S&P Edge (ES) Daily Trade Plan: Negative Gamma Freefall & The 7000 Flip

A detailed ES & VIX plan for Jan 14th, breaking down the PPI volatility, the 7000 Gamma resistance, and the “Leg End” buy at 6880.

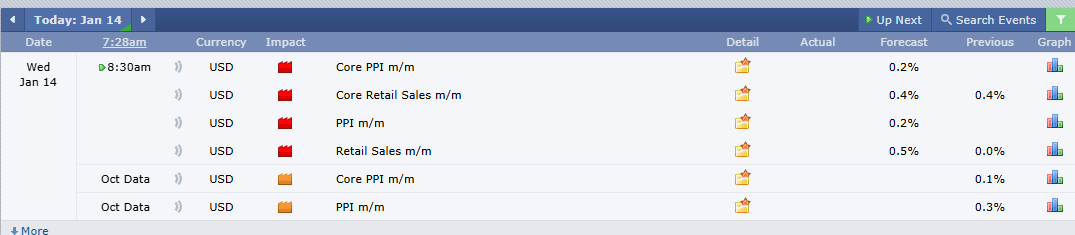

Scheduled News

Options Volatility Levels

Good morning everyone. Today is January 14th, it is Wednesday.

We had an amazing day again in the trade plans. We had the Epic Long from the 6983.50 Daily that paid 35 points and then the other fantastic long at 6977 off the Weekly/4-Hour that paid 30 points. For those of you who followed the trade plan yesterday, congratulations—you made a killing.

For those who joined me in the Post-Market Breakdown yesterday, we spoke specifically about a situation that seems to be occurring right now. A potential opening below the ATH support. Last night price drifted down in the overnight session and we are currently down 26 points.

Yesterday we had a very significant indicator that displayed potential weakness: our Gamma Flip level at 7000. After price got back below the negative gamma, it struggled all day to get back above and continued to use it like resistance. We come into the morning well in Negative Gamma territory with the Gamma Flip level still at 7000. Now that we pushed down, we have some Massive Resistance overhead.

A Note on Today’s Market:

News: 8:30 AM EST Core PPI and Core Retail Sales. These are huge inflationary numbers guaranteed to get a shake. Be very careful.

Volume: Relative Volume is substantially increased at +38.5%. Traders are here to play.

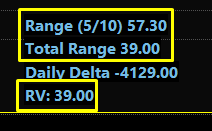

Range: Expected range is 57.5 points. We have moved 39, leaving approximately 18 points left. With increased volatility, this could expand to 25-30 points left in the tank.

Trend: We technically lost on the 4-Hour timeframe yesterday. 7004 is our Upper Line in the Sand.

🧠 Current Market Context

Price is looking pretty soft. After we pushed below 7004 yesterday, price pushed up and touched this level once again at the close (high tick of the afternoon) and has been in free fall ever since.

Below our current price, we do not have much for untested support, which should be noted. If we start to accelerate this free fall, we do not have a lot to buy.