Welcome back, Team, & happy weekend!

It is the first of the month, February 1st, and it’s time to put up some profits for a fresh new month.

This could be a really interesting week. We have some serious geopolitical things in the works right now. We’ve got Trump tariffs on Mexico and China, we’ve got Bitcoin falling like a stone, and we’ve got a new Fed Chair nominated who is a little bit more hawkish.

A Note on This Week’s Market:

Geopolitics: Trump Tariffs (Mexico/China) and a new Hawkish Fed Chair nominee.

Crypto: Bitcoin is down substantially. It is a serious lead for the indices (usually 2 weeks to a month ahead). Currently Risk Off.

Metals: Silver pulled back massive (40%).

Trend: Technically, we have not lost on the Daily or Weekly timeframe, but we have stopped closing above previous All-Time Highs.

Edge: We are in a massive balance range with overlapping value. There is No Edge at our current location.

🧠 Current Market Context

The Bitcoin Lead:

Bitcoin is a high-risk asset, and it is currently getting nailed. It led us to All-Time Highs, and now investors are selling it. If they are selling this, stocks could potentially be next. History tends to rhyme. We are coming into a buy spot on BTC around 70,500, but the drop is a warning signal.

The “No Edge” Zone:

On ES, we settled right back into this massive balance range. We have overlapping values and overlapping Points of Control (POC) from Thursday and Friday. This tells me right away that we have no edge at our current location. This is a “sit on the hands” moment until we get something clear.

The SPX Picture:

SPX is still in the leg up, sandwiched between the 6945.00 Daily and 6901.00 Daily. We have an untested Daily/4-Hour above at 6977.00. If we can’t get above that, she is in some serious trouble.

🚨 VIX Analysis: The 17.50 Pivot

We are keeping a really close eye on VIX because the Monthly/Weekly pivot at 17.50 is going to make all the difference.

The Pivot: 17.50 (Monthly/Weekly).

Headwind: If this catches a bid and holds above 17.50, this thing is going to rip. It could go to the next untested spots around 20.00 and 20.09. This would send indices back down further.

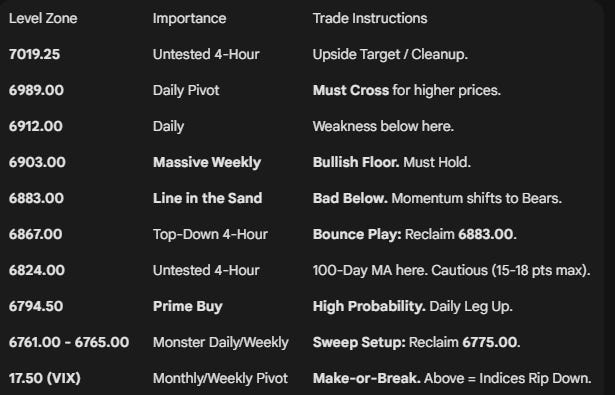

🎯 Detailed Actionable Trade Plan (ES Futures)

Our edge is in the edges. Right now, I have no untested levels below us to lean on. Everything is tested (Red). We need to be extremely precise.

🔴 Key Resistance Zones & Setups

The Progression Pivot: 6989.00

6989.00 (Daily).

Context: We need to get above 6989.00 to continue our progression higher.

Actionable Setup: If we breach this, there is a high probability we push into the 7019.25 area (and the 7022 leg down). If we cannot breach this, we have a problem and could see lower.

The Cleanup Target: 7019.25

7019.25 (Untested 4-Hour).

Context: Matches the SPX 6977 level. We have a market inefficiency/singles to clean up here.

Actionable Setup: If this plays, look for continuation back below 7004.00 and ultimately 6989.00.

🔵 Key Support Zones & Setups

The Weekly Floor: 6903.00

6903.00 (Massive Weekly).

Context: As long as we stay above 6903.00, we are still bullish. But it is massively tested.

Actionable Setup: If we lose 6912.00 and 6903.00, we see serious weakness.

The “Bad Below” Line: 6883.00

6883.00 (Previous Weekly VAL / Leg Down).

Context: Underneath 6883.00 (or 6880.00), we shift momentum hard in favor of the Bears. “Bad Below.”

Top-Down Bounce: 6867.00

6867.00 (Top-Down 4-Hour).

Actionable Setup: If we come down here, look for a bounce to reclaim the 6883.00 level. Look to take profits around 6903.00.

The Prime Buy: 6794.50

6794.50 (Daily Leg Up).

Context: This is the real play. A fantastic, high-probability level.

Actionable Setup: Play for a reaction. It might play to 6839.00 and pull back.

Monster Support: 6761.00 - 6765.00

6765.00 (Daily), 6761.00 (Weekly).

Context: If we sweep the lows at 6794.50, this is the spot.

Actionable Setup: Want to see this play and get back above the pivot at 6775.00 and squeeze higher back above 6794.00. Could target 6883.00 for a massive move.

Last Resort Daily: 6723.00

6723.00 (Untested Daily).

Actionable Setup: Pretty solid level. Look to take profits around 6760.00.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

The edge is in the edges. Currently, we are sitting in the middle of a massive balance range with no edge. This is a “sit on the hands” moment until we get to our levels.

Bitcoin has my attention. When I saw it today, I was like, “Whoa.” It is a big indicator. Couple that with the fact that everything below us is tested, and my antennas are up. We haven’t lost on the higher timeframe yet, but if we lose 6883.00, momentum shifts hard.

I will see you guys on Monday for the Post-Market Breakdown at 5:00 PM.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.

Like, Follow and Submit your email below for 30 days free to the S&P Daily Trade Plans.