S&P Edge (ES) Daily Trade Plan: Coiled Tight & The VIX Tailwind Breakdown

A detailed ES, SPX & VIX trade plan for Dec 3rd, breaking down the 6852.00 developing support, the 6864.00 breakout trigger, and the VIX breakdown below 16.35.

Scheduled News:

Options VOL Levels:

Good morning. Today is December 3rd, it is Wednesday.

Yesterday we had an incredible day in the trade plan. We were able to catch the 4-Hour leg at 6820.00 that was given way ahead of time pre-market; it took us up well over 40 points and counting. Congratulations to all the trade plan subscribers who took advantage of this.

Currently, we have a very tight overnight session with a range of only 23 points. The S&P is coiled tight for a move as we have stayed in the range for 5 days now, balancing and accepting value. We are going to get a move one way or the other; now we just need to understand what levels to watch.

A Note on Today’s Market:

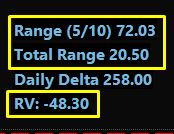

Range: Expected range of 72 points. We have approximately 50 points left in the tank.

Volume: Relative volume is extremely low (-49.5%). Only half of the participants are here today. This means we do not want to fade Trend (which is up) and we need to be prepared for anything.

News: 8:15 AM Payroll Change, 10:00 AM ISM Services PMI. Trump on the mic at 2:30 PM (be careful).

🧠 Current Market Context

We are starting to push above our significant 4-Hour and 1-Hour level at 6860.00. This is a massive area that has caused quite a few reactions over the past week. As we continue to push higher, this area is our breakout area. My bias is long (”default to trend”), looking to ride the grind up, but aware that low volume means a thin order book where volatility could spark at any time.