S&P Edge (ES) Daily Trade Plan: End of Year Finale & The 6958 Breakout

A detailed ES plan for Dec 31st, breaking down the 6958 resistance wall, the 6924.75 support buy, and the EOY volatility risk.

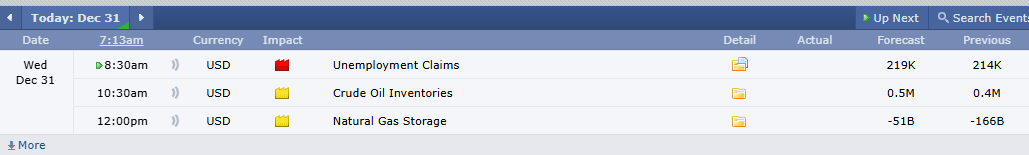

Scheduled News

Options Volatility Levels

Good morning everyone. Today is Wednesday December 31st.

It is the end of the year and end of the month as we come to a conclusion of 2025. I had a fantastic year with everyone here, and I look forward to continuing this endeavor full steam ahead in 2026.

I want to raise some alarms here: End of Year / End of Month days tend to be a little bit more volatile as market participants try to chalk up results for the end of the year. This week has been extremely slow and painful, and while we assume continuation of that, do not be complacent given the huge landmark of the day.

A Note on Today’s Market:

Range: Expected range of 41.85 points. We moved 26, leaving a little more than 15 points left in the tank.

Volume: Relative volume is extremely low at -35% to start the day.

News: Red Tag news pre-market (Unemployment Claims). Be prepared for a shake.

Strategy: Get your money and get out. Hopefully walk away with a half day.

🧠 Current Market Context

We are currently bumping our head on the 6935.75 4-Hour level, which was a huge reactionary point from Monday.

We have desperately tried to push above 6958.00 for two days and have failed. This is our significant 4-Hour and our major above/below level for the day.