S&P Edge (ES) Daily Trade Plan: VIX Explodes Above 22.28 as Key Support Fails

A detailed ES daily plan for Nov. 14th, breaking down the massive 68-point drop, the critical 6723.50 resistance, and multiple “alpha” support levels far below.

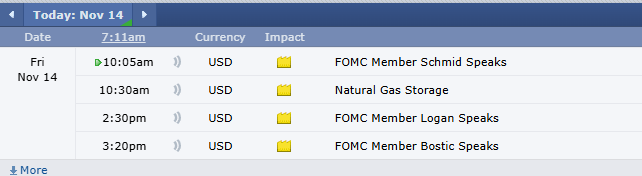

Scheduled News:

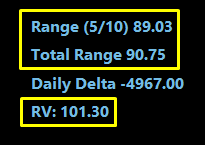

Options VOL Levels:

Good morning, everybody. Yesterday was an incredible day for subscribers, as we were able to call every pop on the way down and also give warning way in advance that we might have a sell. It was a win-win for everyone.

However, waking up this morning, we see that the overnight session has continued to push price down below our current leg. We talked about how significant this was in the post-market breakdown and what the ramifications would be. Bitcoin, our lead, is looking extremely weak, and things aren’t looking too good for the bulls today.

The market is already down 68 points pre-market.

A Note on Today’s Market:

Expected Range: 89 points

Range Already Moved: 90.75 points

Relative Volume: +100%

Context: This means we could actually move another 90 points today.

Sign Up for 30 Days Free: CLICK HERE FOR SIGNUP

Join the 5 PM Post-Market Breakdown: CLICK HERE FOR YOUTUBE

Follow Me on Twitter: @RyanBaileyEdge

Follow the New YouTube Channel: @RyanBaileyEdge