S&P Edge (ES) Daily Trade Plan: Caution at Highs as 6850.00 Support is Tested

A detailed ES daily trade plan for Nov. 13th, breaking down VIX resistance at 18.01, the “massive” 6822.25 pivot, and a potential short setup at 6908.25.

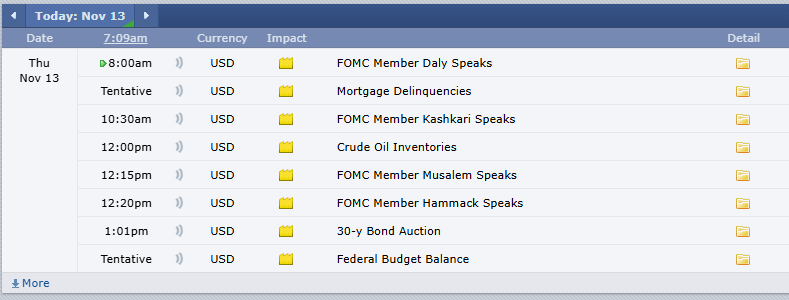

Scheduled News:

Options VOL Levels:

Good morning everyone. Today is November 13th, it is Thursday, and we enter into another amazing day.

Yesterday, the trade plan was incredible. We gave caution at the highs and were able to pinpoint the low of the day, capitalizing on our 6855.00 spot as well as the 6852.00 spot. That essentially propelled us all the way back up into the 80s, producing a 30-point gain.

Last night, price came down and swept the local low from yesterday, held on to the 6850.00 area, and created another significant pop. This time, it took price to 6891.00 (our untested daily created yesterday), which was the high of the overnight session. Now we have come back down to try to test and re-hold the 6850.00s one more time.

Sign Up for 30 Days Free: CLICK HERE FOR SIGNUP

Join the 5 PM Post-Market Breakdown: CLICK HERE FOR YOUTUBE

Follow Me on Twitter: @RyanBaileyEdge

Follow the New YouTube Channel: @RyanBaileyEdge

🧠 Current Market Context

Currently, we have not lost any timeframe on support (neither Daily nor 4-Hour). Even the 1-Hour is technically intact but has been slowly losing some support on smaller legs since yesterday.

I’m starting to see potential weakness. The smack at the highs this morning was a big signal for me that we need to be cautious and could potentially see more down. It all comes down to our 6850.00 spot. We need to be very cognizant of the support between 6850.00 and 6855.00, as this area continues to stimulate buyers upon approach.