S&P Edge (ES) Daily Trade Plan: Core CPI Volatility & The 7000 Gamma Flip

A detailed ES & VIX plan for Jan 13th, breaking down the CPI shake, the fragility at the 7000 Gamma Flip, and the Weekly Imbalance target at 7050.

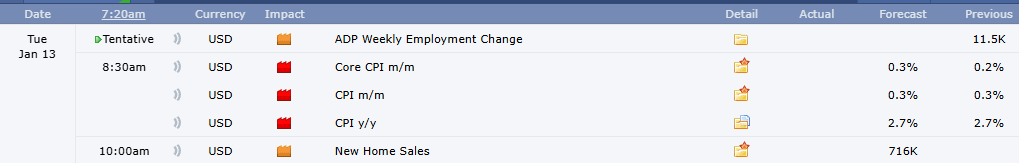

Scheduled News

Options Volatility Levels

Good morning everyone. Today is January 13th, it is Tuesday.

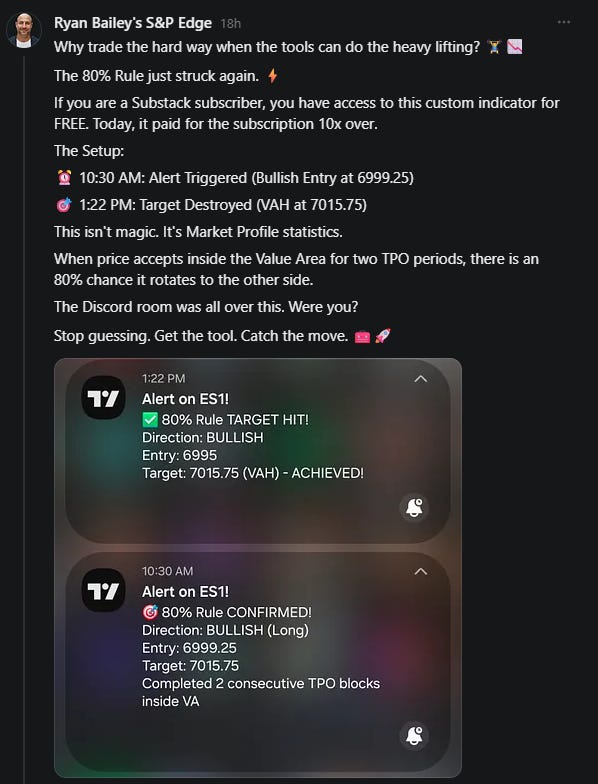

Yesterday we had an incredible day in the markets as the Weekend Review played out perfectly almost every step of the way, ensuring we retained our bullish structure and making All-Time Highs. Our 80% Rule triggered yesterday for a total score of 15 points as a cherry on top. Congratulations to all members who utilized the plan.

As we get into Tuesday, we find ourselves balancing in a very tight range at All-Time Highs, holding our significant Daily/4-Hour at 7004.

A Note on Today’s Market:

News: 8:30 AM Core CPI (Red Tag). This is sure to give us a shake, especially given our current location.

Range: Total range is only 15.25 points. Expected range is 50.75 points, leaving approximately 35 points left in the tank.

Volume: Relative Volume is low at -20%, likely due to participants waiting for the news event.

Gamma: The Gamma Flip level has moved to 7000. Dealers pushing hedges higher makes this market more fragile on a push down.

🧠 Current Market Context

We are holding the 7004 Daily/4-Hour level as our main support. There is no true resistance above us. We have gained on the 4-Hour, Daily, 1-Hour, and Weekly timeframes, so we have no reason to believe we will dump. However, with news and our location, anything can happen.