S&P Edge (ES) Daily Trade Plan: The 6936 Target & “Prime” Buy at 6872

A detailed ES & VIX plan for Dec 12th, breaking down the 6891.25 breakout hold, the “Prime” 6872.00 buy zone, and the VIX floor at 14.93.

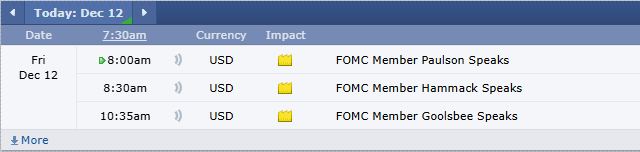

Scheduled News

Options Volatility Levels

Good morning everyone. Today is December 12th, it is Friday.

Yesterday we had an insane pump as the overnight sold off, bringing us down to our epic leg end down around 6840.00. This played for a 90-point squeeze that took us up and almost completed our bullish imbalance up at 6936.25.

We finally gained the significant leg down Daily after multiple attempts at 6891.25, which gives us a nice warm and fuzzy feeling of strength. However, the Futures gapped lower last night at the Globex open. Just because there is no red tag news doesn’t mean we shouldn’t be careful; geopolitical risks still abound, and Fridays can be difficult.

A Note on Today’s Market:

Range: Expected range is 58 points. We have moved 26, leaving approximately 32 points left in the tank.

Volume: Relative volume is up +15% to start the morning.

Context: With no untested resistance above us, if the market decides to rip higher, there is not a whole lot to stop it.

🧠 Current Market Context

We have finally gained the significant daily at 6891.25. We are currently sitting on two levels I want to take note of: the 6896.75 1-Hour pivot and the 6891.25 Daily. This six-point range is a good spot to monitor for a launching point.

We are still looking to meet our significant weekly bullish imbalance target at 6936.25.