S&P Edge (SPX) Weekend Review: Conviction Above 6867 & FOMC Prep

A detailed SPX & VIX review breaking down the 6845 “Thick Support” buy zone, the 6867 breakout, and the fragile VIX floor at 15.73 ahead of FOMC.

Happy Weekend Traders,

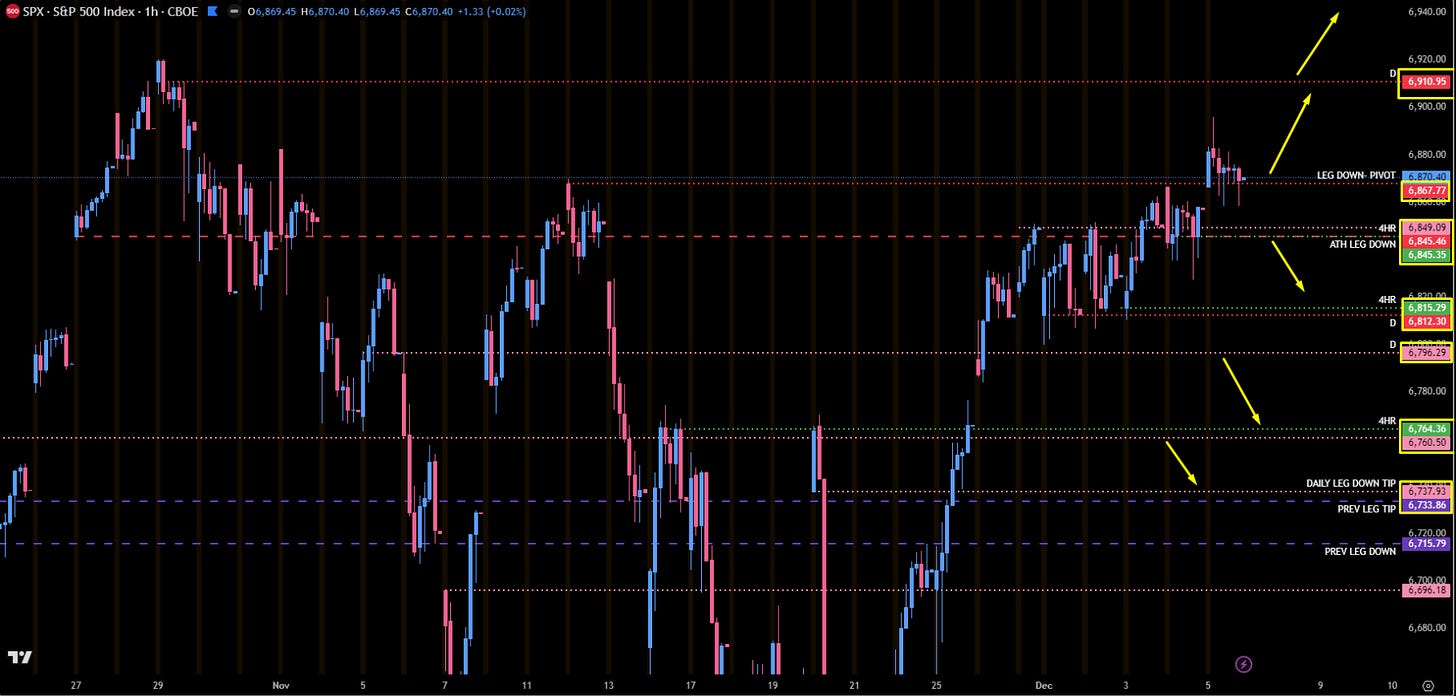

Right now, the SPX is still trending up. We sat all last week in a balance area, continuing to make higher highs as the market slowly accepted the value from the previous week’s massive push-up of 350 points. Generally, after a large push-up like that, the market has to digest the move, just like we did last week—traversing sideways and accepting value.

We closed the weekly above the 6845.46 Weekly last week, which gave us conviction that we will more than likely make All-Time Highs again soon. Then on Friday, once again, we closed the Daily above 6867.77, which was the leg down from the previous move to the lows. This was a huge accomplishment and cements conviction for more upside.

A Note on the Week Ahead:

Catalyst: We have FOMC this week. Market participants are already expecting a 25-point basis rate cut.

Volume: We have had extremely low relative volume up until this point, and we have to assume it will be the same until we have a significant news event.

Warning: When price sparks or moves in this environment, it moves extremely sharp.

🧠 Current Market Context

We are turning up pretty hard and have no reason to believe we have any other direction to be looking but up. We gained on the weekly timeframe last week and now we’ve gained again on the daily timeframe on Friday, giving us a good vibe and positive indication that new All-Time Highs will soon be within reach.

However, because anything can happen and it can happen fast (especially with FOMC), we have to know the levels to play.

🚨 VIX Analysis: Fragile at the Lows

The VIX is extremely low right now and, in my opinion, very fragile.

The Risk: We have to be very cautious when entering the 15.00 handle because every time price gets down here, any type of news or volatility can spark an extreme jump in the VIX, which could cause the indices to fall swiftly (100 to 200 points).

The Pivot: We are currently monitoring a very important Weekly at 15.73 for above or below. This is the big pivot to watch coming into the week.

Support: The first level of support underneath is 14.93 (Untested Daily).

Resistance Levels:

17.21 (Tested Daily): Major resistance.

18.60 (Significant Daily): Very important pivot. A push above 17.21 takes us here.

19.52 (Untested Daily): The only thing that separates an extreme pop. If this plays, we want to see price get below 18.60 as fast as possible to get relief.

22.41 (Monthly): Untested ceiling temporarily.

🎯 Detailed Actionable Trade Plan (SPX)

We are sitting at the significant Daily Pivot at 6867.77. This is the big “above/below” number for us to get above and continue our move higher.

🔴 Key Resistance Zones

Immediate Pivot: 6867.77

Significant Daily Pivot. We closed above this Friday. Holding above keeps the move going.

All-Time High Target: 6910.95

If we push higher, this is the last area of resistance I have (Daily Level).

🔵 Key Support Zones & Setups

“Thick Support” / Buy Zone: 6845.35 - 6849.09

This area is littered with support as it was resistance for the beginning of the week and is now support.

Levels: Daily (6849.09), Weekly (6845.46), and Untested 4-Hour (6845.35).

Actionable Setup: This area is technically untested. I will be looking to buy this area on first touch, anywhere from 6849.00 into 6845.00.

The 4-Hour Pivot: 6812.30 - 6815.29

6815.29: Only level of untested support below the thick zone (4-Hour).

6812.30: Highly significant and highly confluent Daily level (Tested but very important).

Actionable Setup: Use this area for another huge pivot for above/below.

The Reclaim Setup: 6796.29

Technically untested Daily.

Actionable Setup: If price slips below 6812.30, I would look for 6796.29 to play and accept over 6800 for my entry and then regain the 6812/6815 area before looking for continuation higher.

“Major Floor” Buy: 6760.50 - 6764.36

Very large Daily and 4-Hour area. This is the top-down daily of the leg that took us to the lows (gained on Nov 25th).

Actionable Setup: I like this level a lot. If price comes back down into this area, I would be looking to buy this spot on first touch.

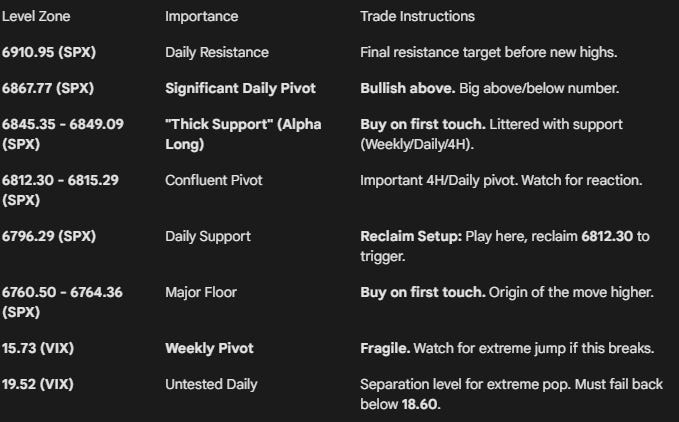

📌 Cheat Sheet – Key Levels Recap (SPX & VIX)

🧠 Final Thoughts

Participants will be very slow this week to make a move until FOMC. As long as everything comes in exactly as planned, the market should continue to Trend in its direction (Up).

Be careful with the relatively low volume, as any news can spark an extreme pop in the VIX sending indices down swiftly. Stick to the levels, watch the 6845.00 buy zone, and respect the 15.73 VIX pivot.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.

Absolutely beautiful analysis. It is an honor to read. Thank you for your due diligence sir!