S&P Edge (ES) Daily Trade Plan: The Pre-Holiday Grind & The 6930 Pivot

A detailed ES plan for Dec 23rd, breaking down the 6930.75 pivot, the 6900 Gamma Flip, and the “Sweep & Reclaim” setup at 6908.50.

Scheduled News

Options Volatility Levels

Morning everyone. Today is Tuesday, December 23rd.

Yesterday our weekend review played out perfectly as we continue to push higher on a slow grind as we have started the Santa Claus Rally. The question is: with this being our last full day, did the Bulls have the gas to take it higher?

As we come into the last full day before the Christmas holiday, we actually come into a Red Tag event starting at pre-market at 8:30 AM (Preliminary GDP). This could give us a bit of a shake this morning.

A Note on Today’s Market:

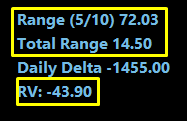

Volume: Relative volume is extremely low at -44%.

Range: Current range is 14.5 points. Expected move is 72 points, but with low volume, expect ~35 points today (above or below ON High/Low).

Structure: We are sitting directly in the middle of yesterday’s value.

Strategy: Be extremely careful. We may only get one or two moves in the AM session, and the rest could be fairly grindy due to a lack of participants.

🧠 Current Market Context

We look pretty lofty after yesterday’s push up and the Gap up on Sunday. The market is setting up for a move either pre-market or at the Bell, but due to the holiday nature, patience is key. “Cash is a position”—being in no trade and waiting is part of the patience it takes to be successful.