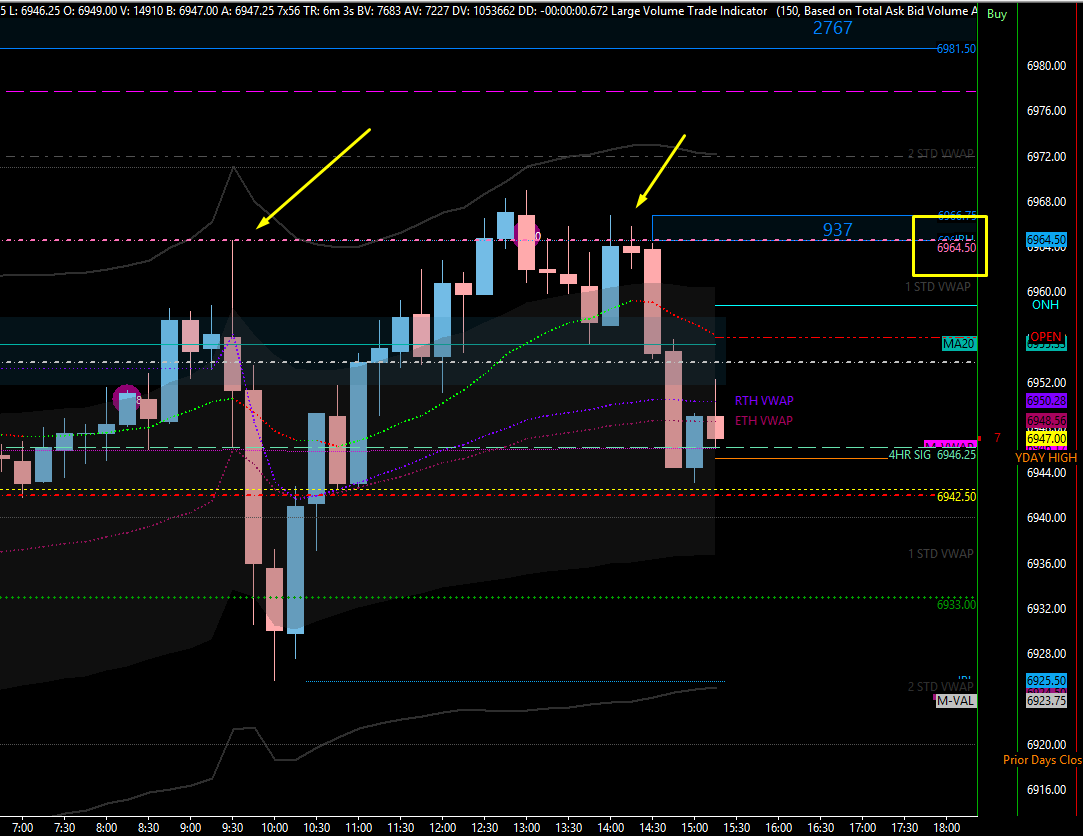

S&P Edge (ES) Daily Trade Plan: The 6964.50 Rejection & Flash PMI Volatility

A detailed ES & VIX plan for Jan 23rd, breaking down the 6942 Barometer, the 6960.50 POC Resistance, and the Critical 6903 Weekly Support.

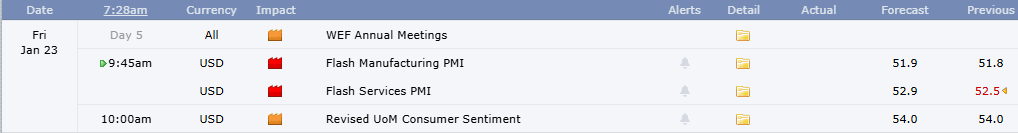

Scheduled News

Options Volatility Levels

Good morning. Today is January 23rd, it is Friday.

We come into another day off of a spectacular trade plan as we had the High of the Day nailed to the tick at 6964.50 that brought us down 40 points into the main area in which Globex gained. Then price reclaimed our 6933 long and went all the way back up to the Daily at 6964.50, only to poke a new high and fail again. For those of you following the trade plan yesterday, you made some serious cash—congratulations.

As we come into the day again, we have Red Tag news this morning. At 9:45 AM we have Flash Manufacturing PMI and Flash Services PMI. This is 15 minutes after the open, and we should expect some volatility.

A Note on Today’s Market:

News: 9:45 AM Flash Manufacturing PMI & Services PMI.

Volume: Relative Volume is flat, letting us know we should expect a relatively normal day (for now).

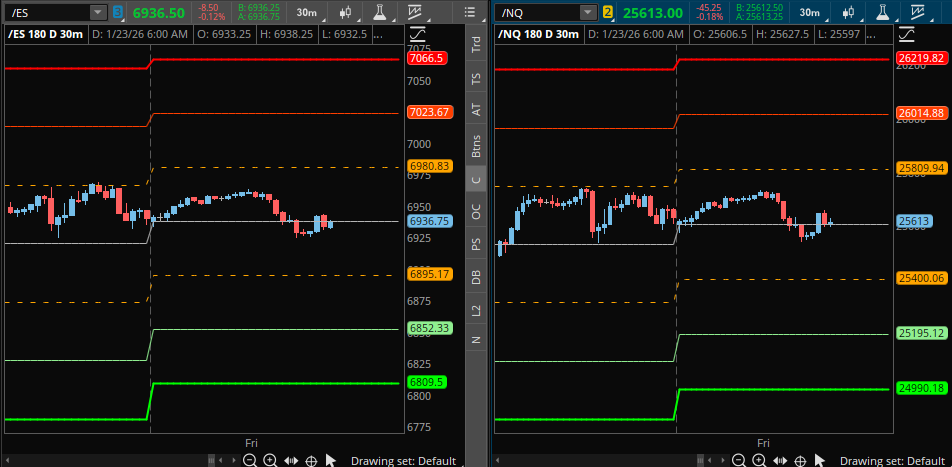

Range: Expected range of 75 points. We have moved 37 in the overnight, leaving approximately 40 points left in the tank.

Gamma: We are in Negative Gamma. The Positive Gamma Flip is past the point of All-Time Highs, meaning we should expect volatility in both directions.

Trend: We have gained on the 4-Hour timeframe. We have not gained on the Daily, but we have not lost on the Weekly. Expect anything.

🧠 Current Market Context

SPX played a serious Weekly structure yesterday at the highs (6929.95). SPX held its ground by closing above the significant 6910 Daily (significant achievement). This is the same level as our 6942 Daily in ES, which we are very aware is our important Above/Below pivot.

Currently, we are sitting below the 6942 Daily. Yesterday we closed above it barely after smacking our head on the 6964.50 Daily. The Daily close above 6942 was a solid indication that we could continue our move higher, at least for now.