S&P Edge (ES) Daily Trade Plan: The Post-Holiday Gap Down & VIX Shock

A detailed ES & VIX plan for Jan 20th, breaking down the massive 100+ point drop, the 6880 pivot, and the “Insane” 150% Relative Volume.

Scheduled News

Options Volatility Levels

Good morning everyone. Today is January 20th, it is Tuesday.

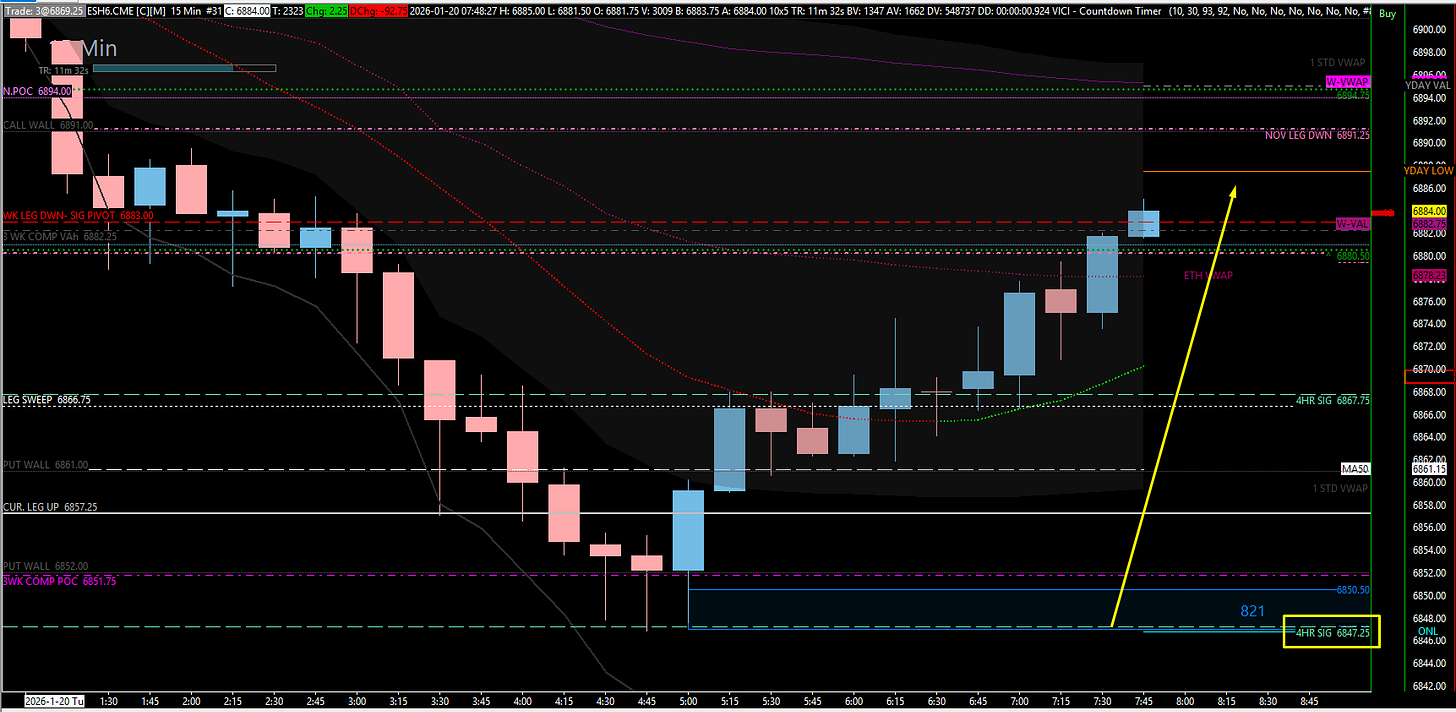

It is the day after the Martin Luther King holiday, and once again we have gapped down in the overnight where we were once down well over 100 points. We have rebounded perfectly from our 6847.25 level (called out in the Weekend Review) and have currently popped 40 points and counting.

As we come into the day, we are into a massive gap down—the first one that we’ve had in a long time.

A Note on Today’s Market:

News: No Red Tag News. All volatility will be from geopolitical events and from VIX being shocked by this massive push down.

Volume: Relative Volume is raised to 150%. This is an insane amount; market participants are out in full force. Be extremely cautious.

Range: We have already exceeded the approximate range of 65 points with a total range of 88 points. (Average RTH rotation is 47.5 points).

🧠 Current Market Context

Last night’s push down allowed us to sweep the Daily Leg at 6866.75, which was a huge catalyst for the pop-up as it relieved a lot of pressure from the Bears. The auction will now need to go back up and retest some levels to satisfy market maker positions.

We are currently balancing off the 6847.25 4-Hour (3-Week Composite POC) and sitting at a significant Pivot Point: 6883 Weekly (3-Week Composite VAH).