S&P Edge (ES) Daily Trade Plan: Negative Gamma Opener & The 6949 Reclaim

A detailed ES & VIX plan for Jan 2nd, breaking down the Negative Gamma volatility, the 6949.25 momentum shift, and the 6912.75 sweep setup.

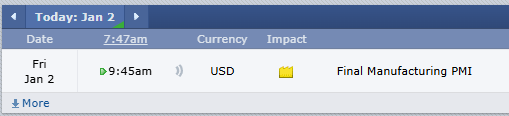

Scheduled News

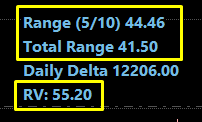

Options Volatility Levels

Good morning everyone and Happy New Year. Today is January 2nd, it is Friday, and it is our first official trading day of 2026.

Market participants are out in full; we have a Relative Volume of 55% this morning, which is relatively high considering we have no pre-market news.

On Wednesday, we had an excellent call with the negative gamma; we touched that at the High of the Day and fell the entire day, playing every single level on the way down including our 6924 4-Hour, 6912/15 Daily/4-Hour, and the Daily at the lows at 6891 at the close. We rested on that only to open back up in Globex yesterday, gap up from that level, and push up over 45 points in the overnight session.

As we approach the last day of the week and the first trading day of the year, we still need to be cautious. We are still in Negative Gamma Territory (moved up to 6975.00) which tells us that money will likely be able to be made in both directions as dealers are currently hedging short. It doesn’t necessarily mean we go down, but it doesn’t mean we go up either—volatility will be high.

A Note on Today’s Market:

Trend: We still have not lost on the Daily Timeframe (Bullish). However, we did lose on the 4-Hour Timeframe, which is my favorite timeframe. Be aware and cautious of this.

Gamma: Negative Gamma at 6975.00. Dealers hedging short. Money to be made both ways.

Volume: Relative Volume +55%.

🧠 Current Market Context

Friday (Wednesday’s close) was a surprising day with the sell-off, however, we came right down and played our Daily at 6891.25. This was our top-down daily for our massive leg down that we just retraced back in November—a beautiful test.

We are currently looking to regain the 4-Hour leg to shift momentum back.