S&P Edge (ES) Daily Trade Plan: Post-FOMC Whip & The “Thick Support” Buy

A detailed ES daily plan for Dec 11th, breaking down the 80-point overnight whip, the confluent support at 6857-6854, and the 6891 breakout hurdle.

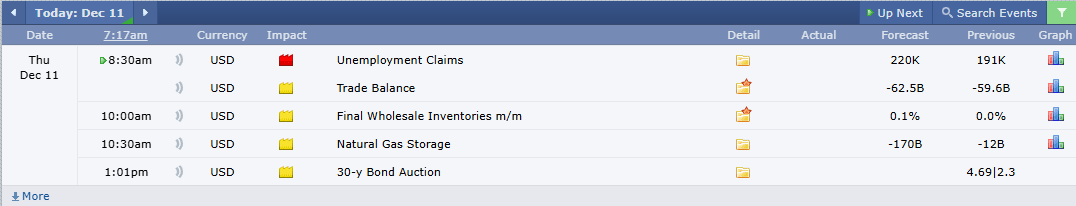

Scheduled News

Options Volatility Levels

Good morning everybody. Today is December 11th, it is Thursday.

We had an epic day in the trade plans yesterday; we were able to catch the low of the day that took us up well over 70 points before the end of the day. Congratulations to all the subscribers who where able to take advantage of this!

Yesterday we had the FOMC rate decision, and as expected, Jerome cut rates 25 basis points, giving us more fuel for the upside party.

However, last night in Globex, liquidity slipped hard. We came down 80 points in the overnight session from yesterday’s high, sweeping our significant Daily at 6822.25. Price was able to reclaim the Previous Weekly Value Area Low and squeeze all the way back up right into our major balance area at 6876.00, almost as if nothing ever happened. Insane overnight moves that produced more volatility that we had in yesterdays session, but where does that leave us now?

A Note on Today’s Market:

News: 8:30 AM Unemployment Claims (Red Tag). Expect a shake.

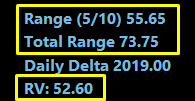

Range: Expected range was 55 points; we have already moved 73 points.

Volume: Relative volume is +59.7%. We have 60% more participants than normal. People are here to trade today.

Condition: Be on the lookout for volatility and continuation moves.

🧠 Current Market Context

We are clearly extremely volatile. We were up really high yesterday and fell 80 points. We now have levels that have been wiped and regained. We lost on the 4-Hour timeframe last night on our push down, but the Daily gained the leg down at 6880.25.

However, we never gained the Daily at 6891.00. This leaves us in a very fragile state because we continue to balance sideways. We haven’t truly lost on the Daily timeframe, but we show weakness on the 4-Hour. Try to stick with the higher timeframe; as long as we hold the 6805.00 level, longs are the way to go.