"Sell America" Is Now Wall Street's Hottest Trade — Here's What It Means for Your Portfolio

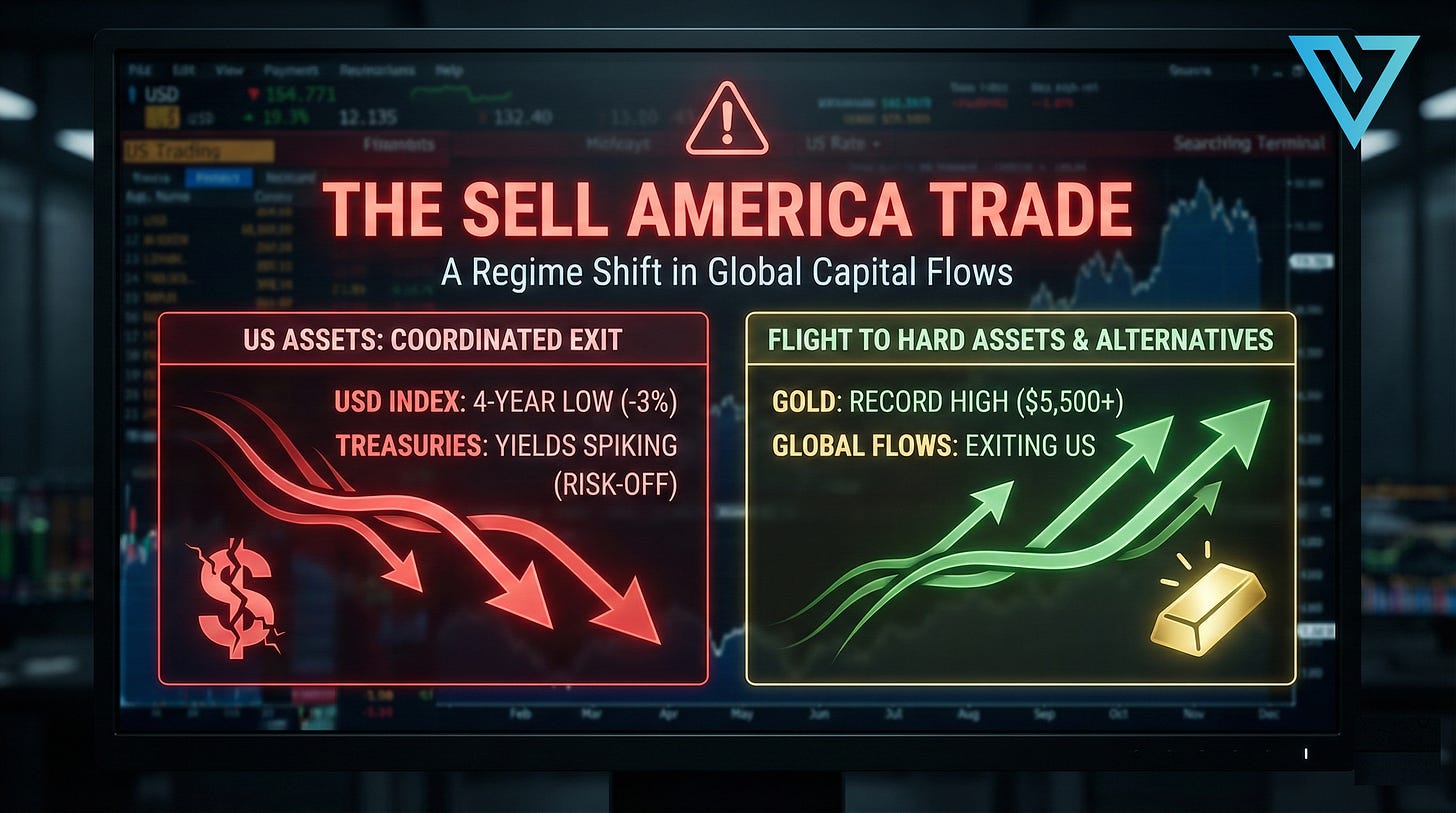

The dollar just hit a 4-year low. Gold broke $5,500. Global investors are dumping U.S. assets. This is what you need to know.

Something unusual is happening in global markets right now.

For decades, when uncertainty hit, money flowed INTO the United States. The dollar strengthened. Treasuries rallied. America was the safe haven.

Not anymore.

A new investment thesis is spreading through Wall Street: Sell America.

And the data is impossible to ignore.

The Numbers Don’t Lie

The U.S. Dollar Index just hit its lowest level in 4 years. Down over 3% since mid-January alone.

Gold broke through $5,500/oz this week — a new all-time record. Investors are fleeing to hard assets.

Treasury yields are rising sharply, not because of growth expectations, but because global investors now see U.S. government bonds as riskier than before.

When stocks sell off AND bonds sell off AND the dollar sells off — all at the same time — that’s not normal market behavior. That’s a coordinated exit from U.S. assets.

Wall Street has a name for it: The Sell America Trade.

What’s Driving This?

Three major catalysts are converging:

1. Tariff Chaos

The Trump administration’s escalating trade war is creating massive uncertainty. New tariff threats seem to emerge weekly — South Korea, Europe, Canada. Businesses can’t plan. Investors can’t price risk. So they’re stepping back.

2. Fed Independence Under Attack

This is the big one. President Trump is expected to name a new Fed Chair next week to replace Jerome Powell. The message to markets is clear: monetary policy may become politically driven.

As one analyst put it: “The Fed as we have understood it over the past couple of decades is fading from view.”

When the Fed loses credibility, the dollar loses value. Period.

3. Government Shutdown Risk

Another potential shutdown looms this weekend. Last year’s 43-day shutdown is still fresh in memory. This kind of dysfunction erodes the “institutional stability, fiscal credibility, and policy predictability” that the dollar’s strength depends on.

What Trump Said That Spooked Markets

During an appearance in Iowa on January 27th, Trump was asked if the dollar had fallen too far.

His response: ”No, I think it’s great.”

The dollar dropped nearly 1% immediately after.

Markets interpreted this as the White House wanting a weaker dollar. That’s a massive shift from decades of “strong dollar” policy.

How Bad Could This Get?

According to FxPro’s chief market analyst: ”The U.S. currency could fall 7% to 8% in the coming months, returning to the lows of 2018 and 2021.”

That’s not a crash. But it’s significant — especially if you’re trading instruments denominated in dollars or holding international positions.

What This Means for ES/SPX Traders

Here’s where it gets practical:

1. Dollar weakness can be bullish for stocks... to a point.

A weaker dollar makes U.S. exports cheaper and boosts multinational earnings. That’s historically been positive for the S&P 500.

BUT — and this is critical — when the dollar is falling because of loss of confidence rather than Fed policy, it’s a different story. Risk-off flows can overwhelm the export benefit.

2. Watch the bond market.

ING analysts are clear: “The bond market will be the most important barometer.” If long-term Treasury yields keep spiking while the dollar falls, that’s a warning sign of stress, not stimulus.

3. Gold correlation matters now.

When gold and equities move together (both up or both down), it often signals macro-driven trading rather than fundamentals. We’re seeing that now. Trade accordingly.

4. Volatility is the opportunity.

“Sell America” trades create dislocations. The S&P 500 will see larger swings on news about tariffs, Fed appointments, and shutdown negotiations. That’s edge for prepared traders.

The Bottom Line

The “Sell America” trade isn’t just a headline — it’s a regime shift in how global capital views U.S. assets.

Does this mean dump everything and run? No.

It means:

Pay attention to the dollar and gold as leading indicators

Don’t assume Treasury bonds are “safe” right now

Expect headline-driven volatility through February

Position sizes matter more than ever

The old playbook of “buy the dip, America always wins” may need some revisions in 2026.

What’s your take on the Sell America trade? Are you adjusting your positioning? Drop a comment below.

Until next time—trade smart, stay prepared, and together we will conquer these markets.