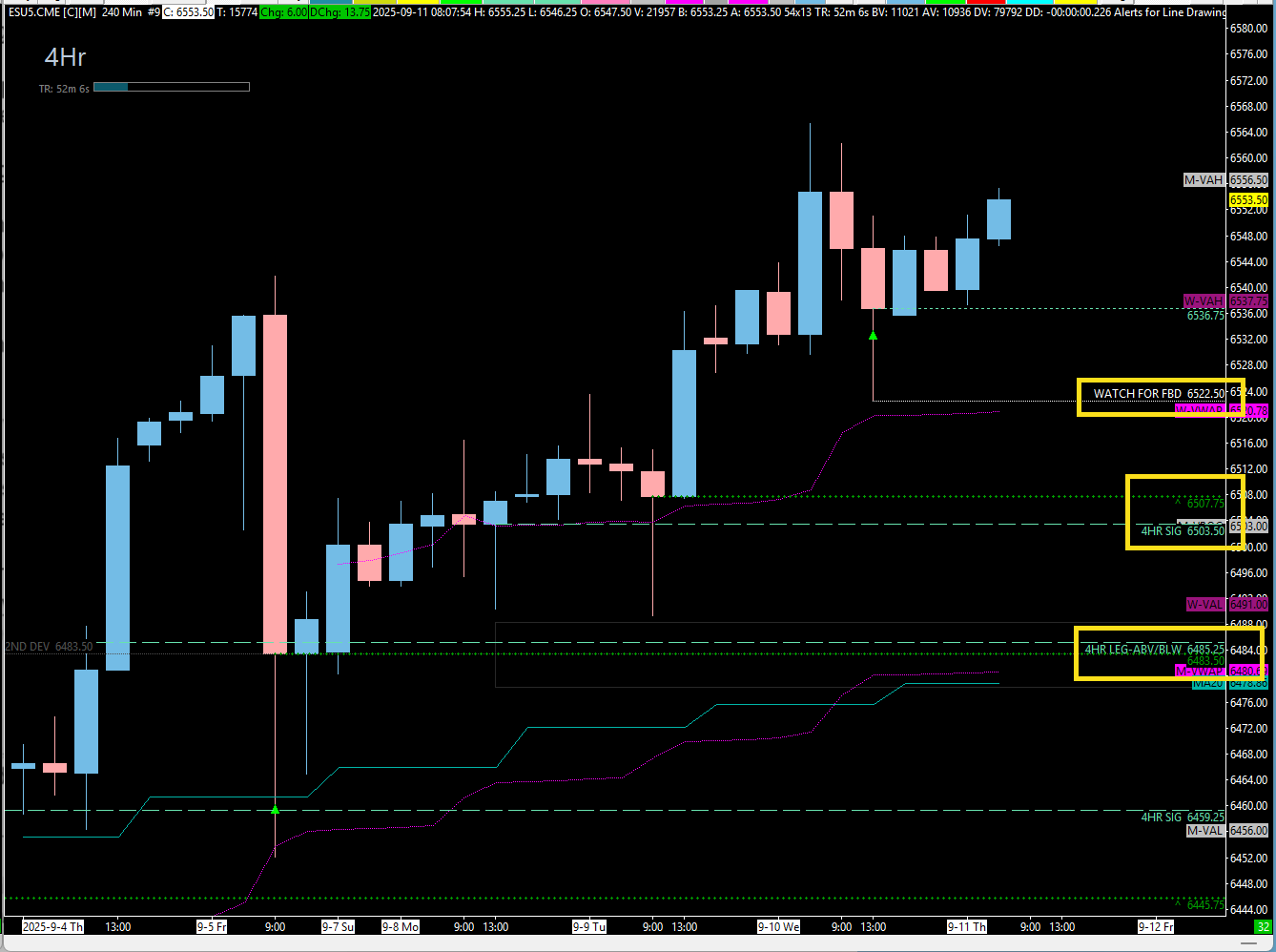

Primary Target (Globex ATH): 6565.25

This is the all-time high that was made in the Globex session yesterday. The cash session was unable to clear it by three points. This remains the primary upside target.

Volatility Extension Target: 6588.00

We have a volatility extension target that goes all the way up to this level.

🔵 Key Support Zones & Setups

The FBD Pivot Zone: 6533.50 – 6536.75

This zone contains our key daily at 6533.50 and a tested 4-hour level at 6536.75. The overnight low is at 6535.75, which is also yesterday's value area low.

Actionable Setup: A sweep below the overnight low (6535.75) that finds a hold at the 6533.50 daily and gets back above the 6536.75 4-hour could continue our upward trajectory.

The Prime Daily Buy: 6516.75

If we move below 6533.50, we could come down to play this significant daily. This is a prime area in my opinion, and I like it for a buy.

Confluence: The weekly VWAP is at 6520.80, providing a nice area of confluence.

Actionable Setup: A confirmation on a long from here would be a move back above yesterday's low at 6522.50, which would confirm that buyers are in control.

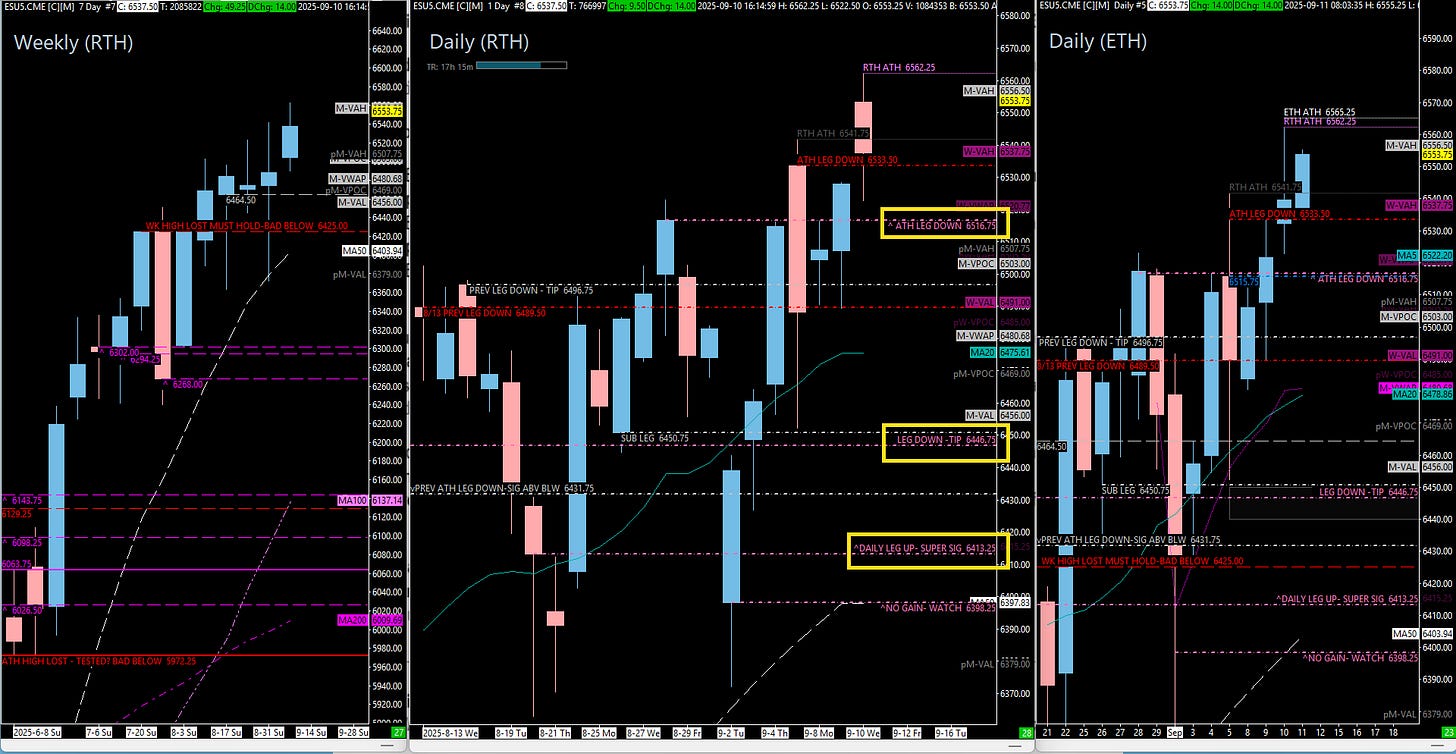

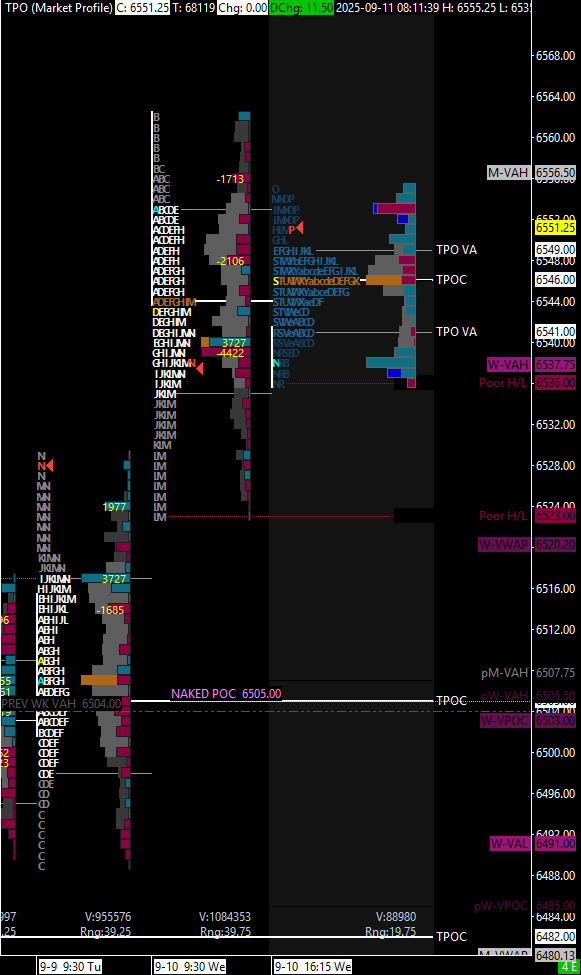

The "Excellent" 4H Leg: 6500.50 – 6507.75

This is an excellent buy opportunity, in my opinion. The main level is the 4-hour leg up at 6507.75.

Confluence: This area has a 1-hour at 6508.00, a naked POC at 6505.00, and the previous weekly VAH at 6504.00. I like this area quite a lot. The lowest level in this leg is an untested 1-hour at 6500.50.

Actionable Setup: A test all the way down to 6500.50 would need confirmation with a reclaim of 6503.50 and ultimately 6507.75. A hold of this leg could produce new ATHs.

The Deeper FBD Squeeze: 6483.50 – 6489.50

If all else fails, we still have our significant (but very tested) daily at 6489.50. Just below it is a 4-hour level at 6483.50.

Actionable Setup: If price were to play and hold the 6483.50 4-hour and get back above our 6489.50 daily, it could trigger a large squeeze to the upside.

🚨 Momentum Shift Levels

Primary Pivot: The daily at 6533.50. A break and hold below this level opens the door for a deeper pullback to test the levels below.

Key Leg Support: The 6500.50-6507.75 zone is the main leg that needs to hold for the immediate bullish structure to remain intact.

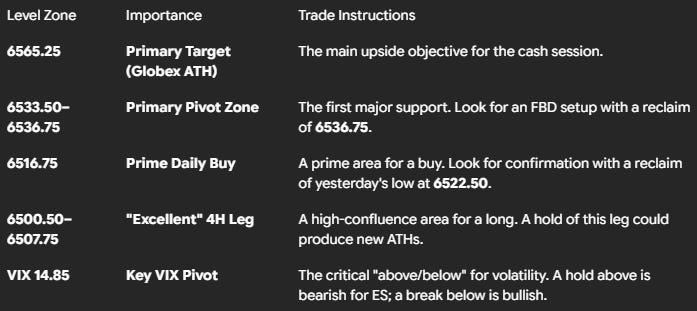

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

The market is on a mission to make new highs, but we have serious red-tag news this morning that can cause a major shakeout. Anything is possible. The plan is to be patient, let the news hit, and look for a high-probability entry at one of our well-defined support zones, especially the prime areas at 6516.75 and the 6507.75 4-hour leg. Keep your head on a swivel.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.

OPTIONS VOL EXTENTIONS

RTH WEEKLY / DAILY + ETH DAILY

4HR ONLY

4HR OVERLAY

1HR ONLY

1HR OVERLAY

VIX

DAILY TPO

WEEKLY TPO

VIX: