S&P Edge (ES) Daily Trade Plan: Rollover Volatility & The 6891.25 Wall

A detailed ES, SPX & VIX plan for Dec 17th, breaking down the 6891.25 resistance, the SPX 6760 bounce, and the fragile rollover structure.

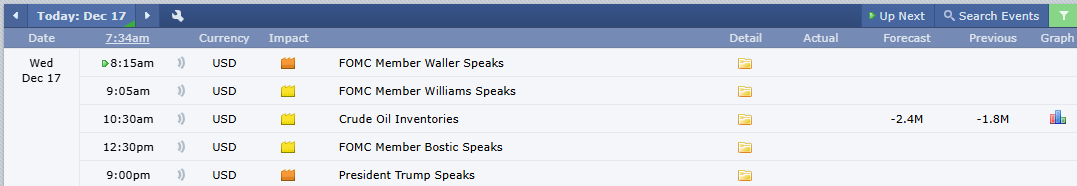

Scheduled News

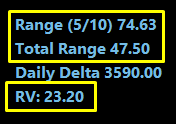

Options Volatility Levels

Good morning. Today is December 17th, it is Wednesday.

Yesterday we had an epic day considering we are right in the middle of rollover. We were able to call the exact top yesterday at 6891.25 as being our major pivot for above or below; that was indeed the high of the AM session that took us down 70 points.

Being in the middle of rollover, things are extremely uncertain anywhere that we have not put new price action, so we need to be extremely careful. The December contract and SPX look very different than what the ES looks like on the March continuous contract. With that being said, we need to exercise caution, however, we are deferring to Trend, which is up.

A Note on Today’s Market:

News: No Red Tag news this morning to speak of.

Range: Average expected range is 74.5 points. We have moved 47.5 points, leaving approximately 30 points worth of range left in the tank.

Volume: Relative volume is elevated this morning at +25%.

🧠 Current Market Context

Yesterday, the December contract came down and played our 6765.00 and 6761.00 Weekly, which was one of the key levels we were eyeing. SPX also came down and played the significant Daily at 6760.50 as laid out in our trade plan; we had a significant pop off that area and are currently right back up over 60 points.

Despite the move up, we must remain cautious due to the rollover structure gaps. Use SPX as your guide today.