Welcome back everyone and it is time for the First Weekend Review of 2026.

I am so hyped to bring it to you. It is going to be a magnificent year and we are going to conquer the markets together. I have taken the past week or two to chill and recharge the batteries, and I am ready to bring you the most amazing trade plans coming into the new year.

We kick off the Post-Market Breakdown starting tomorrow (Monday) at 5:00 PM.

For a January promotion If you have not subscribed to the trade plans before now’s your opportunity to get the whole month of January for free simply by submitting your email in the link below.

🧠 Current Market Context

We had a nice little pullback at the end of the year; the Santa Claus Rally certainly did not show its teeth. However, we are only 88 points off the All-Time Highs (about 1.25%).

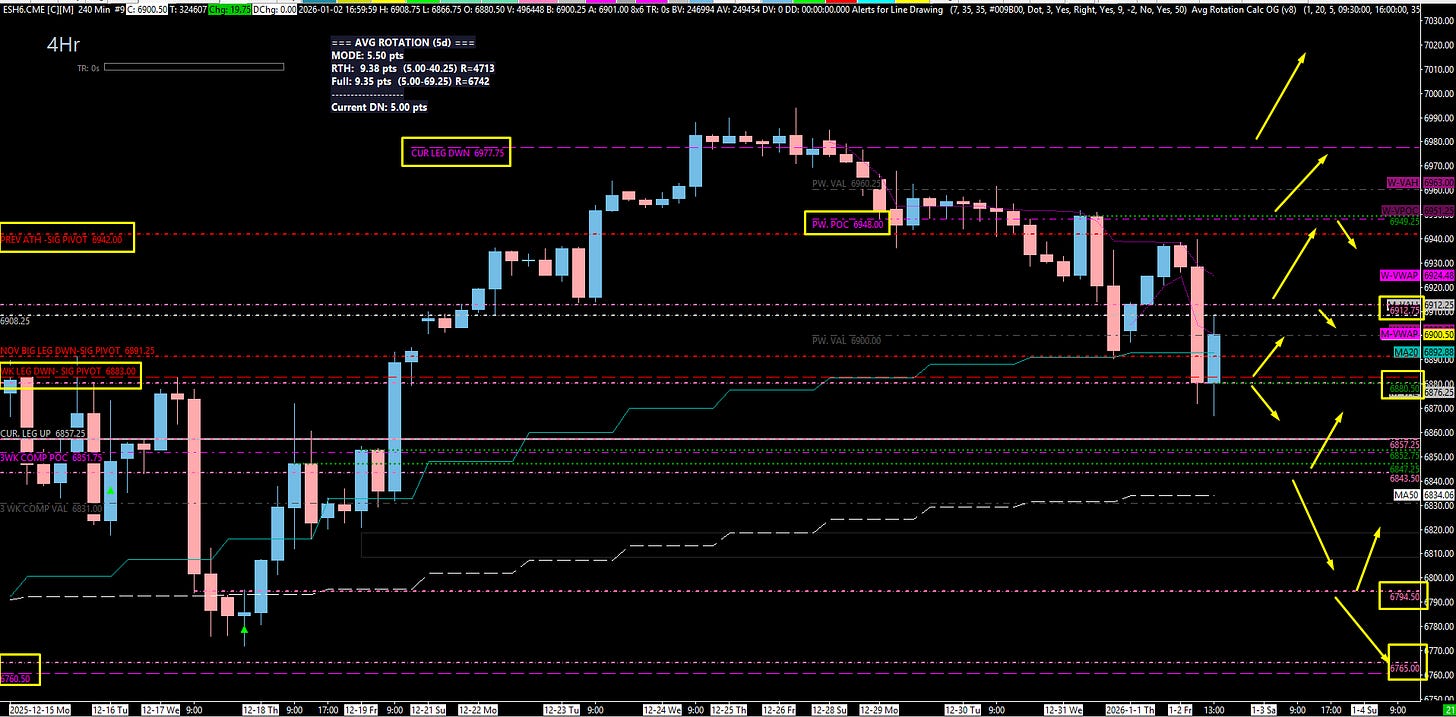

Trend Status: We haven’t lost on the Daily or the Weekly timeframe (High timeframes still looking up). However, we have lost on the 4-Hour timeframe, so we are starting to shift momentum a little bit.

Negative Gamma: Last week, we saw the Negative Gamma level move up to 6975, signaling dealers were hedging short.

Weekly TPO: We have a massive three-week composite where we sat sideways. The 3-Week POC is at 6851.00, acting as a magnet and a point of contention.

📈 SPX Analysis: The Support Pocket

SPX held a key section on Friday. We are looking for the support pocket to play for a move higher.

Support Pocket: 6840.00 - 6831.00

6840.00 (Untested 4-Hour).

6837.00 & 6831.00 (1-Hour Levels).

Actionable Setup: This whole pocket is support and more than likely will play on first touch. Ideally, we play this support before smacking resistance.

Resistance: 6867 (Untested Daily) and 6878 (4-Hour Leg Down).

The Wall: 6900 area is the big wall. Above that, we target 6929 (Weekly).

Prime Buy (Lower): If we push down, my “Prime Buy” location is the 6800 - 6796 area.

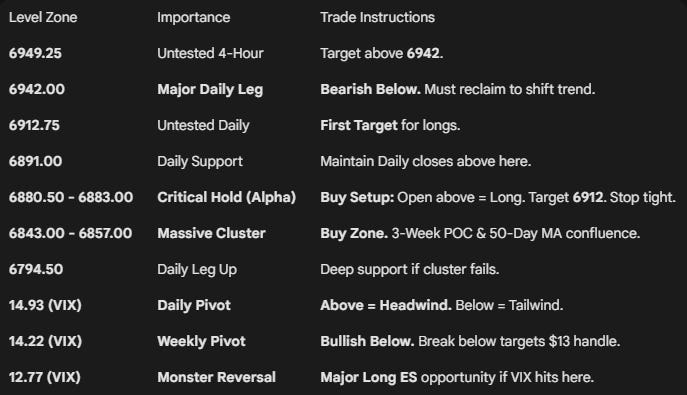

🚨 VIX Analysis: The “Danger Zone” Lows

VIX is looking soft. We are watching the 14.22 Weekly like a hawk.

The Daily Pivot: 14.93. This is the main “Above/Below” pivot. Every time we get below it, it sells back off.

The Weekly Pivot: 14.22. This is the big weekly.

Downside Risk: If we push below 14.22, we get into the $13 handle, which is dangerous. Low VIX can lead to ferocious pops (20-30%) that slide ES a couple hundred points.

The “Monster” Reversal Level: 12.77

If we get way down here, I would absolutely look at this place for a reaction and a potential ES reversal.

Upside Resistance: 15.73, 16.35, and the Ceiling at 20.38.

🎯 Detailed Actionable Trade Plan (ES Futures)

We are in a critical spot. We either hold the 6880.50 area or we come down lower.

🔴 Key Resistance Zones & Setups

Momentum Shift Leg: 6942.00 - 6949.25

6942.00 (Daily - Main Leg from ATH) and 6949.25 (Untested 4-Hour).

Significance: This is the “Big Boy.” Being below 6942 is a problem. We need to reclaim this to shift momentum back to the Bulls.

Immediate Daily Target: 6912.75

Untested Daily.

Actionable Setup: This is the only untested daily level until we get to 6977. We need to get above 6912.75 to start the move back to 6942.

Weekly Save: 6883.00

Friday’s close saved the 6883 Weekly close. We are holding on, but barely.

🔵 Key Support Zones & Setups

The Critical Hold: 6880.50 - 6883.00

6880.50 (Untested 4-Hour - Developing/Did Not Gain).

6883.00 (Weekly).

Actionable Setup: This is the “Make it or Break it” spot. I am going to buy this. If we open above this on Monday, I will look to take this long, ride it to 6912.75, and / or take 10 points.

Stop: Tight. If 6880.50 doesn’t hold, we are going lower.

Daily Leg Down Support: 6891.00

We want to keep Daily closes above 6891 (Leg to Nov Lows).

The “Massive” Lower Cluster: 6843.00 - 6857.00

6857.00 (Daily), 6852.75 (4-Hour), 6851.00 (3-Week POC), 6847.00 (4-Hour), 6843.00 (4-Hour).

Context: The 50-Day Moving Average is also moving up into this area.

Actionable Setup: This is a massive spot. Even if they punch through, I expect this area to get some love.

Deep Support: 6794.50

Daily Leg Up.

Actionable Setup: If we lose 6843, we come down to play this leg. Given this is the daily leg to the ATH i do expect a reaction here and a hold of this level would be critical for the bullz.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

We are in a very critical spot coming into the week. Right now, we either hold the 6880.50 spot or we come down lower. It’s that simple; it’s not brain surgery.

I am ready and excited to hit 2026 super duper hard. Just play the levels for what they are keep your risk in check and you will make money.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.