S&P Edge (ES) Daily Trade Plan: Negative Gamma Volatility & The 6813.50 Hurdle

A detailed ES & VIX plan for Dec 18th, breaking down the “Premium Play” at 6768-6761, the 6813.50 resistance hurdle, and the CPI shake-up.

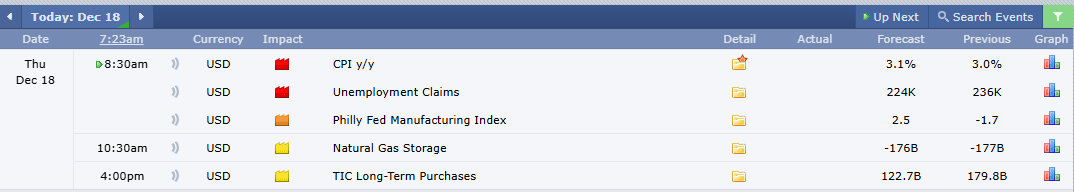

Scheduled News

Options Volatility Levels

Good morning. Today is December 18th, it is Thursday.

We come into the day after a pretty large sell-off yesterday after rollover has shaken things up quite considerably. For those who followed along in the trade plans yesterday, we had a great day knowing that 6883.00 was our potential high, and the market also caved in underneath our massive gamma flip at 6840.00.

As we come into the tail end of rollover, we can start to put a little bit more faith in our current contract (March), however, we are still leaning on SPX considerably until we complete our final roll.

Last night, price came down and played our significant Daily at 6774.25. This was an area I was interested in buying, but we have a very large confluent area directly below. We are currently still in Negative Gamma territory, which means we need to be prepared for volatility.

A Note on Today’s Market:

News: 8:30 AM CPI and Unemployment Claims. Sure to shake things up.

Range: Expected range is 76 points. We have moved approx 40, leaving 36 points left in the tank.

Volume: Relative volume is +15%. Market participants are here.

Trend: We have lost on the 4-Hour and Daily timeframes. My lean is slightly to the downside.

🧠 Current Market Context

We are currently sitting on our important 6805.50. However, the 6813.50 is our true current leg to the highs that we lost this week. This is our hurdle for the day.

We are getting into a very thick area that is a massive “Make It or Break It.” If the area around 6765.00 holds, things could change quickly. If it fails, it will not be pretty.