S&P 500 Daily Trade Plan: Volatility & The 6964.50 Pivot

A detailed ES & VIX plan for Feb 4th, breaking down the massive down move, the 17.44 VIX Pivot, and the 6964.50 Line in the Sand.

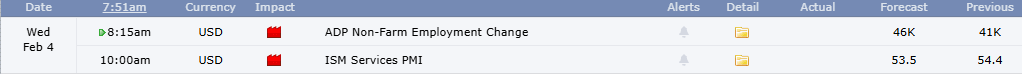

Scheduled News

Options Volatility Levels

Today is February 4th. We come off of a massive down day yesterday which sparked extreme volatility, sending the VIX up over 20% during the day. Our trade plans led subscribers to know exactly where the key pivots were so they could take advantage of the flip and bias immediately. The push underneath 7004.00, our significant Weekly, told us right from the jump that momentum had shifted to bring us down into the 6957.00 4-Hour, which played for a fabulous 25 points. Then, once again, this was our massive line that was significant for us to be Above/Below, and after price breached this level, it ended up falling another 70 points, paying huge dividends.

The kind of day where Careers were made.

A Note on Today’s Market:

News: 8:15 AM ADP Non-Farm Employment Change (Red Tag), 10:00 AM ISM Services PMI (Red Tag). Expect a volatility field day.

Gamma: We are in Negative Gamma. The Gamma Flip is well beyond All-Time Highs.

Range: Expected range of 96.75 points. We have moved 34.5 points in the overnight, leaving approximately 60 points left in the tank.

Volume: Relative Volume is Flat, meaning we have expected normal participants.

Context: Overnight session drifted higher into resistance. 6964.50 will be the deciding factor for direction.

🧠 Current Market Context

The Volatility Spike

We are starting our day once again in Negative Gamma. Yesterday’s move forced us down well over 120 points, but we are holding the leg, putting us right back in the middle of our multi-week balance.

The Deciding Factor

The overnight session has drifted higher, bringing us into our Massive Resistance area. This will be the deciding factor whether we have more up today or continue to push lower and make new lows.