S&P Edge (ES) Daily Trade Plan: Bears Take Control & The 6692 Pivot

A detailed ES daily plan for Nov. 18th, breaking down the 6692 momentum shift, the liquidity sweep setup at 6631, and the critical VIX pivot at 22.28.

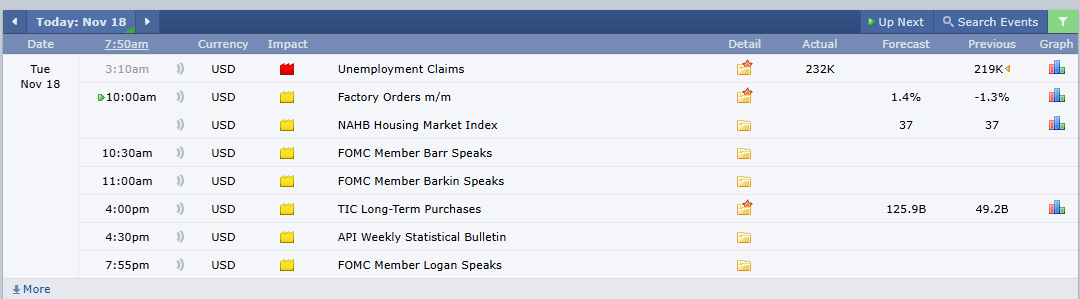

Scheduled News:

Options VOL Levels:

Good morning everyone. Today is November 18th, it is Tuesday.

Yesterday was an unreal day for our subscribers; the trade plan was on point, and it was too ridiculously good. Congratulations to everyone who took advantage of the amazing day.

The market has drifted lower in the overnight session as we had weak jobs data (which apparently came out at 3:00 AM). We are currently down 32 points and continuing to push lower. Last night, we hit our significant daily at 6634.00 almost to the tick, popped up, and shorted from our 6683.00 4-Hour / 6686.50 Daily combo. This has led us back down to leave us firmly below the 6660.00 and 6664.00 daily levels.

We are continuing to show weakness—we have officially lost on the Daily timeframe and the 4-Hour timeframe—but we shouldn’t take all things at first sight.

A Note on Today’s Market:

Relative Volume: +32% (Participants are in the market).

Range: Expected range is 104 points; we have already moved 73. We could move at least another 30 points today.

News: We have Fed speak all day today, so there is a chance for volatility.

Sign Up for 30 Days Free: CLICK HERE FOR SIGNUP

Join the 5 PM Post-Market Breakdown: CLICK HERE FOR YOUTUBE

Follow Me on Twitter: @RyanBaileyEdge

Follow the New YouTube Channel: @RyanBaileyEdge