S&P Edge (ES) Daily Trade Plan: The ATH Hunt & The 6974.75 Pivot

A detailed ES & VIX plan for Jan 7th, breaking down the path to 7011, the critical 6974.75 hold, and the 10:00 AM volatility shake.

Scheduled News

Options Volatility Levels

Good morning everyone. Today is January 7th, it is Wednesday.

Yesterday was an amazing day for the trade plans. We had the 6942.00 pivot that we stayed above and proceeded to launch us all day. We had the amazing smack from the 6977.75 Weekly and the retest of the 6952.00 4-Hour for the long. The trade plans caught it all, so congratulations to all those who took advantage.

Yesterday, SPX made a new All-Time High by a couple of points, but ES missed it by less than a handful. Today, we are going to assume that we will get that All-Time High, but we don’t want to be overconfident.

A Note on Today’s Market:

News: 8:15 AM ADP Non-Farm Payrolls (Red Tag). 10:00 AM ISM Services PMI & JOLTS Job Openings. Be prepared for a shake both pre-market and post-open.

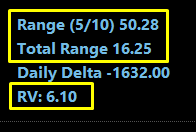

Range: Expected range of approx 50 points. We have an extremely tight overnight range of 16.25 points, leaving 35 points in the tank.

Volume: Surprisingly, Relative Volume is down quite a bit at only 6%. We could lean on stats and expect around 15 points, but the tight ON range suggests we could have a large day.

🧠 Current Market Context

We are currently sitting directly on the 6983.00 Daily. This is the massive daily for the leg down that we gained yesterday that could potentially show us the path to All-Time Highs. As long as we can hold above this structure, we should continue to traverse higher.