S&P Edge (ES) Daily Trade Plan: Rollover Caution & The 6834.75 Support

A detailed ES & VIX plan for Dec 16th, breaking down the cautious rollover range, the 6834.75 daily leg support, and the VIX pivot at 17.21.

Scheduled News

Options Volatility Levels

Good morning everyone. Today is December 16th, it is Tuesday.

Yesterday the trade plan was unbelievably good. Subs had the high tick at 72 for the short that brought us down 70 points right at the open, and we also had the absolute low at 6805.50, which played for an outstanding 40-point plus pop.

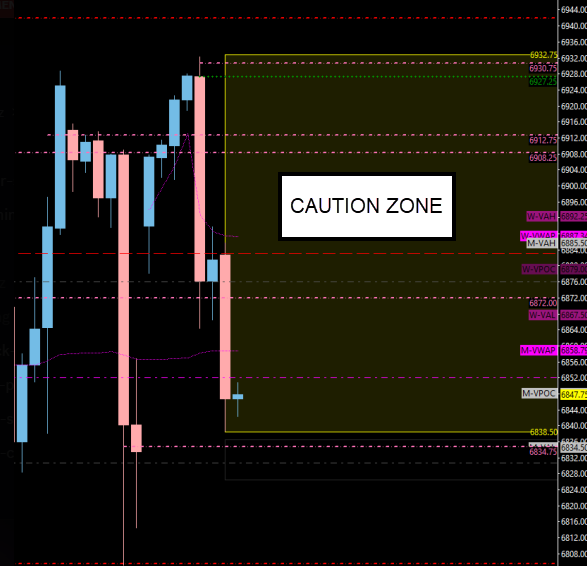

We have officially rolled over into March (H contract) for ES futures. Please notate that all the price action yesterday, in my opinion, is all void. We need to be mindful of the massive 90-point range from 3840 to 3932. We need new price action within this area before we can consider this a good place to trade in and rely on structure. Right now, this area for me is a very cautious zone.

A Note on Today’s Market:

News: Heavy Red Tag news pre-market (ADP, Retail Sales, Unemployment) and 9:45 AM Flash Manufacturing PMI.

Range: Expected range is 75 points. We have moved 53 points, leaving approximately 20-25 points left in the tank.

Volume: Relative volume is elevated at 35%. Participants are here and willing to play.

Caution: Rollover is a sketchy time. I am not including GEX levels due to thin volume spread between contracts.

🧠 Current Market Context

Last night, the market sold off but all it did was fill the rollover Gap and play the Daily Leg at 6834.75. We have held and popped up significantly (40-45 points) bringing us right back to where we closed yesterday.

Given that we played the daily leg at 6834.75, we are continuing to make higher highs and higher lows. This leads me to believe we are still pointing upwards. I am currently still leaning to the bullish side, but I cannot stress enough how much I do not like the 90-point range from 6840 to 6930, and how we need to get a day or 2 worth of price action in this range to make high probability predictions.