SCHEDULED NEWS

Welcome back. It is Sunday, September 14th, and it's time to figure out what levels we're going to play this week. The S&P is on an unbelievable tear, cruising near 6600.00 on Friday. But as you know, a pullback would be quite welcome. We really need to pull back so we can buy some levels.

The market is waiting for one thing this week: Jerome Powell and the FOMC on Wednesday. They're going to lower rates; the real question is if it's a 50-basis-point cut that sends us to the moon. Monday is expected to be a snoozer, but the rest of the week could bring the volatility we need. Let's get into the plan.

🧠 Current Market Context

We are so high up that we could come down 500 points and still be bullish on the weekly timeframe. That's how ridiculous this rally is. We are still in a "buy the dip" market. Do not freak out if the market sells off 100, 200, or 300 points.

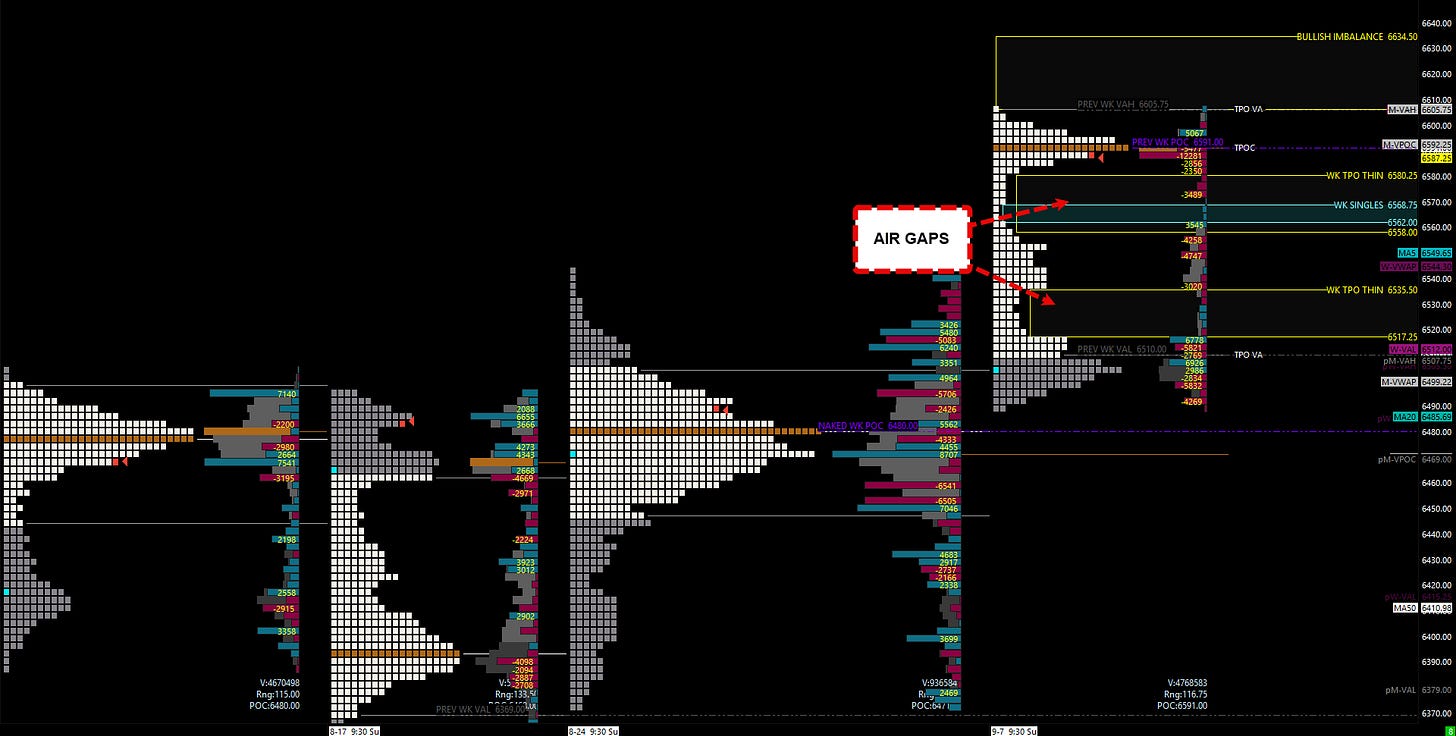

The weekly TPO chart shows why a pullback is likely. We have a bullish imbalance up to 6634.00, but below us, there are "air pockets" of thin volume and single prints. Specifically, a break below the 6583.00 4-hour opens a pocket down to the 6554.00 area. These market inefficiencies will likely get cleaned up at some point. Our job is to be ready at the key untested levels below.

🎯 Detailed Actionable Trade Plan

🔴 Key Resistance & Upside Targets

With the market at all-time highs, we have no technical resistance above us. The focus is entirely on identifying the best support zones to buy a pullback for a continuation higher.

🔵 Key Support Zones & Setups

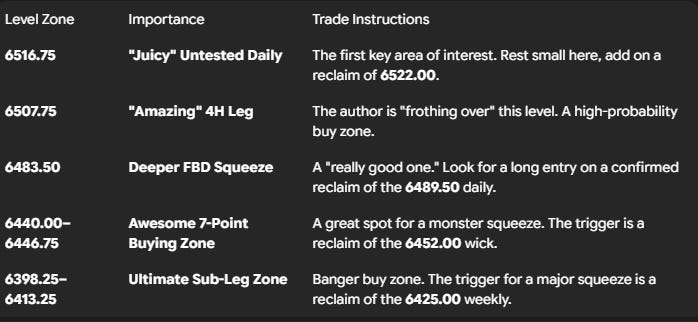

The "Juicy" Daily: 6516.75

This is our first untested daily support of key importance. I like this level a lot and can't emphasize it enough.

Actionable Setup: I will probably rest a small starter position at 6516.75. If it holds, I will wait for acceptance back above 6522.00 to add to the trade, with a first major profit target at the 6533.50 daily.

The "Amazing" 4H Leg: 6507.75

This is the 4-hour leg I've been "frothing over for a while." It's an amazing spot.

Actionable Setup: If 6516.75 doesn't hold, I will buy again at 6507.75. Confirmation would be a reclaim of the 6517.00 daily, and then I'm golden once we get back above 6522.00.

The Deeper FBD Squeeze: 6483.50

We tried to get to this untested 4-hour level last week. If we get there now, it's a great opportunity. It has confluence with a significant daily at 6489.50.

Actionable Setup: This is a really good one. If we play 6483.50, you can market smash a long on the reclaim of 6489.50. If you get back above that daily pivot, she's gonna go.

The 7-Point Buying Zone: 6440.00 – 6446.75

Another awesome, great spot. This zone contains an untested daily at 6446.75, a 4-hour at 6445.75, and the 4-hour leg at 6440.00.

Actionable Setup: This sets up a potential monster squeeze. If we play this area and get back above the 6452.00 wick (reclaiming the 6450.00 sub-leg), you can market smash this thing, targeting 6483.00 and higher.

The Ultimate Leg-End Zone: 6398.25 – 6413.25

This is our main sub-leg up. It contains the significant daily at 6413.25 and another at 6398.25. Both of these are bangers.

Actionable Setup: If 6413.00 plays, you want to see it get above the 6425.00 weekly. You buy above 6425.00, you buy above 6431.00, you set your stops below and you let it go.

🚨 Momentum Shift Levels

Primary Pivot: The daily at 6533.50. A break and hold below this level is the first signal that a deeper pullback to our key untested levels is underway.

Ultimate Bull/Bear Line: The daily/weekly leg-end at 6268.00. We can trade all the way down here and still be in a weekly uptrend. This is the true line in the sand for the bull market structure.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

The bullish move is not over, especially on the weekly timeframe. Don't let a 100 or even 200-point sell-off freak you out; this is still a buy-the-dip market. Our job is to be prepared. We have a clear roadmap of untested, high-timeframe levels to focus on. The first one of key importance is 6516.75, followed by the other fantastic zones I've shown you lower. Let the market pull back, let it come to our levels, and be ready to engage.

I hope you guys have a great weekend.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.

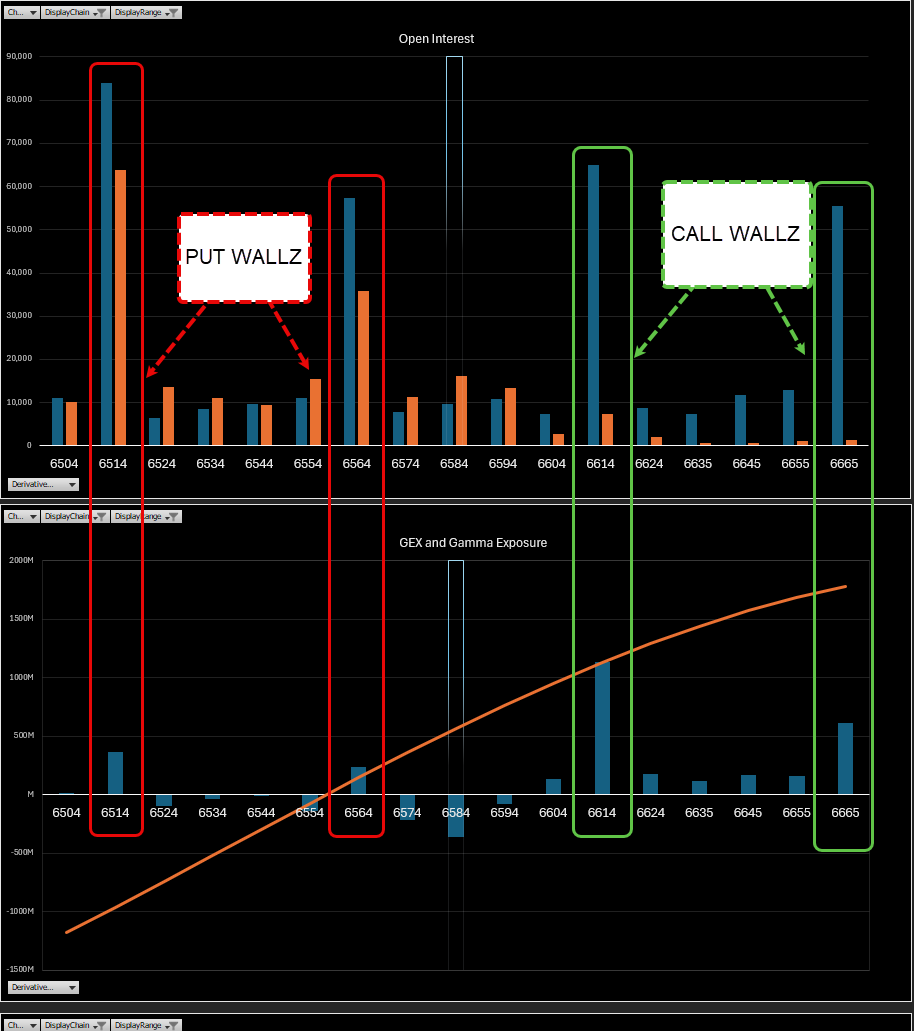

OPTIONS GAMMA LEVELS - ES

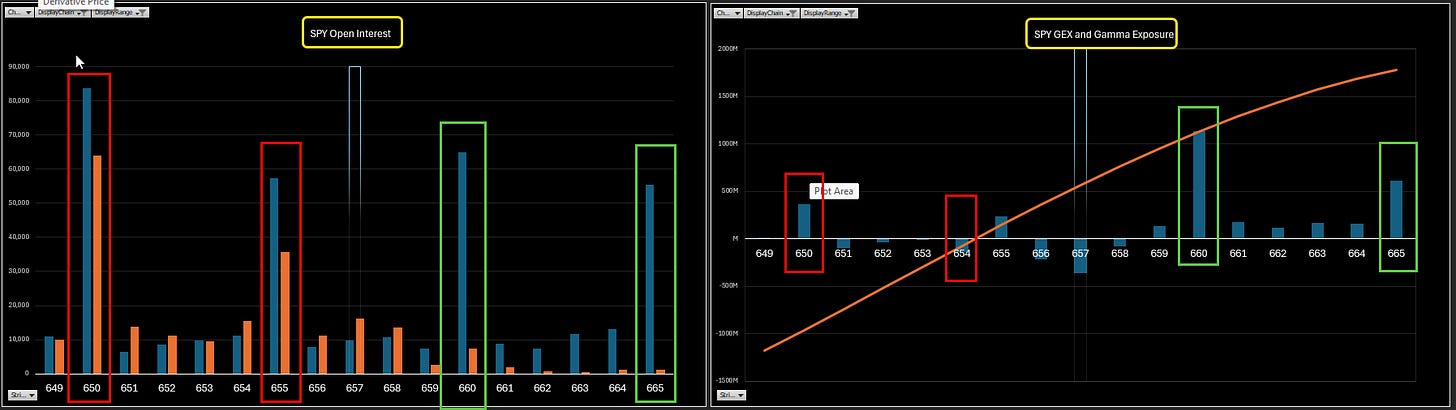

OPTIONS GAMMA LEVELS: SPY

RTH WEEKLY / DAILY + ETH DAILY