S&P Edge (ES) Daily Trade Plan: Approaching The Leg End & Trump Volatility

A detailed ES & VIX plan for Jan 21st, breaking down the 6903 Short continuation, the 6883 resistance cluster, and the critical “Leg End” buy levels.

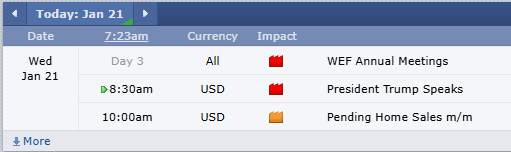

Scheduled News

Options Volatility Levels

Good morning. Today is January 21st, it is Wednesday.

We come into this day off an incredible trade plan as we had an awesome day yesterday—one of those days that will make your month. We had the perfect High Short from the Weekly Level at 6903 that is currently still taking us lower right now (in excess of over 100 points).

We had a nice little pop in the overnight session from our Daily levels at 6830 that took us up all the way to 6857 (Monthly Level) only to roll and make a new low in this morning’s overnight session.

A Note on Today’s Market:

News: 8:30 AM Trump is on the horn. This is guaranteed to shake the market (likely regarding Greenland/Tariffs). Be patient and careful.

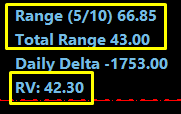

Volume: Relative Volume is elevated at 42.75%. Market participants are here; be prepared for volatility.

Range: 5-10 Day Range is 66.5 points. We have moved 41 points in the overnight, leaving approximately 25 points left. However, keep in mind the average RTH session is approx 45 points.

Context: We have wiped out a month’s worth of progression in three days. We are slowly moving lower towards our significant “Leg End.”

🧠 Current Market Context

We are traversing lower into the significant “Leg End,” a massive pivot area for us to hold. We are approaching serious untested daily support, a significant 4-Hour, and the 100-Day Moving Average.