Scheduled News For The Week:

Hello everyone. Happy Sunday.

It is time for the Week in Review. We are going to go over exactly what happened last week and what to look forward to this week as Monday soon approaches. We had an awesome Friday; it was prophecy. We had a lot of people who made out like bandits on that 6660.00 trade, and I was so happy that it worked out.

From Fridays Trade Plan:

Before we get into the plan, just a reminder of the schedule: I’ll be doing the post-market breakdown on Monday. For all you Discord peeps, I’ll see you in the room to get that bag on Monday, and for subscribers, I’ll see you Tuesday morning with the AM trade plan.

A Note on This Week’s News:

Tuesday: Veterans Day (Bank Holiday). Be aware of this; I haven’t checked the futures market status, but it is a bank holiday.

Wednesday: All-day Fed speak. Expect volatility from this, even without red-tag events, as they just jabber at the mouth.

Thursday: CPI & Unemployment Claims. (There is uncertainty around this report with the potential government shutdown).

Friday: PPI. (We may or may not get any action from this).

Sign Up for 30 Days Free Daily Trade Plans: CLICK HERE

Follow Me on Twitter: @RyanBaileyEdge

Join the 5 PM Post-Market Breakdown: CLICK HERE

Follow the New YouTube Channel: @RyanBaileyEdge

🧠 Current Market Context

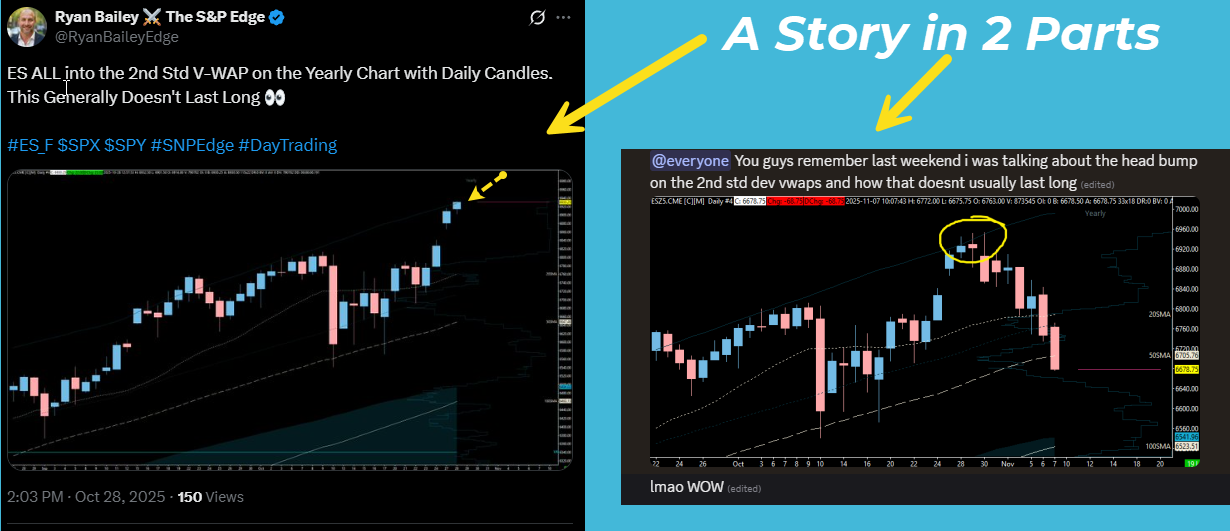

Friday’s price action was absolutely gorgeous. We’ve been talking for about two weeks about how the market was getting stretched out. We noted our very tip-top level was 6950.00, which is exactly what happened by filling the bullish imbalance. I also pointed out that ES was in the second standard deviation on the yearly VWAP, which generally doesn’t last long.

This all came together on Friday. The market came all the way down into our major leg end at 6660.00. Our trade plan was clear: “Our big spot here was 6660. Dealers are hedging this area hard... I’d like to see it get over 6660 and then above 6664 is the trigger.” This setup played out perfectly, targeting the 6738.00 daily leg. It moved up to 6744.00 and closed the day at 6765.00—a total of over 105 points from our level.

This was a massive stick save. Price opened below the 6738.00 sub-leg, flushed to our big 6660.00 wing play, and then came all the way back to close green and above 6738.00. This means the daily timeframe has not lost. My bias is long, and I believe we’re headed to at least 6805.50.

🗺️ ES Weekly TPO Insights

The TPO chart confirms our levels. We had every reason to believe 6660.00 would hold (based on volatility, gex levels, etc.), and it did. We have now jetted back up, closing above the Oct 19th Value Area Low and the Oct 12th Value Area High, back into value.

I see no reason why we cannot target the 6807.00 value area. We have two “sticky” places to watch:

6876.00-ish (Value Area High)

6807.25 (POC)

That 6807.25 POC aligns perfectly with our significant daily level at 6805.00. That daily was a monster level on the way down, and it will be important again on the way up.

₿ Bitcoin (BTC) Context

I made a tweet over the weekend that I was long Bitcoin. It held its monthly low and is starting to accept value higher. This is purely for context. The point is that if Bitcoin looks bullish on a Sunday, this is a good measurement of how the indices will look.

As long as Bitcoin continues this bullish look, we can expect strength in the ES open. I think Bitcoin is going to at least $108,250.00, and I think ES is going to at least 6805.00. I am leaning to the upside, at least temporarily (with higher targets on BTC around $114,000.00).

🎯 Detailed Actionable Trade Plan (ES Futures)

This is a very simple plan for this week. My plan is to get long into 6805.50, watching my ass around the 6788.50 pivot.

🔴 Key Resistance Zones & Setups

The “Tender Hands” Zone: 6883.00 This is the massive weekly leg down / high lost. It’s a very big, highly untested area that could get a smack (confluence with a previous weekly VAH, naked POC, and weekly leg down).

Actionable Setup: This is not an A+ setup because the weekly timeframe hasn’t technically lost (we would have needed a close lower). I will honor it as resistance but will treat it with “tender hands.” If they do smack it, we want to get underneath 6855.50 for continuation down.

The Killer Top Pivot: 6855.50 This was the killer top from Wednesday. We will have to use this as a pivot on the way back up.

The “Undecided” Zone: 6822.25 This is the upper range of this particular leg down. I’m undecided about this area as I have conflicting information (it’s in a range of untested areas from 6815.00 to 6832.00).

Actionable Setup: I am defaulting to 6805.00 as the main pivot.

The Main Pivot: 6805.50 This is our big one. This monster daily level will be our main “above/below” pivot and aligns with the 6807.25 TPO POC.

Actionable Setup: This level is critical. Look for acceptance below 6801.00 as a sign of weakness. If we play 6805.00-6801.00 and then re-lose 6788.50, the market could come down quite nice.

The “Watch Your Ass” Pivot: 6788.50 This is the big major weekly level that has played many times. This is our pivot to get to 6805.50.

The Pivot: 6774.00 This daily is tested, but we will use it as a pivot.

🔵 Key Support Zones & Setups

“The Sweet Spot” / My Favorite Buy Zone: 6738.75 - 6744.50 This is the “sweet spot” for a pullback. We have the 6738.75 daily leg up and a top-down level at 6744.50.

Actionable Setup: My plan is to get long here. All of this is a buy. The stop-out is below 6723.00.

The Invalidation Level: 6723.00 This is the new daily leg up created on Friday.

Actionable Setup: This is the stop-out for the long setup. If we get below 6723.00, we are “super soft,” and it’s a sign of “extreme weakness.”

The “Scared to Buy” Zone: 6683.00 This is a 4-hour level.

Actionable Setup: I would be scared to buy this if 6723.00 fails.

The “Monster” Wing Play: 6660.00 This was the massive 660 leg from Friday. A big monster spot and our ultimate wing play.

📌 Cheat Sheet – Key Levels Recap

🧠 Final Thoughts

That’s what I got for you. We’ve talked about a lot of stuff, a lot of reasons to be bullish at least temporarily, and defined where things go bad. The plan is simple: look for a pullback into our “sweet spot” to get long for the ride up to 6805.50.

I’ll see you all for the post-market breakdown on Monday. For the Discord peeps, we’re going to get that bag on Monday. And for the subscribers, I’ll see you Tuesday morning with the AM trade plan. Be good, and have an excellent rest of your weekend.

Until next time—trade smart, stay prepared, and together we will conquer the markets!

Ryan Bailey, VICI Trading Solutions.