Good morning, everyone, and welcome to the weekend review.

The market continues its relentless push higher, but as we look at the structure, things are starting to feel a bit fragile up here. We had another strong weekly close, and Thursday’s trade plan worked beautifully, with the dip into 6746.50 paying out 50 points to the highs on Friday. Now, we have to determine where the next opportunity lies, and the high-timeframe charts are giving us some very clear clues.

🧠 Current Market Context

Starting with the weekly TPO profile, we can see a large, low-volume area below us. This type of inefficiency suggests that price will more than likely want to pull back, at least into the 6720.00 - 6725.00 area, and potentially as deep as the weekly Point of Control at 6708.00. This aligns with the main theme for the week: the market is bullish, but it’s structurally weak from a high-timeframe support perspective.

The issue is that we have wiped out almost all of the high-timeframe support on this incredible run. In fact, we only have one single untested daily level left in this entire structure, which is at 6722.25. This makes the market feel fragile. While the government shutdown means we have no real news on the calendar and the VIX is in a holding pattern, we must be prepared for a pullback into one of our key zones. The plan is not to short this strength, but to patiently wait for a dip to a great location.

🎯 Detailed Actionable Trade Plan

🔴 Key Resistance & Profit-Taking Targets

With price at all-time highs, there is no overhead structural resistance. The focus for the week will be on identifying key support zones for potential long entries.

🔵 Key Support Zones & Setups

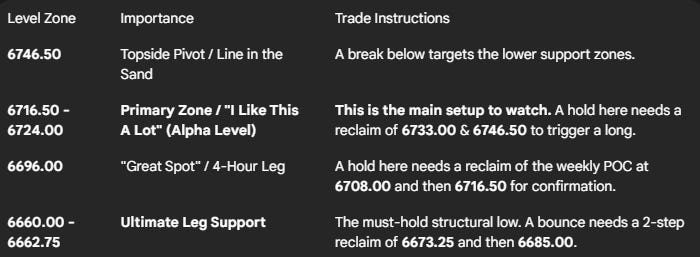

The Topside Pivot Zone: 6746.50 - 6752.50

This zone, defined by the RTH daily pivot at 6746.50 and the ETH pivot at 6752.50, is our key line in the sand at the highs. Being above or below this area will be huge for determining immediate direction.

The “I Like This A Lot” Zone: 6716.50 - 6724.00

This is my primary zone of interest, as it contains our only untested daily support at 6722.25, along with an untested 4-hour at 6724.00. What makes this area so powerful is the inclusion of the 6716.50 4-hour level. This was the level that acted as major resistance for days, rejecting price multiple times before we finally broke out. We have to assume this area will play a major role as support on a retest.

Actionable Setup: If price pulls back into this zone and holds, the trigger for continuation is a move back above the 6733.00 4-hour, and then ultimately a reclaim of the daily at 6746.50.

The “Great Spot” / Signature Trade: 6696.00

This 4-hour level is the leg of the prior move up. I really like this spot; it’s a great location and even has one of my signature “wing play” setups involved with it.

Actionable Setup: If this level plays, we have to see price get back above the weekly Point of Control at 6708.00 and then clear the major resistance at 6716.50. Once that happens, this thing could get cooking again.

The Ultimate Leg Support Zone: 6660.00 - 6662.75

This is the big one. This area is defined by an untested 4-hour at 6662.75 and the absolute must-hold daily leg to the high at 6660.00. A daily close below 6660.00 could get ugly pretty fast. This area has massive confluence from a two-week composite POC and the 20-day moving average.

Actionable Setup: This is a two-step confirmation trade. If the 6662.75 level plays, the first trigger is a reclaim of the 6673.25 daily pivot. The final confirmation is a move back above the monster pivot at 6685.00. Once those two steps are complete, you’ve got something good.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

It’s hard to tell what will happen this week. With no major news on the calendar, we may continue to grind higher. However, the market structure is telling us a pullback is probable. The plan is to stay patient and disciplined. We are not looking to short this market; we are looking to join the trend at a high-probability location. I’ve given you the key levels and the specific triggers you need to see to confirm that buyers have stepped back in. Let the market come to us.

Have an excellent rest of your Sunday, and we will talk soon.

Ryan Bailey, VICI Trading Solutions.