Scheduled News

Happy Sunday, everybody. Hope you are all staying warm on this chilly Sunday.

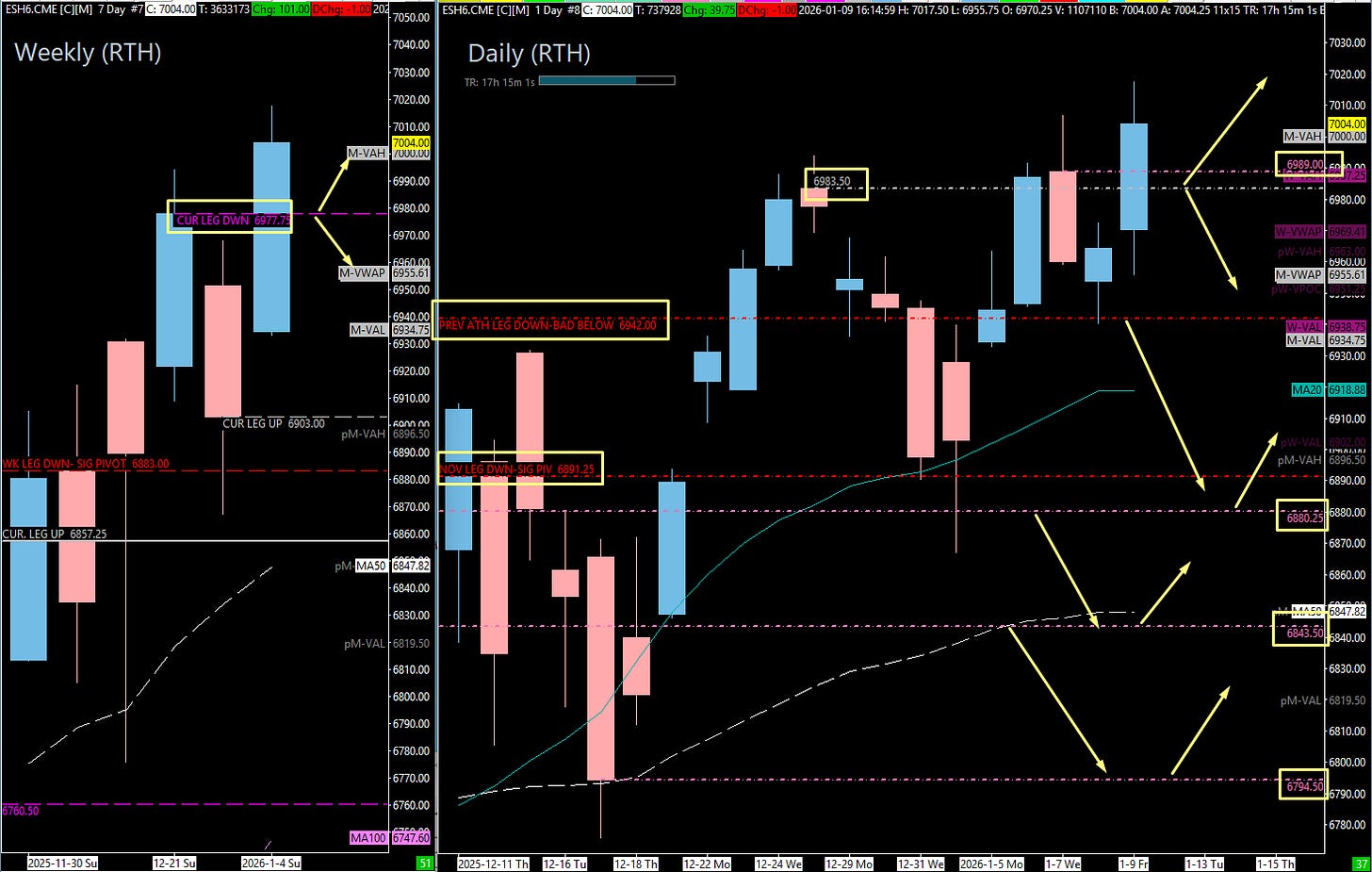

We have had nothing but an insane push since April, and right now, we have no reason to believe that we are going the other direction. We are up on the Weekly, Daily, 4-Hour, and 1-Hour timeframes, which means we are bullish until proven otherwise.

🧠 Current Market Context

We are traversing All-Time Highs.

The Macro View: It is not the price of gold or stocks simply going up; it is the price of our dollar going down. They have printed 80% of our money supply in the past five years, so indices and metals are catching up on an inflation play.

Weekly TPO: We are still pushing into the highs. The 4-week average range is about 113 points, so we are looking at roughly 110 points for next week.

Critical Structure: The key to this week is the Previous Weekly Value Area High (approx 6988.50). If we pull below this, we have a serious issue as we don’t have anything untested for quite some time.

🚨 VIX Analysis: Green Light (For Now)

VIX is giving us the green light for more up.

Upside Pivot: 15.73. Our very significant pivot has shifted here.

Above: Targets 16.35 (Untested Daily) and 16.51 (Weekly).

Below: Continues to provide a nice tailwind on the indices.

Midpoint Pivot: 14.93 (Daily). If we get back above this, we could retest 15.73.

Downside Support: 14.42 (Daily) and 14.22 (Weekly).

Breakout: A break of 14.22 sends us into 13.60 pretty swiftly.

The “Monster” Spot: 12.92 - 12.77.

This is a monster Weekly/Monthly spot. VIX is extremely low, and the smallest reactions can cause a knee-jerk pullback in ES. Expect a sever reaction here!

🎯 Detailed Actionable Trade Plan (ES Futures)

We are looking to hold the 6988.50 area to continue our progression higher.

🔴 Key Resistance Zones & Targets

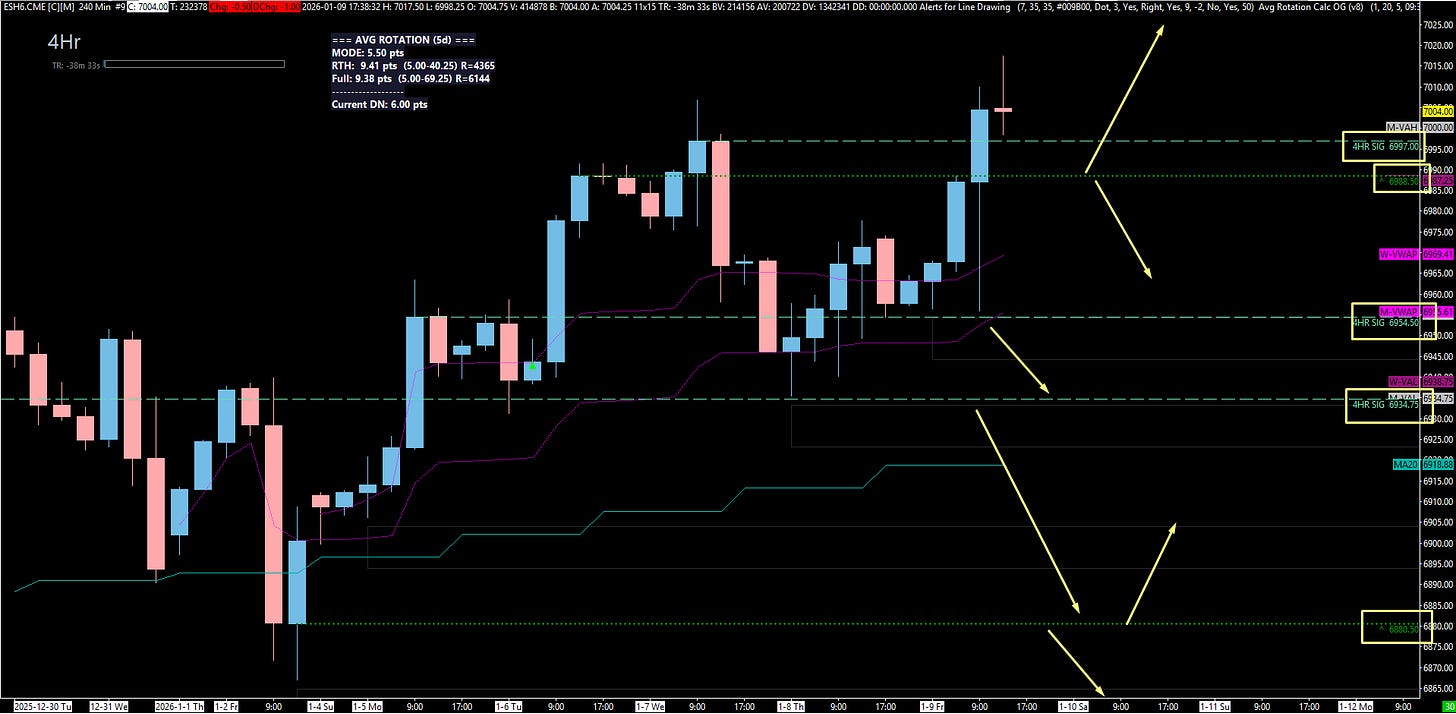

High Target: 6997.00

Top Down Tested 4-Hour from Friday.

Actionable Setup: We want to see continuation above 6997.00 for the push higher.

ATH Targets:

We are doing price discovery. As long as we hold the supports below, we go to the moon.

🔵 Key Support Zones & Setups

The Critical Hold: 6988.50 - 6989.00

6988.50 (Daily / 4-Hour / Previous Weekly Value Area High).

6989.00 (Top-Down Daily).

Actionable Setup: This is the critical spot. We really need this to hold to continue to traverse higher.

Risk: A push below 6985 (Overnight context/Pivot) puts us in trouble.

The Weekly Floor: 6977.75

Untested Weekly (Top-Down).

Actionable Setup: If 6988 fails, we could come down here. However, a move below 6977 would be catastrophic for ES right now. It puts massive resistance above us.

“Fantastic Buy Spot” (Deep Support): 6880.00

4-Hour Leg to the High.

Actionable Setup: If we lose the 6977/6983 area, we could traverse all the way down here. This is a fantastic buy spot.

The “Thick” Zone: 6843.50 - 6857.25

6857.25 (Monthly Leg), 6851.75 (3-Week Composite POC), 6847.25 (4-Hour), 6843.50 (Daily).

Confluence: 50-Day Moving Average is also here.

Actionable Setup: This is a very thick area of confluence.

Daily Leg to High: 6794.50

Untested Daily Leg.

Actionable Setup: This is the true leg in. It can catch a falling knife.

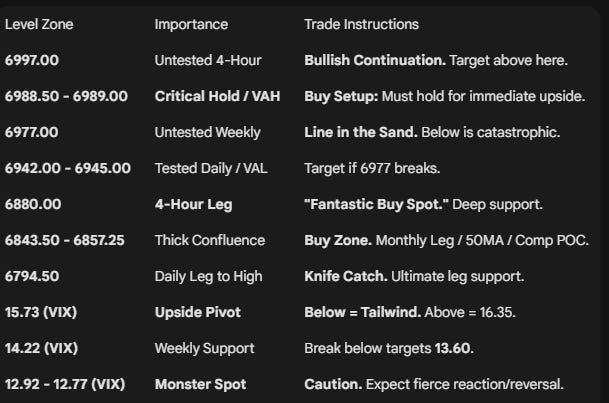

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

We are up on the Weekly, Daily, 4-Hour, and 1-Hour timeframes. We are bullish until proven otherwise.

The primary focus is the 6988.50 area (Previous Weekly VAH). As long as we hold this, we continue to traverse higher. If we close a daily below 6983/6977, we are coming down.

Even a nice pullback of 100-200 points would still keep our bullish structure very much intact.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.

Submit your email below for 30 days free to the S&P Daily Trade Plans.

RTH WK/ DAY

4HR Only