S&P Edge (ES) Daily Trade Plan: Balancing Above 6861 & The 6872 Wall

A detailed ES, SPX & VIX plan for Dec 4th, breaking down the 6872 resistance wall, the 6850.25 composite pivot, and the VIX breakdown below 16.35.

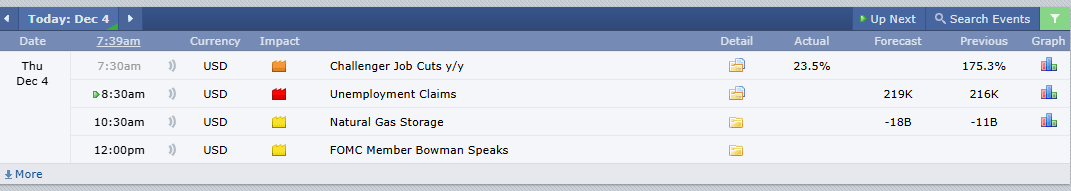

Scheduled News:

Options VOL Levels:

Good morning everyone. Today is December 4th, it is Thursday.

We come into the day off of another Trend Day from yesterday, as price swept yesterday’s low and 6820.00 (just as the trade plan provided) and pushed up all day for a total of 55 points and counting.

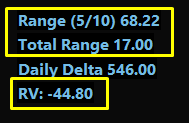

In the overnight session, we have started to balance above the area that we struggled so terribly hard to get above: the 4-Hour at 6861.00, the Daily at 6857.00, and the Previous Weekly Value Area High at 6864.00. We have sat within this range all night, balancing in a very tight compressed range of 17 points, all while bumping our head on the significant Daily and Monthly at 6872.00.

A Note on Today’s Market:

Range: Expected range is 68 points. We have moved 17, leaving a possible 25 to 40 points left in the tank.

Volume: Relative volume is extremely low again at -43%. Be prepared for anything; if a news event sparks off, there are no market participants to hold this up.

Strategy: With low relative volume, we may not get the whole 40 points. We look to continue to walk up, balance, accept value, and move higher.

News: 8:30 AM Unemployment Claims.

🧠 Current Market Context

Where we are sitting right now is such a fragile place as it could go either way depending on the news. This 6872.00 level is a huge “Upside Wall of Resistance.”

However, we default to trend. We are currently in “buy the dip” mode, but we need to be extremely careful of the overhead resistance at 6872.00 with VIX at extreme lows. I am looking for any little bit of volatility to pop VIX hard, which could send indices down sharply. Let the dust settle before picking up any longs.