S&P Edge (ES) Daily Trade Plan: The 6945 Gamma Flip & High Volume Volatility

A detailed ES & VIX plan for Jan 6th, breaking down the 6945 Gamma Flip, the 6942 Barometer, and the “Prime” Buy at 6880.25.

Scheduled News

Options Volatility Levels

Good morning everyone. Today is January 6th, it is Tuesday.

Yesterday our Weekend Review plan played perfectly with the 6912.75 Daily being our ultimate pivot; through Globex it was the resistance that turned into support and took us all the way up to the highs yesterday. We have balanced and flirted with our significant pivot at 6942.00.

As we come into the day, we have a slightly elevated VIX but no Red Tag news to speak of. However, that does not mean we should ignore any chance of volatility. We are flirting with our Gamma Flip level at 6945.00, which is the difference between dealers hedging long and dealers hedging short. A push below this level (and ultimately 6942) could cause some volatility.

A Note on Today’s Market:

Volume: Relative volume is very high at +53.9%. Participants are out to play; this is an indication of potential volatility.

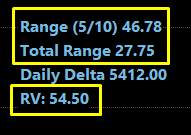

Range: Expected range is 46.75 points. We have moved 27.75, leaving approx 20 points left. However, given the volatility, we could extend to 56 points, giving us 30+ points left in the tank.

Trend: Yesterday the Bulls gained on the 4-Hour timeframe. We have now officially gained on the Daily, Weekly, and 4-Hour. We are pointing to the upside.

🧠 Current Market Context

We are flirting with the major level at 6942.00. This is going to be a major “Above/Below” level for us as it is the previous leg down from an All-Time High. All signs point to more up on the higher timeframe but that doesn’t mean that we cant move down to find buyers before continuing our push higher.