S&P Edge (ES) Daily Trade Plan: The 6692.25 Inflection Point & Where Bears Fail

A detailed ES daily plan for Nov. 19th, breaking down the 6692.25 “major inflection point,” the 6673.00 continuation short, and the critical VIX pivot at 22.28.

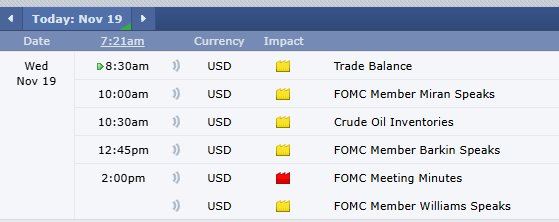

Scheduled News:

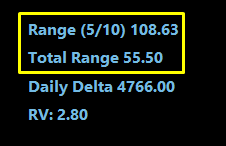

Options VOL Levels:

Good morning everyone. Today is November 19th, it is Wednesday.

We come to this trading day fresh off of an amazing day yesterday; we had the high, the low, and everything in between. We talked about it in the Post-Market Breakdown (video link below), and we couldn’t be happier with the way things turned out.

Last night, price drifted in balance all evening inside yesterday’s value area as buyers and sellers continue to battle for an undetermined direction. We come in this morning with a total range of 55 points in the overnight session, but a potential range of 108 points. This means there is approximately 50 points “left in the tank” for a move above the overnight high or below the overnight low. We will more than likely break out of this range, but figuring out where is the key.

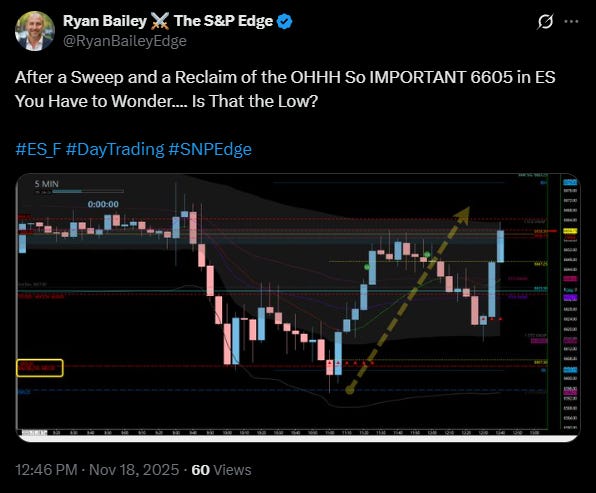

I have something special today. Yesterday I emphasized the bear side, but I failed to mention “where everything goes wrong.” I have included the Tweet below that gave a precursor to my thoughts, and below the paywall, I have included a video for your review.

Sign Up for 30 Days Free: CLICK HERE FOR SIGNUP

Join the 5 PM Post-Market Breakdown: CLICK HERE FOR YOUTUBE

Follow Me on Twitter: @RyanBaileyEdge

Follow the New YouTube Channel: @RyanBaileyEdge