Happy Sunday, everyone.

Just wanted to give you a personal greeting today. We had an amazing week last week; almost every single day was just ridiculously on point with the trade plans. I had a lot of people reach out and thank me for the excellent analysis. We had a lot of new subscribers and quite a few people come into the Discord room, and I’m just really excited with the progress.

To have people reach out and say, “I’m finally starting to be consistent,” is such a feel-good moment for me. Thank you so much, it means a lot and keeps me motivated.

I have a few awesome things to talk to you about:

🎁 Limited Time: 30-Day Free Trial

I’ve decided to discontinue the 30-day free trial after we hit 100 paid subscribers (we are currently at 51). If you haven’t checked out the paid plans, this is a limited offer. The link is in the description below; just put your email in, and I’ll get you turned on.

🎉 Special Offer: Free Discord Access

I have decided to do something special for the first five people who sign up for a paid subscription (this also applies if you are on a free trial and convert to paid). I am going to give you 30 days free to the Discord room. We’ve had an incredible response, and people are absolutely loving it. Act NOW to make sure your one of the first 5!

Finally, make sure to follow me on all the socials. This will be on YouTube, as will the post-market breakdowns. Follow me on Twitter, YouTube, and Substack—all the same handle. Please like and retweet; let other people know what we’re doing here.

Follow Me on Twitter: @RyanBaileyEdge

Follow the New YouTube Channel: @RyanBaileyEdge

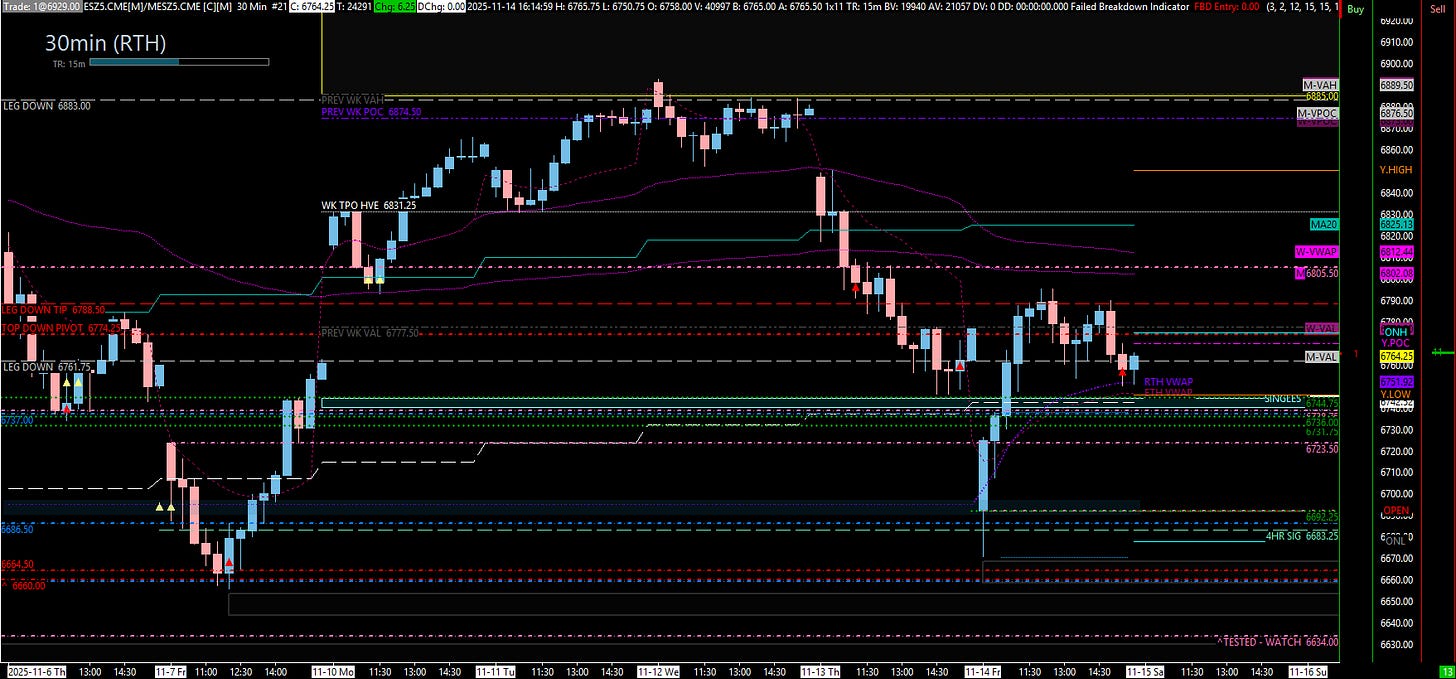

🧠 Current Market Context: The “Double Stick Save”

Last Sunday’s review was prophecy. I said I thought we would come all the way up, play the weekly at 6883, get knocked, and come all the way back down to 6725.00-ish or lower. That is exactly, exactly what happened.

Now, let’s talk about what’s really important, because this resonates with me the most.

Our sub-leg to the all-time high is 6738.00.

Stick Save #1 (Last Week): On Friday, November 7th, they opened below 6738.00, came down to test 6660.00, and then closed above 6738.00. They didn’t lose the daily.

Stick Save #2 (This Week): On Friday, November 14th, they opened well below 6738.00. I told everyone this was super bearish. But... they backtested and ran, and once again closed above 6738.00.

They have had two opportunities to lose the daily, a whole week apart, and they couldn’t do it either time. This, to me, represents significant strength. More than likely, we are going to “W out” (make a W-pattern) and go higher.

The 4-Hour timeframe never lost; we held the lows. It looks like we could be making a massive W here to bounce up.

Invalidation: Where does it all go wrong? If we get a close below 6738.00 and especially 6723.00, we’ve got some serious issues. 6723.00 is not a level I love; it’s more about the 6738.00 sub-leg that keeps getting all the attention.

🗺️ ES Weekly TPO Insights

We are still balancing in this massive previous week’s range, and in my opinion, it looks like we’re going up.

Imbalance: We have created a massive bullish imbalance, once again, up to 6990.00. This makes perfect sense; we’ve talked about the JPM collar up at 6995.00 (SPX, but close enough). We have a lot of reasons to be bullish coming into the end of the year.

Rotation Target: Once we pop above the previous week’s Value Area Low, we should rotate into 6831.00 fairly easily.

Gap Fill Target: The weekly POC at 6874.00 is a gap fill and a fantastic spot for a target.

Obstacle: We still have to deal with the low volume node at 6805.00.

Warning: We also have some singles down to 6740.00. I think we could “pop down there first and then go,” which lines up perfectly with our candlestick analysis.

🎯 Detailed Actionable Trade Plan (ES Futures)

My thesis is that we are forming a large “W” pattern and will grind up. As long as the 6738.00 area holds, that’s what I see.

🔴 Key Resistance Zones & Setups

Weekly Pivot: 6788.00 We got a nice big smack from this level, but we didn’t quite lose it.

First Target /Untested Daily / TPO Node: 6805.00 This is the major Daily we have played multiple times and a low volume node we have to deal with on the way up.

Main TPO Target: 6831.00 This is the first major TPO target to fill in the inefficient area.

Gap Fill Target: 6874.00 - 6876.00 This is the weekly POC gap fill. A fantastic spot for a target.

Bullish Imbalance: 6990.00 This is the massive bullish imbalance created on the TPO chart.

🔵 Key Support Zones & Setups

“The Spot” / Primary Long: 6738.00 - 6742.00 This is the confluence zone I am watching for a pullback.

Levels: It includes the daily sub-leg at 6738.00, TPO singles at 6740.00, the 50-day moving average at 6742.00, and “stacked” 4-hour levels.

Actionable Setup: “I think... we’ll back test this area... and then ultimately continue to go higher.” As long as they hold this area, this thing is going to continue to grind up.

Invalidation Level 1: 6738.00

Actionable Setup: A close below this level is the first sign of weakness and “serious issues.”

Invalidation Level 2: 6723.00

Actionable Setup: A close especially below this level would be bad. This level is “not getting a whole lot of love,” but it’s the line.

Secondary Support: 6692.00 This is a new daily and 4-hour leg up.

Actionable Setup: I don’t think we revisit this, but be cautious buying it if we are already underneath 6738.00 and 6723.00.

“Insanely Tested” Zone: 6660.00 This is the bottom of the “W.”

Actionable Setup: This area is insanely tested, but “we continue to hold it.”

“What If It Fails” Zone: 6605.00 - 6652.00 If the main thesis fails, these are the lower levels.

Actionable Setup: I do like this 6652.00; it’s a pretty good spot. 6605.00 is super duper important. Also, watch 6634.00.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

That is the weekend review. We talked about lower, we talked about higher. The “double stick save” at 6738.00 is the most important takeaway and points to significant strength. We are in the most bullish time of the year (Santa Claus rally-ish era), so unless we get crazy geopolitical news, that’s what we’re looking at.

Don’t forget the special offer: first five paid subscribers get a free month in the Discord room. Sign up for the free trial if you haven’t! I’ll see you all on Monday for the post-market breakdown.

Until next time—trade smart, stay prepared, and together we will conquer the markets!

Ryan Bailey, VICI Trading Solutions.