S&P Edge (ES) Daily Trade Plan: Positive Gamma Shift & The 6989 Momentum Pivot

A detailed ES & VIX plan for Jan 15th, breaking down the 7004 resistance, the Gamma Flip at 6970, and the Gap Fill Buy at 6964.50.

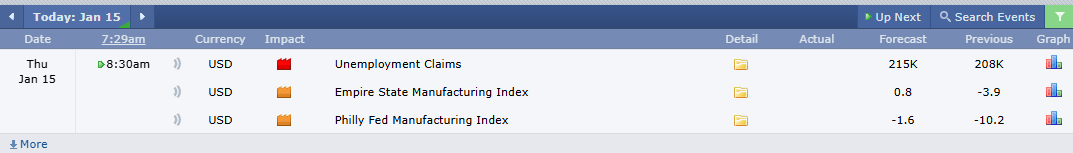

Scheduled News

Options Volatility Levels

Good morning. Today is January 15th, it is Thursday.

Yesterday was a glorious day with the trade plans. We called in the Post-Market Breakdown exactly what came to fruition: opening below the support to the All-Time High, back-testing our Weekly at 6977, falling most of the morning session, only for the Bulls to sweep some major levels, reclaim our significant Daily at 6942, and push all the way back up higher than where we opened.

Now as we come into the morning, we have Red Tag news pre-market (Unemployment Claims) and we are currently gapped up 27 points. Price continues to push higher in the overnight session on increased relative volume.

A Note on Today’s Market:

Gamma: We have had a shift in our Gamma Flip level, putting us back in Positive Gamma territory. Dealers are hedging long once again.

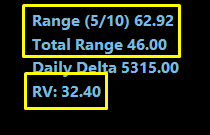

Volume: Relative Volume is 34%.

Range: Expected range of 62 points. We have moved 45 points in the overnight session, leaving approximately 20 points left above or below the overnight high or low.

Condition: Yesterday was a free fall, and this morning is a Gap Up with Red Tag news. Today is sure to be interesting.

🧠 Current Market Context

At the time of writing, we are currently above the level that shifts momentum in the favor of the Bulls: our Daily Pivot at 6989 (also located with the Previous Weekly Value Area High at 6989.75). Being above this level is a major momentum shift pivot that could lead us much higher this morning.