Welcome back, everybody. It is time for the Weekend Review, and it is the President’s Day edition. I waited to put this out just to kind of see what would happen with the holiday price action, but a quick reminder: I do not count any of the action that happened today. Anything that happened today will be retraced tomorrow, so please keep that in mind when we actually open the markets up.

A Note on This Week’s Market:

Holiday Action: Monday’s President’s Day price action does not count and will likely be retraced.

Trend Shift: We have lost support on the 4-Hour, Daily, and Weekly timeframes on ES. We have serious downside momentum ahead of us.

The “No Edge” Zone: We are currently sitting in the middle of a massive balance area. There is no edge here. Our edge is in the edges.

SPX Divergence: SPX is giving us a slightly different picture, having held its leg to the All-Time High, but ES is my jam and the cash session is currently pointing lower.

🧠 Current Market Context

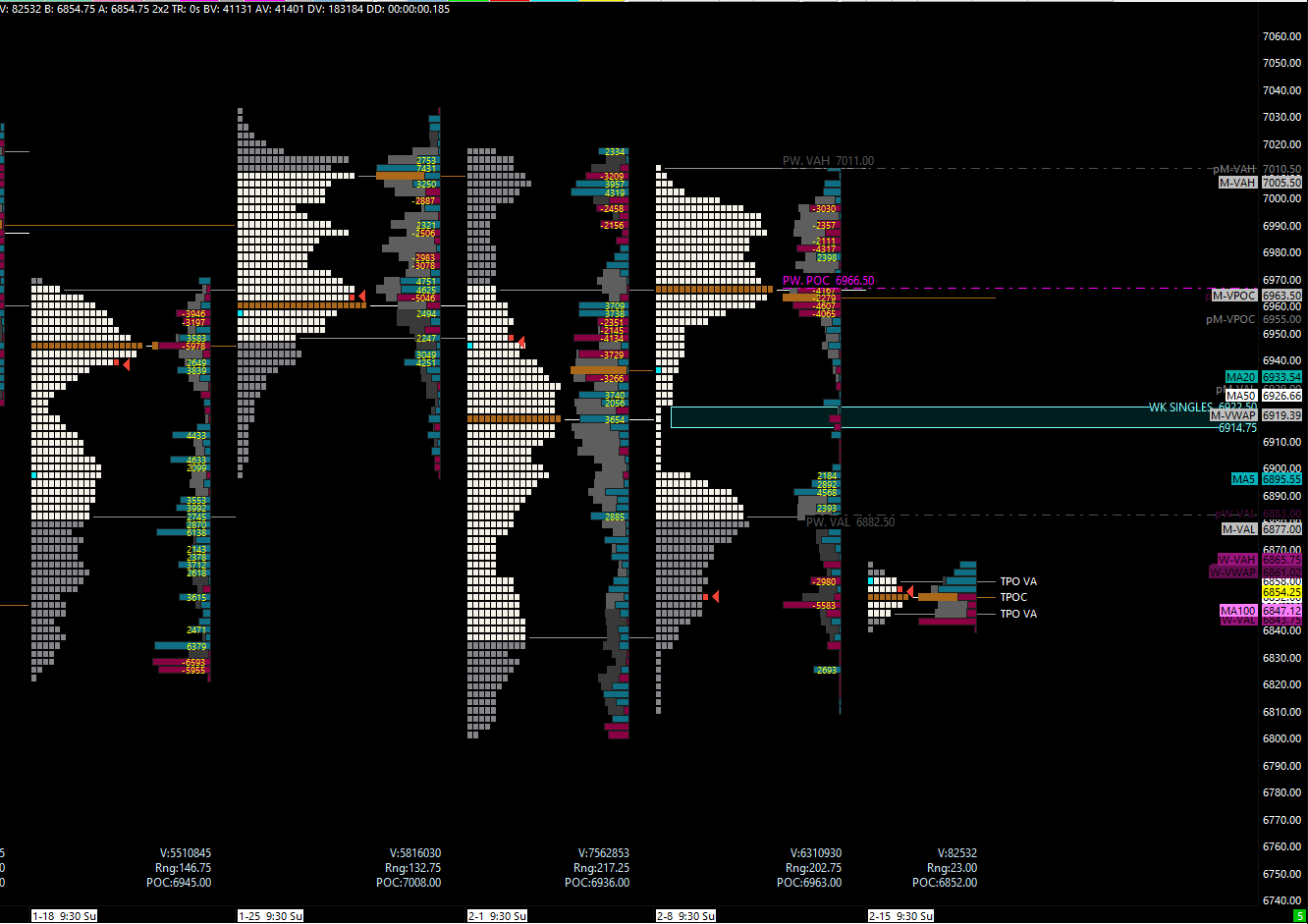

The Momentum Shift

Taking a close look at our weekly profile, we have a pretty soft-looking chart. We’ve been rejecting over and over again from that 7004.00 spot we continuously played at the highs. Now, we’ve had major closes below all the supports to the All-Time High in this particular leg up. We lost on the 4-Hour, we lost on the Daily, and we certainly closed below and lost on the Weekly. We are due to come make a new low underneath our swing low at 6780.00.

SPX Context & Divergence

One of the big things about the SPX is that we are getting conflicting signals. SPX has still not lost its leg, holding the 6798.40 Daily and popping almost 90 points on Friday. However, they did not accomplish anything and stayed below resistance. If we push below 6834.00, we will continue to push down on SPX and eventually make new lows targeting the gap fill at 6738.00, the 6696.00 area, and ultimately the ultimate buy zone at 6617.00. If Bulls want to shift momentum back up, they must clear the 6865.00 Weekly to target 6926.00 and 6940.00.

🚨 VIX Analysis: The 20.00 Handle Battle

VIX has been hovering around our massive 20.00 handle for weeks now. This is our major pivot point that essentially acts as the massive inflection for the S&P to move up or down.

The Pivot: 19.50 to 20.00 Handle.

Headwind: If they break above our 20.78 Weekly and ultimately the 21.77 Daily, we could push higher into the 23.43 Weekly, and the massive untested levels at 24.69 (Daily), 24.70 (Monthly), and 26.42 (Highest Untested Daily). Once we break out above 20.00, this push could continue higher, which will in turn push the indices down significantly.

Tailwind: Once we move below 19.50, we get a nice little tailwind on the indices, which puts us right back up to the highs. Anything below 19.50 could actually send VIX much lower and ES much higher.

🎯 Detailed Actionable Trade Plan (ES Futures)

We are right now in a very large area where I basically have no edge. We do not do business in the middle. Short to bring it down, long to bring it up.

🔴 Key Resistance & Momentum Shift Zones

The Primary Short: 6896.00 - 6903.00

6903.00 (Massive Weekly / Daily), 6896.00 (Weekly).

Context: This is the area we fell from on Friday. Nothing has changed here; 6903.00 is our major momentum shift.

Actionable Setup: This is my first thing to short right now. If we come up and play 6903.00, we want to look for a fallback underneath the swing pivot (Friday’s high). This could give us a lot of push down to make new lows. If we break above 6896.00, we have singles that need to be cleaned up running to the 6925.00 area.

“Bad Below” Pivot: 6880.00

6880.00 (Massive Weekly).

Context: This actually played today in the holiday session and sent us back down. This is a massive level for our momentum shift. It is Bad Below.

The Monthly Leg: 6857.00

6857.00 (Massive Monthly).

Context: This is our current leg to the All-Time High. A push below this keeps the momentum to the bearish side intense, and we should look for VIX to stay above the $20.00 handle as long as we are below this.

🔵 Key Support & Sweep Zones

The 6750 Liquidity Sweep: 6723.00 - 6765.00

6765.00 (Major Pivot), 6738.00 (Untested Daily), 6736.00 (4-Hour), 6723.00 (Untested Daily).

Context: We played the 6765.00 area in the overnight previously, squeezing 200 points. All of that is tested. I would be very cautious about buying these Dailies as long as we are underneath 6765.00.

Actionable Setup: Conditional Long: I am looking for a sweep underneath 6750.00 into the 6736.00 or 6723.00 levels. Wait for this to play, reclaim the low around 6750.00, and get back above our major daily / weekly pivot at 6765.00. This is squeeze-worthy. We ride this back up to our major targets at 6794, 6815.00 and 6839.00.

The Reclaim Pivot: 6652.00 - 6672.00

6672.00 (4-Hour Reclaim Pivot), 6664.00 (Untested Support), 6652.00 (Untested Support).

Actionable Setup: If we move below 6723.00, we come down into this area. I am not going to buy this blindly. I’m going to wait for these areas to play and get a solid 15-minute close above the 6672.00 level. Then we ride this all the way up to 6700.00 and 6723.00.

Last Line of Defense: 6591.00 - 6600.00

6600.00 (Handle), 6591.00 (Support).

Actionable Setup: At this point, I’d be pretty sketched out, but I would look for it to reclaim the 6600.00 handle, get long, and take it back up to 6652.00.

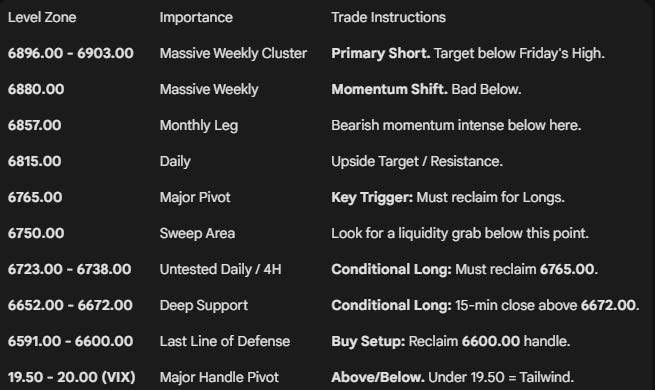

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

I tried to keep it easy and super clean. We don’t have any bullshit in the middle. All you got to do is stick to the plan and just know right now we have no edge in the middle of this range.

Our edge is in the edges. I show you where you need to buy, I show you where you need to short—wait for the setup. If any one of these trades come into fruition this week, they could potentially generate massive profits. Be patient, sit on your hands, stick to the plan, and together we’ll conquer the markets.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.

ES RTH Daily

WK TPO