Welcome back, everybody. It is time for the Weekend Review, and I hope everyone is staying warm. It is insane outside in Indiana right now; we are getting like 8 to 12 inches worth of snow. I just got back from walking my dog, and man, what an adventure.

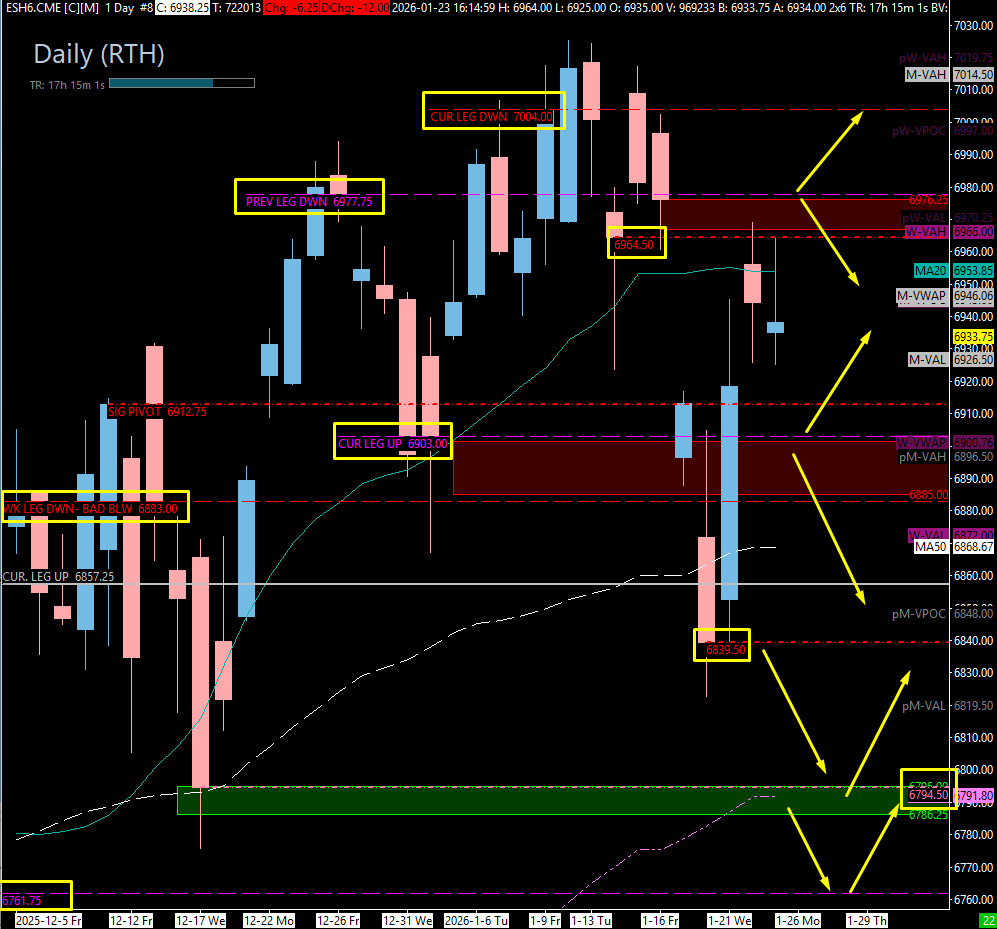

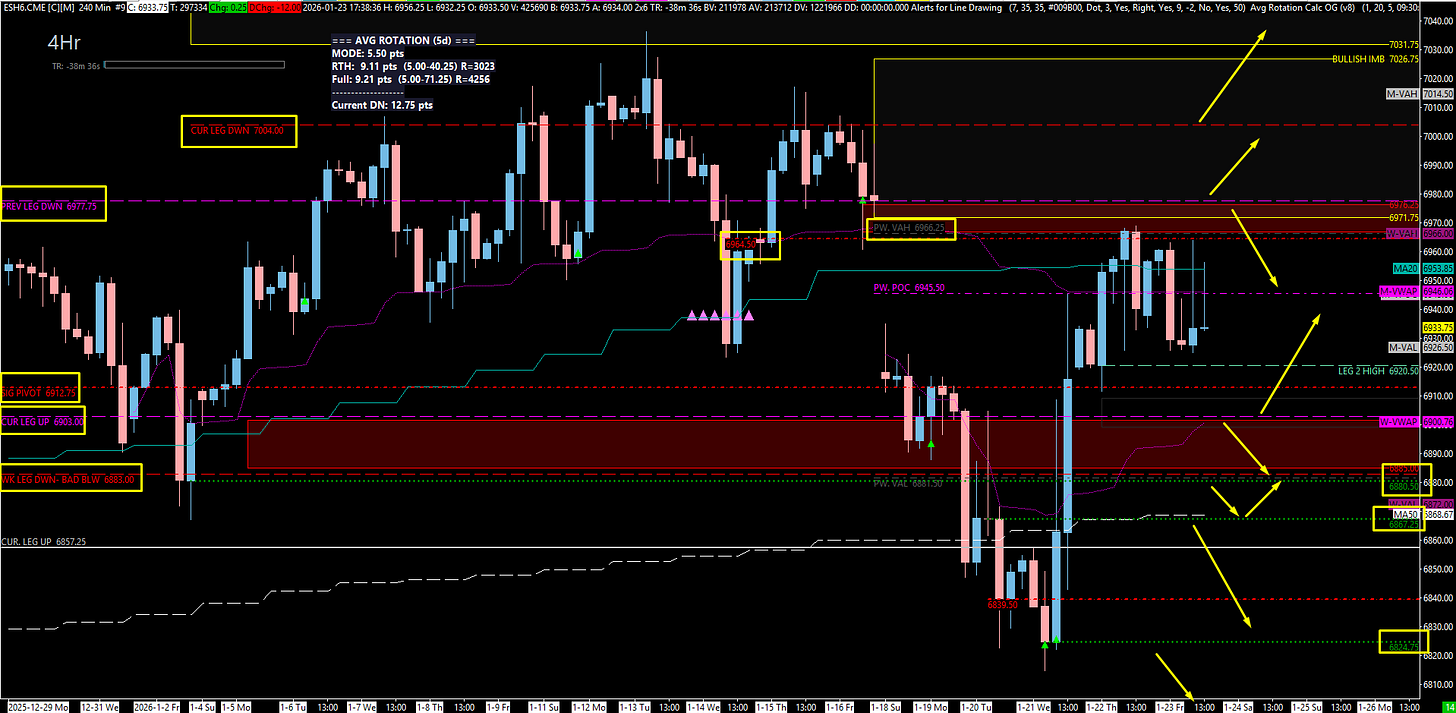

Let’s get right into what’s going to happen this week. We are in a very pivotal spot. We have actually not lost on the Weekly timeframe (we swept the weekly leg and it caused a nice little squeeze), but we have lost on the Daily timeframe. With that being said, we have hit some extreme resistance in SPX and we are “danger close” on ES. Early this week or even as soon as Monday will likely be a big “Make It or Break It” day for us.

🧠 Current Market Context

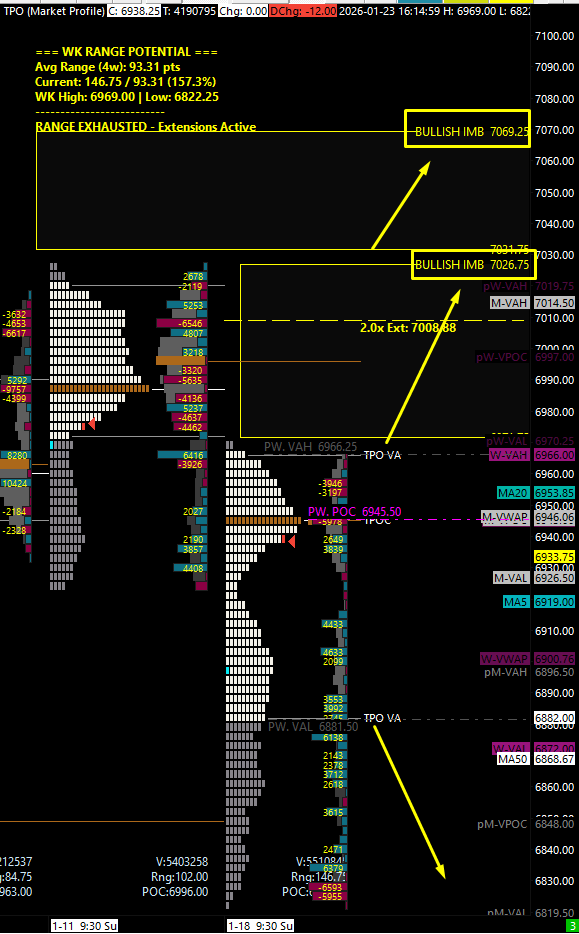

Weekly TPO: Last week we exceeded the weekly expectation by 50%. For next week, our 4-week average range is right around 110 points.

Imbalances: We have an extremely Poor High (inefficient bullish imbalance). This leads me to believe we could push higher to fill this. Our first Weekly Bullish Imbalance takes us up to 7026.75.

The Condition: To target higher, we need to hold above the Previous Weekly Value Area High at 6966.25. If we break below the Previous Weekly Value Area Low at 6945, we have a serious issue and could push down into the 6900 range.

Weekly TPO

📈 SPX Analysis: The Sandwich

We are basically sandwiched between the Daily at 6901 and our Weekly at 6929.94.

The Ceiling: We hit the major Weekly at 6929.94 (Big Gap Fill). If we get above 6929, we move higher and could go back to All-Time Highs.

The Floor: We have the Daily at 6901. If we move below 6901, we could come down pretty far.

Sub-Support: We have a 4-Hour sub-support at 6896. We have been sitting here bouncing back and forth since the 22nd.

Momentum: Moving below 6901 certainly shifts momentum in the favor of the Bears.

🚨 VIX Analysis: The “W” Pattern

VIX is down in the $15 handle, holding the Daily at 15.41.

Structure: They “W’d out” here, which really could take us back into our big Monthly/Daily resistance area at 17.44 - 17.62. This is the big spot to overcome.

Breakout: If they pop this spot, we could come into the $20 handle.

The Pivot: We use the 16.51 Weekly (Tested) for Above/Below guidance.

Above 16.51 takes us to the 17.50s.

Warning: There is a possible chance we could gap down in the indices given this VIX look.

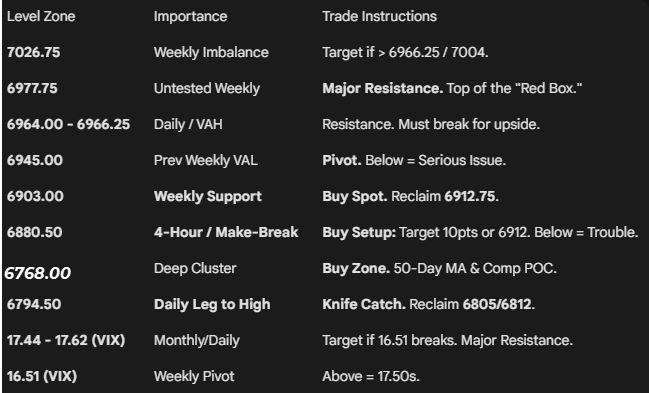

🎯 Detailed Actionable Trade Plan (ES Futures)

We are sandwiched between the Weekly support at 6903 and the resistance block starting at 6964.50.

🔴 Key Resistance Zones & Setups

The “Red Box” Resistance: 6964.50 - 6977.75

6964.50 (Tested Daily), 6966.25 (Prev Weekly VAH), 6977.75 (Untested Weekly).

Context: This is all resistance. We need to break above 6964 and 6977 to clear the path higher.

Bullish Target: If we clear 7004, we target the Weekly Imbalance at 7026.75.

🔵 Key Support Zones & Setups

Immediate Weekly Support: 6903.00

6903.00 (Weekly Leg / Prev Weekly VWAP).

Actionable Setup: This is our “Buy Spot.” We want to see 6903 play and reclaim 6912.75 (Daily) and 6920.50 to get Long.

Note: 6903.00 is the only untested level for a long until we get much lower.

The “Make It or Break It” Spot: 6880.50

6880.50 (Untested 4-Hour), 6883 (Weekly - Tested) 6881.50 (Prev. Weekly VAL).

Context: Underneath 6903, things get “real shifty.”

Actionable Setup: Momentum shift hard below 6903. and we should look momentum to favor the bears. 6880.50 could play but you would need to take profits at 6903 weekly as this has played so many times as resistance prior i can see it being trouble once below again.

If we do not hold 6880.50, we come down lower, no questions about it.

Deep Support Cluster: 6843.50 - 6857.00

6867.25 (Top Down 4hr), 6857.00 (monthly)

Confluence: The 50-Day Moving Average is also here.

Actionable Setup: A very thick area of confluence. If we lose 6880, I expect this area to get some love, but being below both 6903 and 6883 I expect this reaction to be minimal look to take profits at 6880/6883

The Daily Leg (Leg End): 6794.50-6786.50

6794.50 (Untested Daily Leg to High) 6786.50 (4hr Leg End)

Actionable Setup: This is the only Daily we have that is untested as far as being a “Leg End.” This is a big level of support that can catch a falling knife. Use the 4hr at 6786.50 as the lower level to lean on for support

Reaction: 100-Day Moving Average is at 6791. Look for a reaction here.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

We are in a very pivotal spot. We have not lost on the Weekly, but we have lost on the Daily. Early in the week even Monday will likely be a big “Make it or Break it” for us.

I really feel like it’s laid out for us and it’s going to be very simple: We are above this or below that. Stay warm, and I will see you guys on Monday for the Post-Market Breakdown.

🚨 IMPORTANT UPDATE: Edgeful Free Trial Deadline

Edgeful is removing their 2-week free trial offer starting February 1st. That means you only have until the end of the month to use the link below and lock in your 14-day free trial. I use this software every single day for statistic-driven data—Gap Fills, Initial Balance Breakouts, and historical probability stats—and it is an absolute game-changer. Do not miss this window; sign up before the 1st to secure your free trial and get the data you need to trade with confidence.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey,

VICI Trading Solutions.

Daily - Regular Trading Hours

4HR Full Overlay