S&P Edge (ES) Daily Trade Plan: OpEx Volatility & The 6827.75 Pivot

A detailed ES, SPX & VIX plan for Dec 19th, breaking down the OpEx volatility, the critical 6827.75 pivot, and the “Premium Play” at 6768-6761.

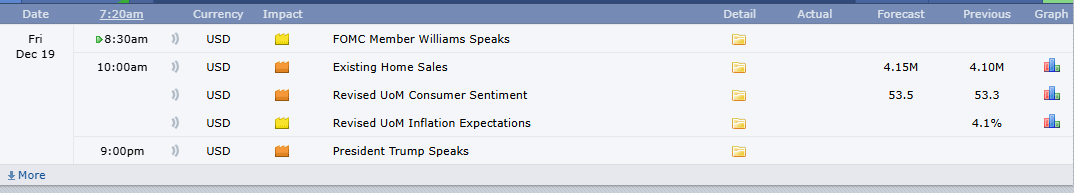

Scheduled News

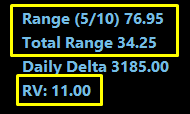

Options Volatility Levels

Good morning everyone. Today is December 19th, it is Friday.

We have a big day on our hands with Options Expiration (OpEx). Coming into the day off of an amazing day yesterday with the trade plans; the high at our Daily at 6872 and our significant low at 6813.50 both played magnificently, loading our Substack followers up with major profits.

We have no Red Tag news to speak of, but OpEx is sure to cause some volatility. We have a 76-point expected range and have currently moved 35 points, meaning we have approximately 35 to 40 points left in the tank above the overnight high or below the overnight low.

A Note on Today’s Market:

Value: We are sitting directly in the middle of yesterday’s value area, giving us no significant edge either direction. Our edge is in the edges.

Statistic: If we open in the prior day’s value, there is an 80% chance we will move outside of that range sometime during the day. Be prepared for that at the bell.

Condition: Price has been balancing back and forth in a 35-point range.

🧠 Current Market Context

We have not gained on any timeframe (Daily, 4-Hour, or 1-Hour). This leads me to still believe we could come down more. However, last night the 4-Hour did close positively for an attempt to gain support.

We are currently sitting on our 4-Hour level at 6827.75. This level is very important as this is our midpoint pivot. It has to hold this morning for us to continue this push up.