Good morning, everyone. This is a quick update to the Weekend Review.

I'm publishing this because I wanted to expand on a concern I had on Friday: At the time of the pop i made a few mentions that I really didn't believe the 100-point pop was sustainable. Often, after these Fed events, we get a reaction in one direction, and then it goes the other way. After the rally on Friday, I just sat on my hands to see what would happen.

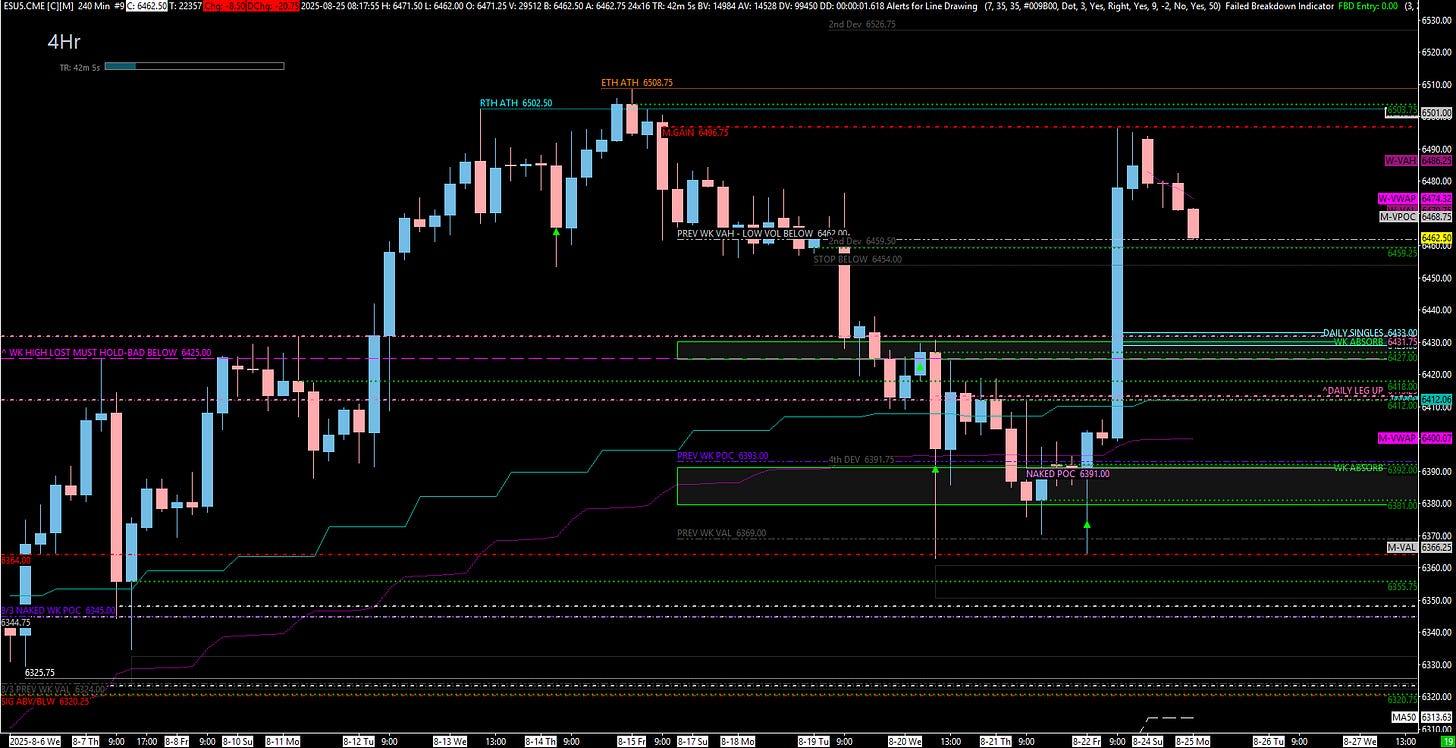

Sure enough, we rallied right up to an untested daily level and refused to make the ATH and have since smacked back down to our signifant level at 6462 which was our Signiant above or below level. Let's look at where we stand and why I'm urging caution this morning.

🧠 Current Market Context: The "Why" for the Caution

While the path of least resistance is still technically up, I have a weird feeling that something doesn't smell right. Several key factors have my antennas up.

The ES Picture: After the smackdown, we are now testing the 4-hour support zone around 6459.00-6462.00, which was also the previous weekly value area high we identified as a key pivot. The most concerning fact is that despite the massive rally on Friday, we did not gain on the daily timeframe. They had all that fuel and momentum and still rejected off a daily level. That concerns me.

The Bitcoin Lead: For years, I've used Bitcoin as a leading indicator for risk assets, and right now, it's looking "angry" and "soft." It's down 2% this morning. This generally signals weakness for the indices. While BTC is coming into a support zone around $109,500, its current weakness is a significant warning sign.

The VIX Warning: The VIX, which got annihilated on Friday, has popped back up and is now holding well above the key weekly pivot at $14.85. It has also successfully back-tested a 4-hour level. This tells me that fear is creeping back into the market.

🎯 Detailed Actionable Trade Plan: The Two Scenarios

Given this context, there are two primary scenarios for the day ahead.

Scenario 1: The Bullish Hold

For the bull case to remain intact, we need to hold the current 6459.00-6462.00 support zone. A successful defense here could lead to a push back up, with the first major hurdle being the 6503.75 4-hour level, and then a potential attempt at a new all-time high.

Scenario 2: The Bearish Pullback (My Preferred Scenario)

If we push below the current support (specifically below 6454.00, my stop from the weekend), we will more than likely come down to fill the single prints left from Friday's rally. This would bring us into my key area of interest for longs.

🔵 Primary Long Zone: 6431.75 – 6427.00

This is the key area to look for longs on a clean pullback. It contains our significant daily and weekly levels. A deeper poke could even test the 6413.00 spot, which is our new daily leg.

A Note on Sizing: While I am still looking to buy a pullback to this zone, I am exercising extreme caution, especially when it comes to sizing. The conflicting signals mean it's easy to get caught offsides.

🚨 Momentum Shift Level

The Daily Leg at 6412.00 / 6413.00: This remains the most critical line in the sand for the bullish structure. As we talked about over the weekend, a push below 6412.00 would be pretty bad and could open the door to a much deeper correction toward the untested levels at 6392.00 and 6381.00.

📌 Cheat Sheet – Key Levels Recap:

To recap, I didn't believe the pop on Friday, and I'm not sure I believe it now. The leading indicators are flashing warning signs. That doesn't mean the support zones won't get a reaction—they more than likely will. I just don't know if they will take us all the way back up to new highs just yet.

I am telling you to exercise caution. My gut feeling, using Bitcoin as a lead, has me a little sketchy. It wouldn't surprise me to see a lot of Friday's move get retraced. Stay safe and be patient today.

Until next time—trade smart, stay prepared, and together we will conquer these markets!

Ryan Bailey, VICI Trading Solutions.

ES-4hr

VIX

BTC