S&P Edge (ES) Daily Trade Plan: Grindy Upside & The 6822.25 “Prime” Buy

A detailed ES daily plan for Dec 2nd, breaking down the “Prime” 6822.25 buy zone, the 6936.00 TPO target, and the critical VIX pivot at 16.35.

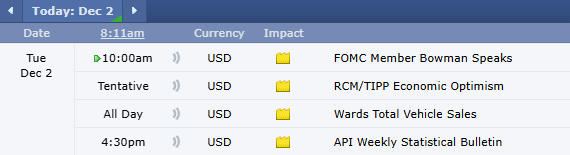

Scheduled News:

Options VOL Levels:

Good morning everyone. It is December 2nd, it is Tuesday.

Yesterday we had an awesome day based on our weekend review trade plan. Even in a low relative volume environment, we still had a fantastic day, so congratulations to everyone who was able to take advantage of these moves. As even if it was slow and grindy, the plan still plays to perfection.

In the overnight session, we held the lows all night, essentially maintaining our posture above the 6805.50 Daily and ultimately staying above our 6822.25 Daily as well. Being above this daily was huge for us yesterday as this was our trigger for the upside long, and now we have once again cemented our position above that pre-market.

A Note on Today’s Market:

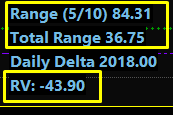

Range: Estimated range of 84.3 points. We’ve currently moved 36.75, which means we have approximately 50 points left in the tank.

Volume: Relative volume is extremely low (-44%). Emphasize this. This means we do not want to fade the trend (which is to the upside) and we could have an extremely slow and grindy day with the trend.

News: No red tag news to speak of today.

🧠 Current Market Context

We have positioned ourselves to move higher. I want to remind everyone something I pointed out in the weekend review: last week’s weekly close left us with an extremely large bullish imbalance that could take us all the way up to 6936.00 before completing this market inefficiency. These are the upside targets we need to be looking at for the high timeframe.

My bias is strictly long (”we only want to play to trend”). We are maintaining our bullish posture above the 6805.50 line in the sand.