S&P Edge (ES) Daily Trade Plan: The IB Breakout & The “Prime” Sweep Setup

A detailed ES & VIX plan for Dec 30th, breaking down the 84% IB Stat, the 6930.75 “Prime” Buy, and the 6958.00 Breakout Level.

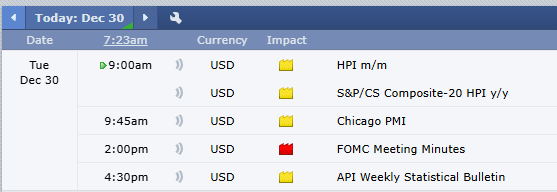

Scheduled News

Options Volatility Levels

Good morning everyone. Today is December 30th, it is Tuesday.

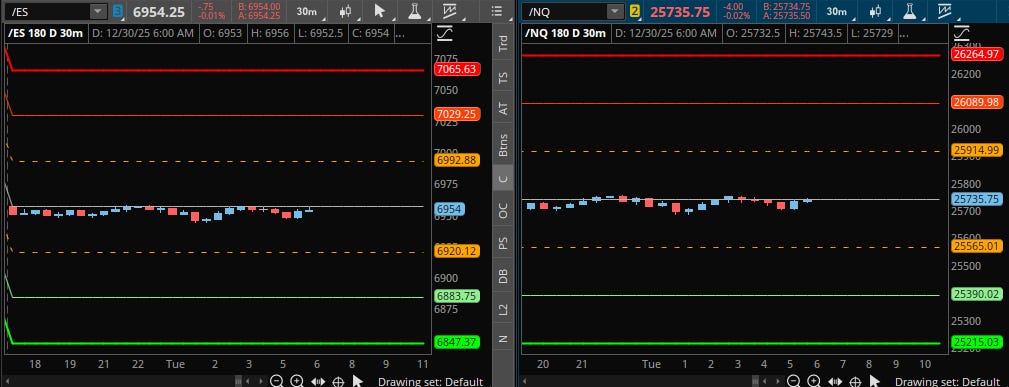

We are still in the middle of our holiday trading. We have extremely low relative volume and have sat sideways in a very small 14-point range in the overnight session. The market is still holding the previous All-Time High and gives the appearance that it wants more up as we sit at the peak of the Santa Claus Rally.

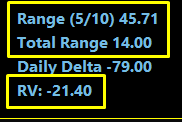

We have an expected range of 45 points today and we have only moved 14, which means we could move approximately another 30 points today above or below the overnight high or low. Given the holiday action, expect extremely slow and grindy price action similar to yesterday. We need to be extremely patient and wait for our setups.

A Note on Today’s Market:

Statistic: We are sitting in yesterday’s Initial Balance (IB). If we open inside yesterday’s IB, we have an 84.62% chance of breaking that range within the first hour. That means we would either push above 6968.00 or below 6944.00 within the first hour. Keep an eye on this highly probable statistic.

Volume: Relative volume is starting off at -20%.

News: No Red Tag news. FOMC notes at 2:00 PM (Potential Algo shake/gyration).

🧠 Current Market Context

We are currently still looking to the upside for longs; we are just waiting for areas of support to buy. We have not lost on the Daily timeframe nor the 4-Hour; we are still very much pointed to the upside and have no reason to be looking for shorts other than maybe a scalp here or there.